With high hopes for the start of 2021, and a seemingly good grain production year, the COVID pandemic and the risks and regulations associated with it, is preventing the Grain SA team from travelling to our members for our annual regional meetings.

The 2021 regional meetings will however proceed in a virtual format and all members and interested grain producers are invited to join the discussions. Six regional virtual meetings are scheduled on the following dates with a specific focus:

The links for each meeting will be sent out to members, be made available on the website and communicated on all channels. The discussions will be kept as interactive as possible and we look forward to the possibilities of increased participation from members.

Since Prof Roberts' report, Grain SA has worked hard to find alternatives that will result in a more effective differential system. Grain SA deemed it important that calculations function as close as possible to reality within the physical market. It is important that there are points where producers can deliver at a zero differential, the possibility of more than one reference point and that re-deliveries are limited.

Johann Strauss from UFS is engaged in research that offers these possibilities. Grain SA has sent various communications about the system and its possibilities to members and market role players as well as consulted with role players in various market segments. Thus, on 28 January 2021, Grain SA requested the Sunflower and Soybean Forum to officially request the JSE to investigate the system as a new methodology. The JSE was part of the meeting and confirmed the did have discussions with Mr Strauss and that they will soon have a follow-up discussion to test possibilities and feasibility. Strauss tested seven different methodologies and, from the results, proposed a new system.

The system can perform the calculations on a fair basis for all role players, based on physical movement of grain, given supply and demand as well as market competition.

For more information on the system, the following links can be viewed:

Conditions are generally very wet in all the production regions. Promising yields are largely expected in the western parts of the country although there are waterlogged spots where damage is already visible. Follow-up rain in the central parts of the North West is also welcomed. Crops look very good in the Eastern parts of the country with conditions that are very wet in parts of the Eastern Free State, while rain occurred at a critical time in Mpumalanga last week after a few drier weeks. Sunshine is welcomed where fields are too wet.

View the full agricultural production conditions as of 28 January 2021 here

Click on the image above for a complete update

Following on the success of the first Grow for Gold National Yield Competition hosted by Grain SA last year, the organisation is excited to announce the launch of the 2021 competition.

Formal yield contests provide an estimate of yield potential under similar conditions, for a specific region, motivating producers to achieve outstanding results, receive recognition for new and ground-breaking farming practices and reward innovation.

In Grain SA’s constant endeavours to promote sustainable and profitable grain production, the 2021 Grow for Gold National Yield Competition will further highlight the actual potential growth that innovative production practices can achieve. Crop yield is an important metric to understand as it assist with understanding food security and can explain why a crop’s cost can fluctuate year-on-year. In addition, there is still a massive gap between the genetic potential of crops and what is actually realised in the field.

Together with all seed companies, the competition protocol has been further refined to ensure the assessment of all participating producers, from small-scale to commercial, under the same stringent criteria. Grain producers compete in 16 categories, including dry and irrigated land, both regionally and nationally aiming to achieve the highest yields per hectare, regardless of the cultivar planted. Pioneering production practices and inventive farming are vital in achieving record-breaking yields.

The 2021 Grow for Gold National Yield Competition invite all South African grain producers, that plant maize, soybeans and sunflower, to participate in this second annual yield contest. The success stories of the 2020 Grow for Gold winners has not been all about high plant populations or inputs, but focussed on producers who identified and mitigated yield-limiting factors specific to their individual fields. Coming from various regions planting a variety of seeds, these successful grain producers pinpointed specific management tips that any grain producer can take home and apply to their own farming operations and improve their agronomic knowledge.

Producers can obtain information about the Grow for Gold National Yield Competition from the website at www.groeivirgoud.co.za or from their seed company.

Wheat farmers will have something to look forward to and will have the opportunity during this 2021 season to compete in the 2022 Grow for Gold National Yield Competition. More information will be available as as the wheat planting season nears.

