Grain SA's regional meetings start next week and members are invited to join their nearest meeting. The meetings will focus on Grain SA's strategic direction for 2020, the basic land reform situation, the PPGI agricultural plan, inputs and monitoring, the current market situation, research and development, profitability, the current economic situation, the state of levies and member benefits. Make sure to not miss the meeting in your area.

The meeting dates are available on the website as below. Updates are made as needed:

The Leadership Academy for Agriculture gives young farmers active, innovative and practical exposure that will enable them to be leaders in South African agriculture both at farm and national level.

The Leadership in the Connection Economy programme is presented by the Leadership Academy for Agriculture, formerly known as the Grain Academy. This programme equips young leaders in agriculture to lead, think and behave differently to make a profound difference in their enterprises, communities as well as organised agriculture in South Africa.

The programme is certified by NWU Business School (NQF 7) and presented by thinking fusion AFRICA. All programme costs will be covered except transport and accommodation.

To apply before the closing date of 24 January 2020, click here for the website.

Outbreaks of gerbil infestations have been reported in the summer grain production regions, with damage reported in the Free State, North West and KwaZulu- Natal. It is crucial that producers take precautionary measures as soon as possible and scout their crops on a daily basis for the presence of gerbils.

CropLife South Africa urges grain farmers to download and follow the gerbil management programme (download a copy here) and to refrain from using any pesticides off-label to control gerbils.

Any of the registered rodenticides as listed in the gerbil management plan must be placed in bait stations or in gerbil burrows as explained in the plan. Scattering rodenticides onto the soil surface is not only illegal but ineffective and poses a severe risk for biodiversity. We also encourage grain farmers to attract owls and diurnal raptors to assist with gerbil control – this is all explained in detail in the management plan. Scouting is a very important part of the management plan and farmers are encouraged to check hedgerows for burrows and gerbil droppings. Once found, it should trigger the implementation of the management plan.

For any particular advice call Dr Gerhard Verdoorn at CropLife SA on 082 446 8946 or email him at gerhard@croplife.co.za.

For further reading on gerbils refer to below recent published articles:

South Africa is a small player when it comes to the use of inputs, with the majority of inputs imported from abroad. This article is a reflection of price trends in the past year for agro-chemicals and fertilizer.

