Grain SA's Production Input Working Group had their annual discussions with some of the input umbrella organisations at the end of July. This included meetings with Fertasa (fertilizer companies), SAAMA (agricultural machinery companies) and CropLife (agricultural chemical companies).

The implementation of Leaf services' grading inspections has been withdrawn, pending an appeal process initiated by industry. Depending on the outcome of the appeal, further litigation will be considered.

The most recent Executive Meeting took place on 28 July and various specialist working groups are taking place including the Northern- and Southern Barley working groups, Groundnuts, Sorghum, Alternative Crops and Canola. Feedback videos of each meeting are uploaded on the Grain SA YouTube channel as they become available and can be viewed here

The past couple of months have been an uphill battle for the agrochemical and fertilizer industry. International agrochemical and fertilizer prices have continued an upward trajectory, owing to increased demand, lower production, and shortages of some raw materials. South Africa, as an importer of these products, continues to be at a disadvantage with price increases, with the only reprieve being a stronger Rand that moved from R16.74 in July'20 to R14.54 in July'21.

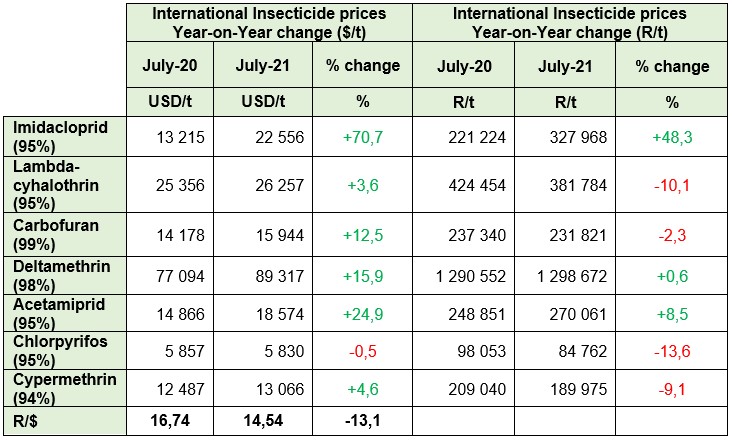

Tables 1 and 2 indicate trends in the prices of international agricultural chemicals (active ingredients) on the left and international prices in Rand value on the right. Between July 2020 and July 2021, the Rand has appreciated by 13.1%. The impact of the stronger Rand can be seen on the right hand side of each table.

Table 1 depicts increases for all insecticides in Dollar terms, between 3.6% and 71%, except for Chlorpyrifos, which is showing a 0.5% decrease. Some of the active ingredients are following a similar trend in Rand terms, including Imidacloprid 48%, Acetamiprid 8.5% and Deltamethrin 0.6%, while the rest are going against the international price trend, showing decreases in Rand terms of up to 13%. Generally, South Africa as a net importer of these ingredients follows international price trends, but the impact of the stronger Rand is seen by the moderate increases and the magnitude of the decreases in Rand terms, while international prices are increasing.

Table 1: Insecticide prices: International in Dollar and Rand value

Source: Grain SA

Source: Grain SA

*Data as at July 2021

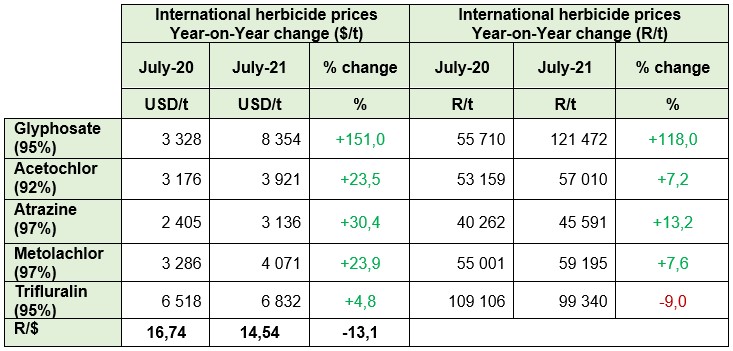

Herbicides listed in table 2, point to a significant increase in the prices of all active ingredients by up to 151% for glyphosate in Dollar terms, with a similar trend in Rand terms, albeit to a lesser degree; however, Trifluralin shows a decrease of 9%, over the period of review.