The 2020 Grow for Gold competition’s records and success stories can be accessed in the Grow for Gold Mini Focus in the SA Graan/Grain magazine on the following link: https://sagrainmag.co.za/magazine/

South Africa, like many parts of the world, experienced turbulent times during 2020, with an unstable currency, disruptions in input supplies and a deteriorating economy. Furthermore, 2021 started on a similar note with the second wave of COVID-19. Despite all the disruptions, global agricultural value chains have remained resilient and most uncertainties have been resolved. This article reflects on price trends in the past year for agro-chemicals and fertilizer as well as give an outlook for 2021.

Herbicide and insecticide price trends

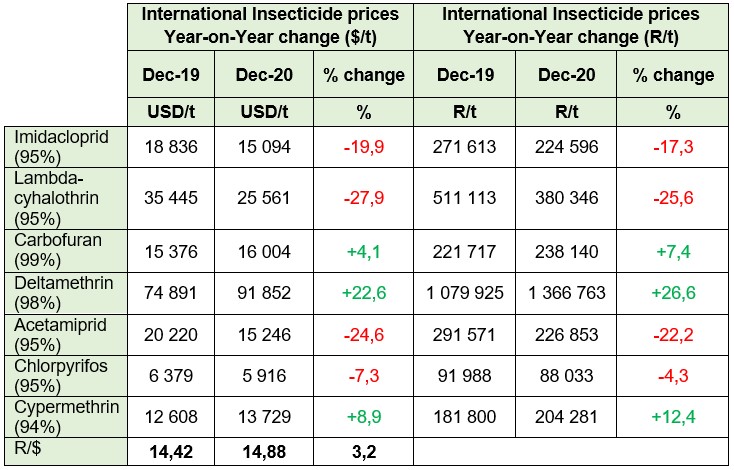

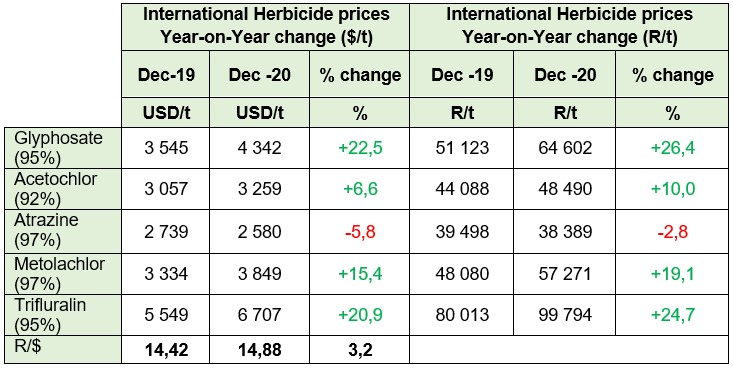

Tables 1 and 2 show trends in the prices of international agricultural chemicals (active ingredients) on the left and international prices in Rand value on the right. Between December 2019 and December 2020, the rand has depreciated by 3.2%. The impact of this depreciation can be seen on the right.

When viewing insecticide prices (table 1) there has been significant decreases for over half of the insecticides in rand terms, with the other half showing increases of up to 26.6%. This trend follows the international price trend and the impact of the Rand is seen by the magnitude of the increase or decrease, being slightly lower in Rand terms.