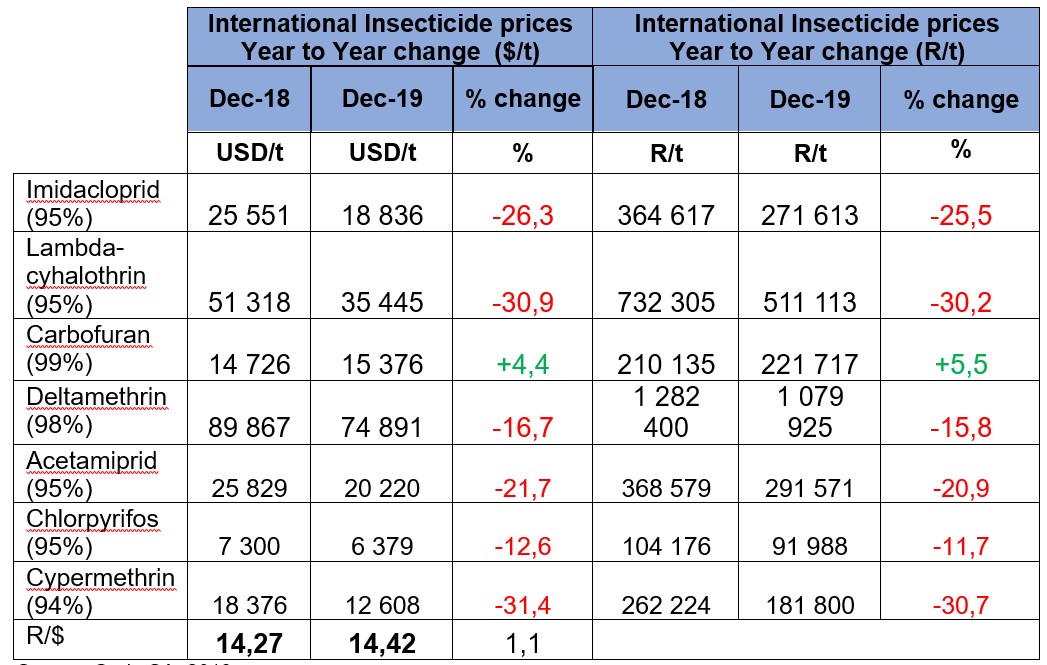

Tables 1 and 2 show trends in the prices of international agricultural chemicals (active ingredients) and the equivalent Rand value. Between December 2018 and December 2019, the rand has depreciated by 1.1%, with the impact clearly visible below. Looking at insecticide prices (table 1) there has been significant decreases in most of the insecticides in rand terms, with only Carbofuran showing a slight increase between December 2018 and December 2019.

Table 1: Insecticide prices: International in Dollar and Rand value

Source: Grain SA, 2019 - *Data as at December 2019

Source: Grain SA, 2019 - *Data as at December 2019

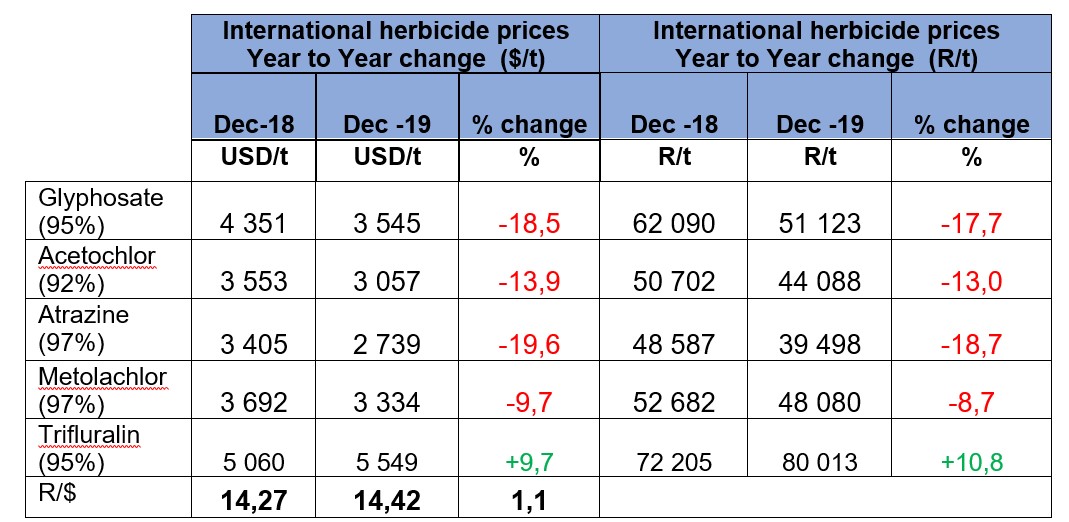

Herbicides (table 2) indicate a general decrease in the prices of all active ingredients except Trifluralin that has shown an increase in rand terms from December 2018 to December 2019.

Table 2: Herbicide prices: International in Dollar and Rand valueSource: Grain SA, 2019 - *Data as at December 2019

