The National Assembly has once again granted the Ad-hoc Committee an extension to complete their work on the proposals for an amendment of Section 25 of the Constitution. One could consider the extension following the limitations with regards to COVID, but what transpired in the last week before their initial deadline of 31 May 2021, raised more than just eyebrows in the agricultural sector. In December 2018, the National Assembly agreed to amend Section 25 to make expropriation of land without compensation more explicit in the Constitution.

Agri SA released a statement on Monday citing a Dangerous twist in debate on amendment of section 25 expressing its concern over further amendments proposed to Section 25 following bilateral discussion between political parties. Proposals to completely remove the entire sub-section 3, which makes provision for compensation for expropriation, as well as apparent calls to an amendment to the wording of sub-section 5, which stipulates that the state must introduce reasonable legislative and other measures to promote state custodianship of land, is very disturbing. Furthermore, the proposal to remove the 1913-cut-off date for land restitution claims could possibly complicate the process event further.

Grain SA took part at all levels of engagements during the consultations phases and is not in favour of an amendment to the Constitution. “What transpired from the political discussions last week does not just fall way outside the mandate of this particular process, but the thought process will be the end of all private property ownership in South Africa and probably the end of the economy and food security. How can one ignored the Courts on the issues dealt with in the Constitution? The Constitution is judged by the Courts, not by Parliament,” Grain SA CEO, Jannie de Villiers said.

Agbiz released a statement EWC debate out of sync with South Africa's economic policy direction with clear concern about the proposals being entertained at all and expressed dismay at its consideration as it is not in line with the country’s economic policy direction and in a critical time when energies should be directed at economic reconstruction and recovery, Dr John Purchase, Agbiz CEO stated.

Agri SA also confirmed it by stating that “custodianship of land will deprive all private landowners of their property rights without receiving compensation, giving control over all private land to the state. This is a recipe for an economic and humanitarian disaster, and an invitation for large-scale corruption”, said Willem de Chavonnes Vrugt, chair of Agri SA’s Centre of Excellence: Land.

For further details and the list of current recommendations on the project to Amend Section 25 of the Constitution can be obtain from Parliament here.

Grain SA’s renowned annual agricultural tradeshow, the 2021 NAMPO Harvest Day that was rescheduled for 17 – 20 August has been cancelled, the organisation announced yesterday.

Following the initial postponement earlier this year, government policies and guidelines permitting, the arrival of the 3rd COVID-19 wave, and the amendments to the lockdown levels under the National State of Disaster has left the organisation with no alternative. With more than 750 exhibitors participating in this agricultural showpiece, sights are now set on 2022.

Throughout the first half of 2021, Grain SA continued to monitor the surge in the coronavirus pandemic nationally and the accompanying regulations and restrictions on the country. The rising COVID-19 cases led to further limitations on outdoor gatherings providing complex challenges in hosting the Harvest Day, and in the interests of all visitors, event personnel, exhibitors and the local community's health and safety, the event has been cancelled. It marks the second straight year the NAMPO Harvest Day has been called off due to the pandemic.

“The decision to cancel or postpone any event, especially the NAMPO Harvest Day - the biggest agricultural show in the Southern Hemisphere - is not an easy call for any organisation” CEO, Jannie de Villiers said. “Events of this scale require significant investment of time and resources by the organisers, approval institutions at local and national levels, exhibitors and service providers alike, and a decision as to whether NAMPO 2021 should go ahead had to be taken timeously”, de Villiers added.

Furthermore, Grain SA continuously consulted with its NAMPO stakeholders and partners evaluating the possibility of hosting the 2021 NAMPO Harvest Day in its original format whilst still ensuring the safety of both exhibitors and visitors alike. “The NAMPO Harvest Day requires months of planning from the organisation and its exhibitors and with many of its stakeholders still prohibiting participation in, and attendance of events, the decision to cancel the event was once again, a necessary one,” Dr Dirk Strydom, Manager: Grain Economy and Marketing said.

Grain SA remain committed to presenting a diversified agricultural trade exhibition to the benefit of our loyal partners, the local community, the agricultural sector and the broader public, and we look forward to hosting the 2022 NAMPO Harvest Day from 17-20 May 2022 on NAMPO Park, just outside Bothaville in the Free State.

NAMPO Cape , scheduled for 8-10 September 2021 in Bredasdorp, Western Cape and the NAMPO Alfa Expo, scheduled for 30-Sep – 2-Oct 2021 on NAMPO Park, Bothaville have also been cancelled. The decision to host these two popular events will be reconsidered should government regulations be amended.

