March 2020

| Written by a retired farmer |  |

Farmers producing grain crops with modern mechanisation methods and vehicles use diesel in high or relatively lower volumes depending on the size of the area being farmed. Delivery trucks, 4x4 bakkies, generators, irrigation pumps and all the other diesel driven machines add to the diesel used by a tractor or in many cases a fleet of tractors.

QUANTITY AND CONTROL OF THE DIESEL USAGE

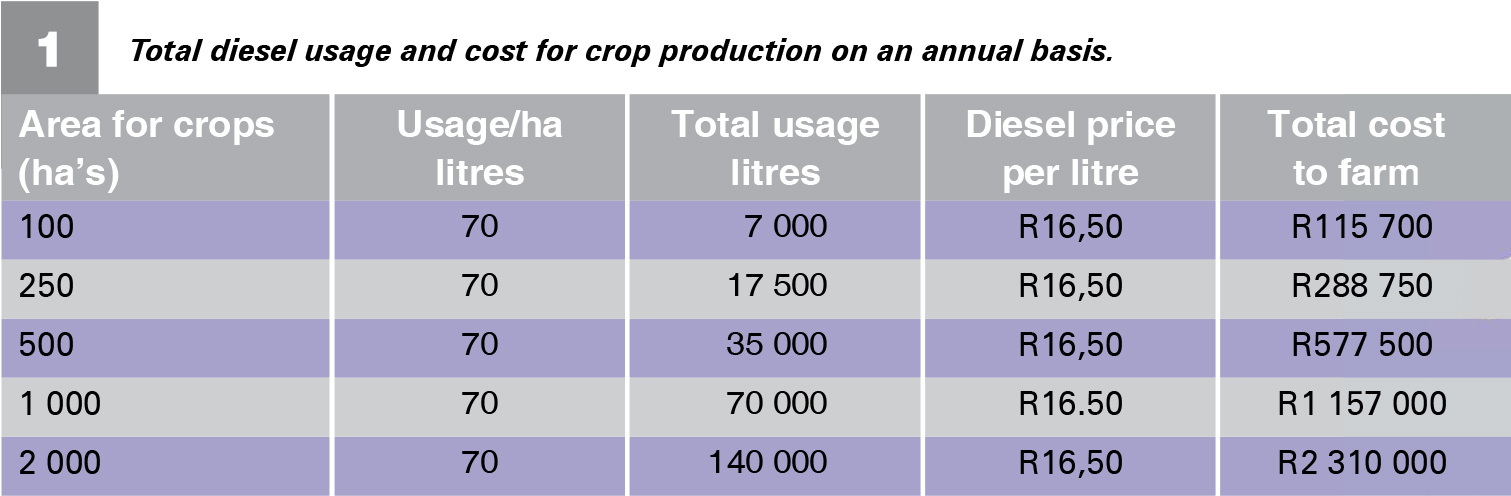

Let us assume that your average annual usage per hectare for crops is about 70 l/ha. This could be much higher or lower depending on the kilowatt size of tractors and the widths of implements drawn and efficiencies of the engines and have a different range depending on whether you use a full mechanical or minimum tillage programme in your operation.

The above assumption thus implies an expense of R1 155 per hectare for diesel. The total diesel usage and cost for crop production on an annual basis for various areas is shown in Table 1.

See which of your production parameters and farm size fit the chart. The total quantity of diesel used by all the other vehicles and machines on the farm must be added to Table 1 to calculate the actual annual total diesel cost.

See which of your production parameters and farm size fit the chart. The total quantity of diesel used by all the other vehicles and machines on the farm must be added to Table 1 to calculate the actual annual total diesel cost.