Source: Grain SA, 2019 - *Data as at December 2019

Source: Grain SA, 2019 - *Data as at December 2019

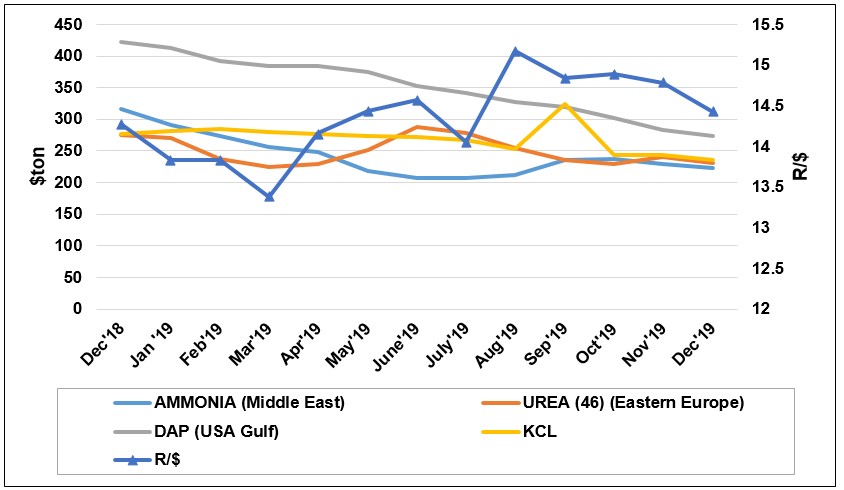

Figure 1 depicts international fertilizer prices in Dollar from December 2018 to December 2019 as well as the Rand/Dollar exchange for the same period. Reviewing the past year, a general downward trend in international fertilizer prices is noticed. DAP prices decreased the most at 35.3%, followed by Ammonia 29.4%, while Urea and Potassium Chloride decreased by 16.3% and 15.2% respectively.

Figure 1: International fertilizer prices -

Figure 1: International fertilizer prices -

Source: Grain SA - *Data as at December 2019

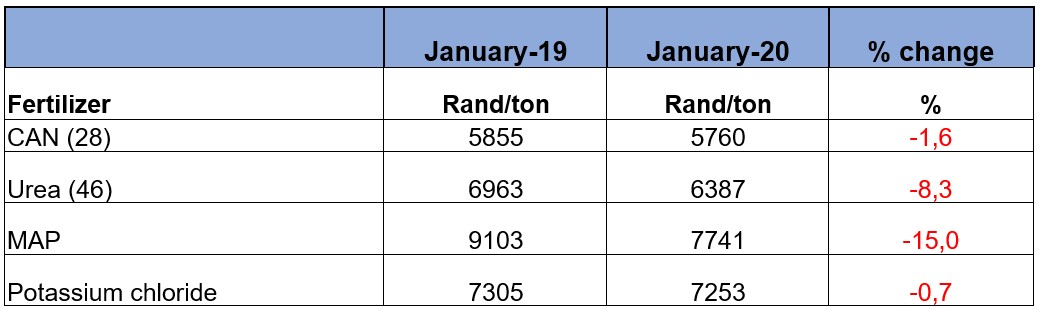

Table 3 depicts average domestic fertiliser prices. These are in line with international prices; domestic prices also show a slight decreasing trend over the past year.

Table 3: Local fertilizer prices

Source: Grain SA - *Data as at December 2019

Source: Grain SA - *Data as at December 2019

The outlook for 2020 is indicative of similar factors that have kept prices low in 2019, slow global economic growth, trade tensions and mixed signals about manufacturing, slowing down sales.

According to Rabobank’s global fertilizer outlook, prices will be kept at bay for various reasons. Environmental policies in China have led to a restructuring of the fertilizer industry, which will keep prices down in 2020. The US fertilizer demand is expected to rebound after seasonal issues in previous crops; however, the forecast still points to weak pricing dynamics. Stricter environments regulations are expected to decrease fertilizer demand by 1.8% for the European Union, fertilizer producers face record low prices, weak demand, coupled with pending emissions pressures. Brazil is expected to see a 2% increase in fertilizer demand for 2020 compared to 2019, due to lower fertilizer prices and anticipated good commodity prices. Drought in various parts of Australia has affected demand for fertilizer and especially urea; this is expected to keep prices in check, together with ample stocks ahead of next season. Lastly, New Zealand is also expected to see a downside in fertilizer prices as a result of new environmental reforms.

Given the above forecasts for agro-chemical and fertilizer prices, South Africa is expected to follow a similar trend with side-ways to lower prices since the country is a net importer and global prices have a big impact on local prices, subject to the Rand keeping its value.