Historically, South Africa has been a net importer of protein and vegetable oils. In 2012, the dtic together with industry role players developed an import replacement strategy to expand the South African soybean sector. Significant investments were made in the soybean and sunflower seed crushing plants, with a total capacity of 2.5 million tons, with the dedicated soybean crushing capacity estimated at 1.75 million tons. The establishment of domestic crushing plants yield positive results and a significant increase in the production of soybeans. As a result, an increase in oilcake and oil production is assisting in gradual import replacements. Furthermore, investment and policy were developed to attract new soybean seed technology to South Africa. The Breeding and Technology levy was introduced to incentivise the development of new cultivars and technology. Since March 2019, this levy has been implemented on soybeans to compensate seed companies for their investment in genetics and technology in the soybean seed market. Since its inception, positive outcomes are visible, which will further increase local production and opportunities to increase local processing to substitute imports of oil and oilcake.

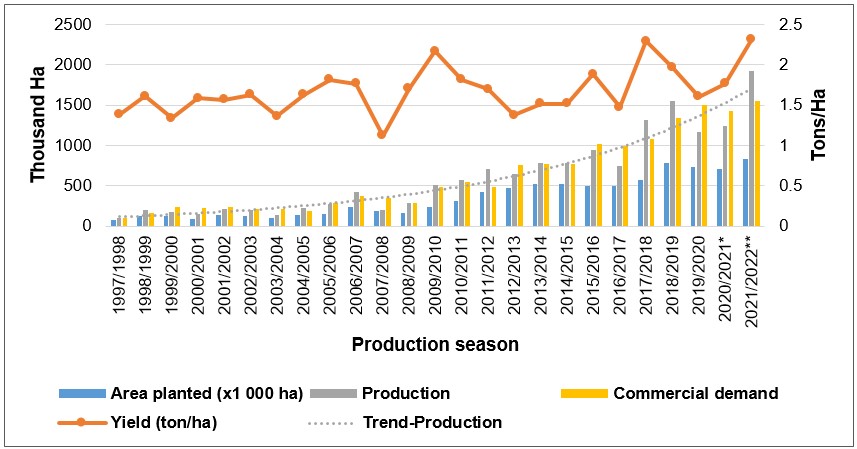

The summer crop harvest season is well underway and according to the Crop Estimates Committee's 4th production estimate, the expected soybean crop is 1.9 million tons (figure 1), which is set to be the highest on record. The soybean producers have responded to the high demand in crushing capacity, with soybean area increasing by 64.4% since 2016/17 and it is expected to continue to increase firmly over the next few years. The demand for locally produced soybeans has also grown by about 48% in the same period, with an average annual consumption of about 1.2 million tons, most of which is crushed for oil and cake.

Figure 1: South African Soybean Area planted, production, demand and yield

Figure 1: South African Soybean Area planted, production, demand and yield

Source: Grain SA

In the current marketing season, South Africa might produce a surplus of soybeans since oilcake imports still take place. Coupled with the ineffective logistical system from inland to the Western Cape for instance, this leads to pressure on prices due to excess stocks as local processors are unable to expand.

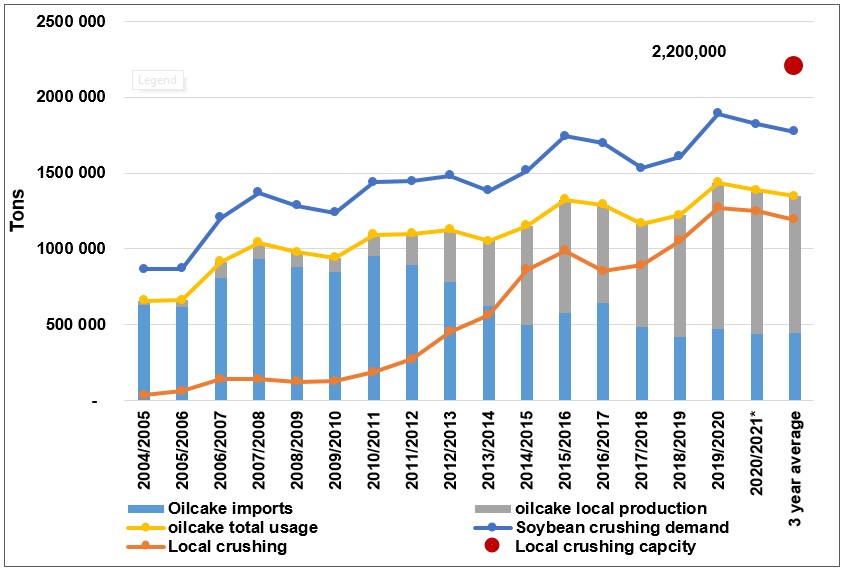

Figure 2 indicates an increased soybean oilcake production with slowly declining imports. Import substitution gained momentum since 2014, and the volume of soybean demanded crushing to fulfil the current oilcake usage which remains relatively high. South Africa is slowly closing the gap with surplus soybean production and expansion of local processing, local crushing capacity is currently sufficient to service current and additional demand.