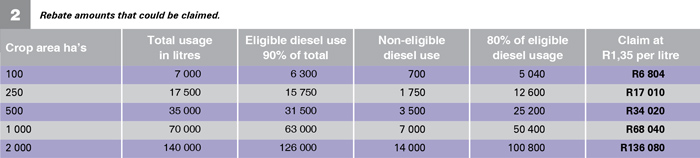

SARS DIESEL REBATES

To financially assist farmers and other industries and to encourage primary sector food production the diesel rebate system was introduced. These rebate payments on total diesel production are sourced from the general fuel levy which is about R3,40 per litre. The rebate is calculated at 40% of the general fuel levy which equals about R1,35 per litre. Only 80% of the qualifying ‘eligible’ diesel consumption in a farming operation may be used as the basis for the rebate calculation. ‘Eligible’ diesel would be only fuel that is directly used for production purposes.

Using Table 1 as a reference, the rebate amounts that could be claimed are seen in Table 2.

The farmer can decide from Table 2, at which value point it is viable or prudent to follow the SARS registration process to qualify for the rebate. There is much record keeping and administration time involved in submitting a valid claim to SARS.

SARS REQUIREMENTS TO QUALIFY

The diesel rebate is administered through the VAT collection system so famers must be registered for VAT to qualify, (VAT 101 form). When registered for VAT the farmer can apply to be registered for the diesel refund scheme by completing the VAT 101D registration application form. Please refer to the SARS website for all the detailed requirements to qualify for the above. Once registration is accepted, the diesel rebate claim is submitted with your usage amounts as shown above, on the VAT 201 return form. This could be monthly or six monthly depending on your registration conditions.

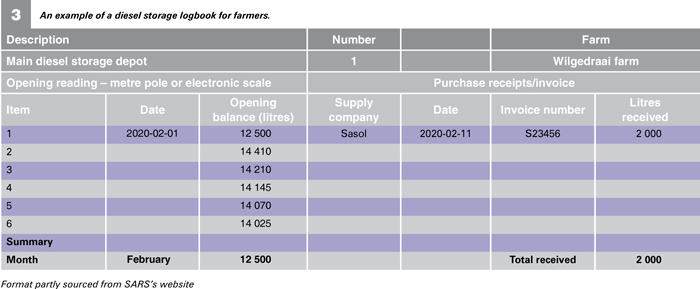

Most farmers would have a control system for monitoring their diesel usage by using the delivery receipts and invoices paid and by keeping detailed logbooks of all deliveries to main tank storage and usage by individual tractors, trucks and LDV’s.

This however becomes mandatory and SARS only accepts hand recorded or electronically approved monitoring systems subject to inspection. Although SARS will accept the amounts as given on the VAT 201 return on eFiling, you can be subjected to an intensive audit by SARS at any time. Both a diesel storage and dispensing and a diesel usage logbook must be duly be kept in detail.

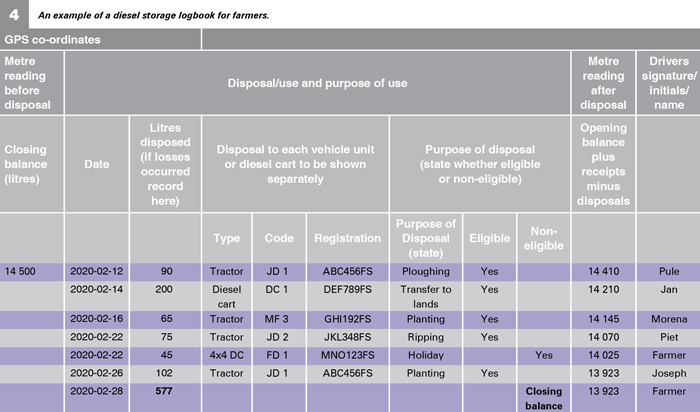

An example of each is shown in Table 3 to Table 4. Please look carefully in the column headings to see what is legally required and you will have an idea what a diesel logbook should look like. If you can afford it, buy electronic monitors for all tanks, tractors and machines that can record all this data in digital format. All operators have tags which are used at every fill up. The managers can then monitor all usage remotely in real time from a computer for control and be able to submit very accurate data to SARS.

CONCLUSION

If you wish to qualify for a diesel rebate, reliable and accurate records must be kept on the farm in a format that can be submitted to SARS with confidence.

Publication: March 2020

Section: Pula/Imvula