Table 1: Insecticide prices: International in Dollar and Rand value

Source: Grain SA

Source: Grain SA

*Data as at December 2020

Table 2: Herbicide prices: International in Dollar and Rand value

Source: Grain SA

Source: Grain SA

*Data as at December 2020

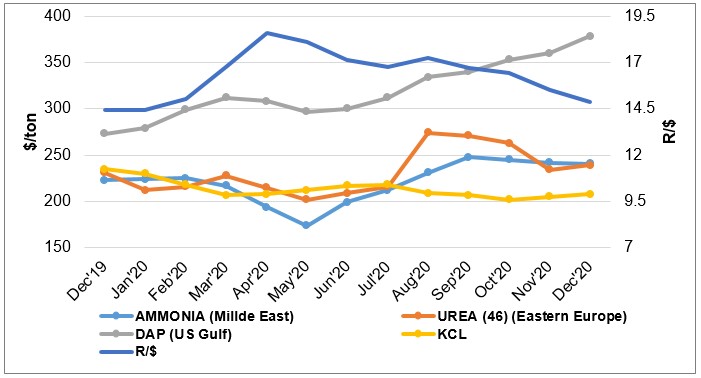

Fertiliser price trends

Figure 1 depicts international fertilizer prices in Dollar terms from December 2019 to December 2020 as well as the Rand/Dollar exchange, for the same period. Looking at the past year, there is a general upward trend in international fertilizer prices, especially for the second half of the year. DAP prices increased the most with 38.5%, followed by ammonia with 8.1%, and urea with 3.5%, supported by strong demand from key crop-growing regions, like Brazil and Australia. On the other hand, potassium chloride decreased by 11.5%, potash prices remains subdued due to oversupply internationally.

Figure 1: International fertilizer prices

Figure 1: International fertilizer prices

Source: Grain SA

*Data as at December 2020

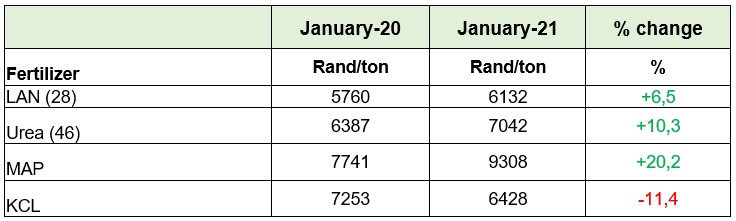

Table 3 depicts average domestic fertiliser prices. These are in line with international prices; showing an increasing trend for all except potassium chloride, between January 2020 and January 2021.

Table 3: Local fertilizer prices (Average price list prices)

Source: Grain SA

Source: Grain SA

*Data as at December 2020

Chemical and Fertilizer Prospects for 2021

The world chemical outlook for 2021 at this point looks robust, with many of the fundamentals for growth in place. The continued improvement in commodity prices is anticipated as prices firm due to tight stocks, driven by maize and soybeans. In addition, global crop area is expected to increase in line with predictions. According to the IMF, the global economy is expected to rebound by 5.2%, with economies starting to rebuild amidst the pandemic. Agricultural policies across the globe should remain positive, with the key assumption that US-China Phase-2 deal will move ahead. Lastly, ENSO neutral conditions now developing into a strong La Niña that is expected to continue into the second quarter of 2021, this carries an extra degree of weather related risk and uncertainty.

According to the World Bank’s commodity Markets Outlook, fertilizer prices are projected to increase modestly by 3% in 2021. Global supply of primary raw materials (ammonia, phosphate rock and potash) for all uses in 2021 is expected to grow by 2%. The International Fertilizer Association (IFA) expects global fertilizer demand to grow by 1% in 2021/22, much more slowly than in 2020/21. South Asia would continue to drive the expansion of global fertilizer use, followed by Eastern Europe and Central Asia, Latin America and Africa.

Several factors are contributing to greater fertilizer demand, including government measures, resilient crop prices, a more attractive relationship between crop and fertilizer prices, weakening of domestic currencies in large agricultural exporting countries, and favourable weather in key consuming countries. In addition, some farmers may have purchased fertilizers earlier than usual as a precaution against potential delivery delays or financing difficulties. The lingering COVID-19 pandemic will probably not affect fertilizer logistics significantly, as already demonstrated in 2020. However, the uneven nature of global economic recovery could affect consumer food demand, government budgets, farmers’ input purchasing behaviour and their financing conditions.

Given the above outlook for agro-chemical and fertilizer prices, South Africa is expected to follow a similar trend with higher prices owing the sector being a net importer and global prices have a significant big impact on our local prices, with the rand fluctuation also playing a significant role.

The latest issues of the 2021 January edition of Pula Imvula, Grain SA's magazine for emerging farmers, has been loaded on the website. Be sure to read any of the editions for the latest news and articles. Simply click on one of the links below.

| Pula Imvula English | Pula Imvula Sesotho | Pula Imvula Tswana | Pula Imvula Xhosa | Pula Imvula Zulu |

|