Figure 2: Figure 4: South African soybean oilcake import substitution

Figure 2: Figure 4: South African soybean oilcake import substitution

Source: SARS and SAGIS

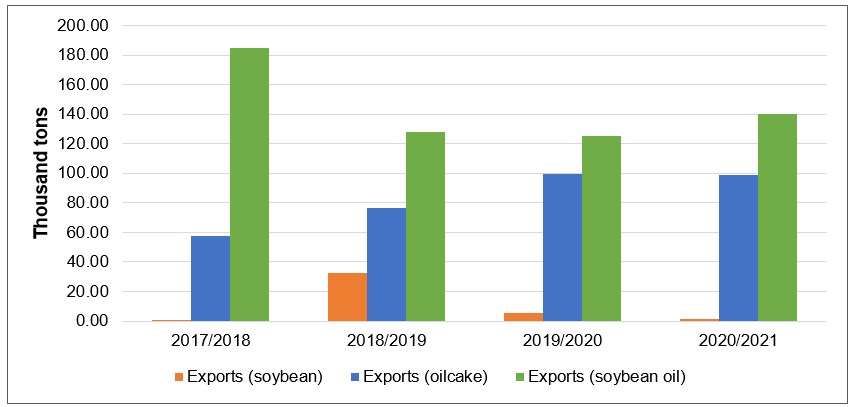

During the 2020/21 marketing season from 1 April 2020 to 28 February 2021, total soybean exports were 1 060 tons, while soybean oilcake amounted to 99 000 tons and soybean oil 138 978 tons (figure 3), according to SAGIS. Although this may not seem like much, with the rapid increase in production, export markets need to be further explored. Foresight is therefore needed to relieve the market of any pressure when the need arises. With the expected increase in production for the 2021/22 season, existing and possible new export markets, logistics systems and the export capacity in the country's ports need to be looked at, as exports provide price stability for markets.

Figure 3: South African production and exports of soybean and its derivatives

Figure 3: South African production and exports of soybean and its derivatives

Source: Grain SA, SAGIS

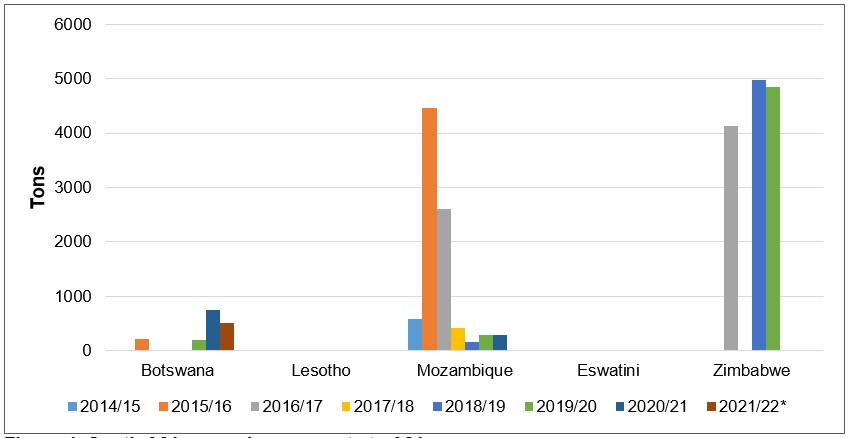

According to SAGIS data, South Africa typically exports soybeans to the neighbouring countries (figure 4) with Turkey the only country on record outside of Africa with 27 000 tons exported in 2018/19.

Figure 4: South African soybean exports to Africa

Source: SAGIS

2021/22*(Mar 2021)

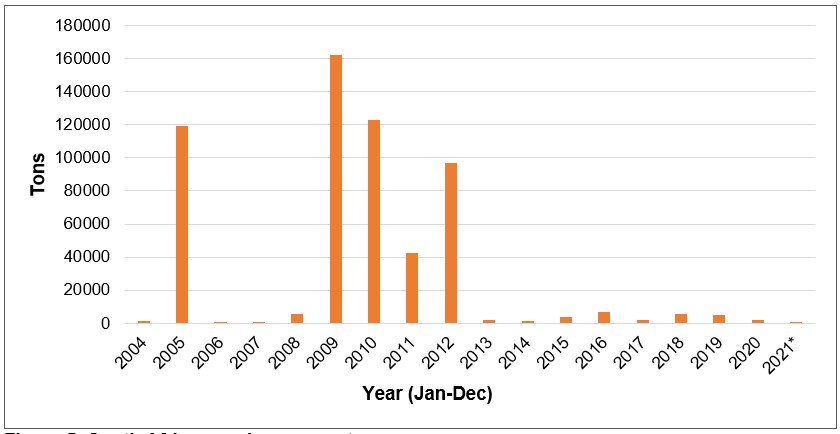

Figure 5 shows that between 2004 and 2021, SARS also has a record of soybeans exported to the countries listed in table 1. Although most of them are small quantities, it is a good indication of available and accessible export markets.