Table 2: Herbicide prices: International in Dollar and Rand value

Source: Grain SA

Source: Grain SA

*Data as at July 2021

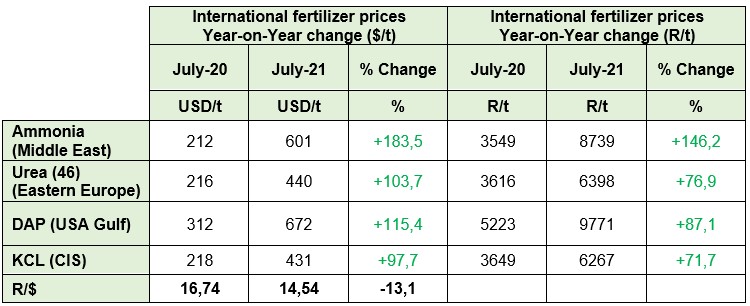

Table 3 depicts international fertilizer prices in Dollar terms between July 2020 and July 2021 on the left and the same ingredients in Rand terms on the right. There is a significant upward trend in international fertilizer prices over the past year. Ammonia prices increased the most by 184%, followed by DAP 115%, Urea 104% and KCL by 98%. In Rand terms, Ammonia increased by up to 146%, followed by DAP 87%, Urea 76%, and KCL by 72%. The increases in Rand terms, although still significant and severe, is lower for active ingredients compared to the Dollar terms, and is an indication of the counter-effect of a stronger Rand.

Table 3: International Fertilizer prices in Dollar and Rand value

Source: Grain SA

Source: Grain SA

*Data as at July 2021

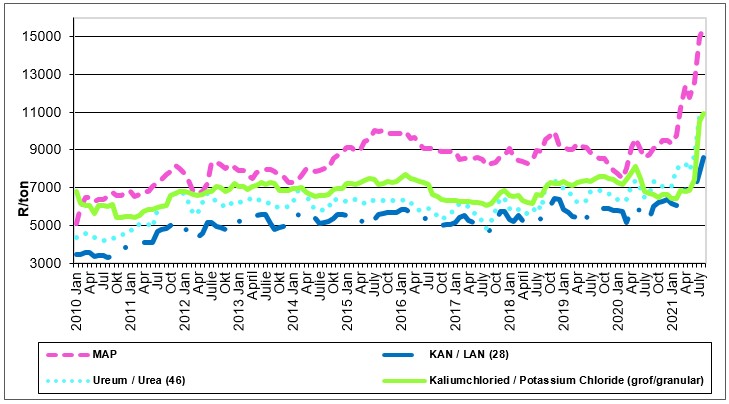

Figure 1 depicts average domestic fertiliser prices since 2010. Focusing on the period between August 2020 and August 2021, local prices have moved in a similar trend to international prices, with an increasing trend for MAP 77%, LAN 60%, Urea 63%, and KCL 63%.

Figure 1: Local fertilizer prices (Average price list prices)

Source: Grain SA

*Data as at July 2021

Agrochemical and fertilizer prices remain high due to demand, mainly as a result of shortages of some raw materials like oxygen, due to the COVID pandemic. Agrochemical production in China has been struck with issues of water supply and electricity rationing, therefore lowering operating rates. Another issue in China has been the consolidation of major producers, which will cause monopolistic behaviour. Demand in the next few months will further play a role in price determination and Glyphosate regulation in some countries will influence production. Mexico for one would like to phase out Glyphosate by 2024. Fertilizer prices continue to be rallied by increasing commodity prices. The last pertinent issue is increasing transport costs; high shipping costs and a deficiency in shipping capacity remain a problem. Many ports still struggle with backlogs since COVID started.

Critically, as producers approach the coming summer crop planting season, timeous planning and ordering inputs in advance will avoid disappointment and delays.

The latest issues of the 2021 August edition of Pula Imvula, Grain SA's magazine for emerging farmers, has been loaded on the website. Be sure to read any of the editions for the latest news and articles. Simply click on one of the links below.

| Pula Imvula English | Pula Imvula Sesotho | Pula Imvula Tswana | Pula Imvula Xhosa | Pula Imvula Zulu |

|

Agri SA in partnership with the Department of Health is seeking to identify and assess farms/farming operations within the sector that can make their workplace clinics and/or premises available to establish workplace vaccination sites. Vaccination sites may also assist the employees/workers family members or clients/ client - farmers to increase the outreach number of the site.

Farming businesses have the following options:

Employers that are willing to make their clinics available may complete the short survey below to assess their viability.

https://www.surveymonkey.com/r/3RMCDY2

The NDoH and medical schemes may reimburse the cost of the vaccine, its distribution to your site and the cost of administration. Vaccinations sites will only run for a short period. To have a site that runs for a longer period to justify its establishment (say a month or two), we recommend that a site be able to service at least 2,000 to 5,000 lives. Again, Agri SA anticipate that these lives can be comprised these ways:

Interested parties and/or farming operations are encouraged to click on the links provided to assess viability.