Figure 5: South African soybean exports

Figure 5: South African soybean exports

Source: SARS

2021*(Jan-Mar 2021)

Table 1: Soybean exports

|

SADC Region, Ethiopia, Ghana, Kenya, Liberia, Mali, Morocco, Nigeria, Sudan, Togo. |

Argentina, Australia, Canada, Chile, China, Colombia, France, Germany, Grenada, Indonesia, Japan, Mexico, Malaysia, Saint Helena, Saudi Arabia, Singapore, Sri Lanka, Taiwan UAE, UK, US, Thailand, Vietnam. |

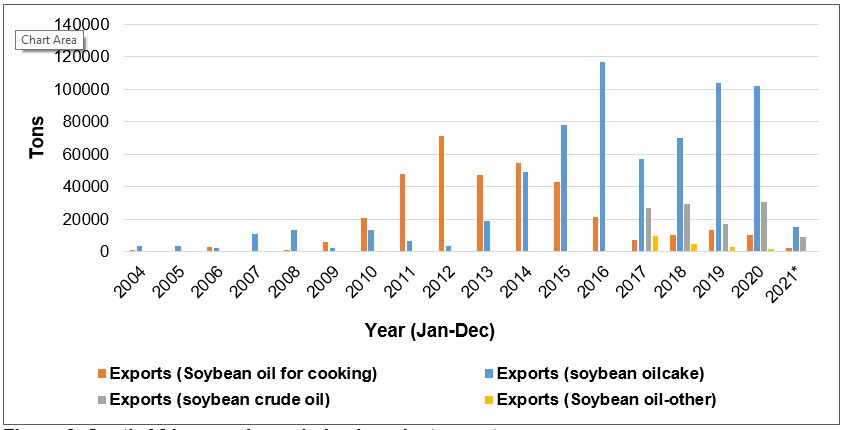

Figure 6 indicates that South Africa similarly exports large quantities of soybean oil and oilcake across the world. The major destination for these products is the SADC region. All destination countries are mentioned in table 2 for each product. Although some products have been exported to places like East Africa, China, the Middle East and the EU before, these were small quantities compared to the SADC region, but are great markets to focus on in future, competitiveness considered.

Figure 6: South African soybean derived product exports

Source: SARS

2021*(Jan-Mar 2021)

Table 2 Export markets for soybean derivatives

| Soybean oilcake | Soybean oil for cooking | Soybean oil-other uses |

|

SADC region, Burkina Faso, Gabon, Ghana, Kenya, Nigeria, Sudan and Uganda, Argentina, Australia, Germany, Oman, Reunion, Saint Helena, Saudi Arabia, Seychelles, Slovenia Switzerland, UAE and the US. |

SADC region, Brazil, China, Denmark, Ethiopia, Fiji, France, French Polynesia, Gabon, Germany, Ghana, Greece, Honduras, India, Kenya, Liberia, Moldova, Netherlands, Niger, Saint Helena, Sierra Leone, Uganda, UK, US. |

SADC region, China, Denmark, Eswatini, Ethiopia, Ghana, Kenya, Nigeria, Saint Vincent, Sudan, United States. |

Source: SARS

Furthermore, South Africa seized an opportunity during the China-US trade war to become a supplier to the Chinese market, which happens to be a major consumer of soybeans. Due to the absence of trade agreements between China and South Africa, a protocol market had to be established for soybeans. The process started in 2018 and is currently in the final stages. Once this market is open, a great opportunity for SA exports beckon due to the location advantage compared to the US.

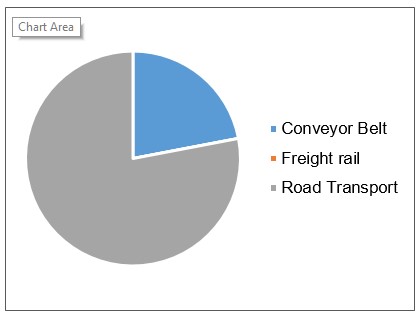

SAGIS data reports most soybean is transported by road followed by conveyor belts, with no records of rail transport (figure 7). Additionally, all the soybean that was exported over the years moved through the Durban harbour. There is major impetus within the industry to sharpen rail transport logistics in the short term, with further prospects for improvement in the long term. One of the objectives of the Agricultural Master Plan is to increase rail transport logistics, capacity and efficiency at the ports in the long term. Throughout the entire transport logistics system, it remains one of the most important factors, as it is the endpoint and to a large extent determines the capacity for and efficiency of exports. Future objectives include deepening the Maydon Wharf (RBT and Agri Port sections) - from the current 9.56m and 10.5m respectively to 13m. This will allow parts of the Durban harbour to handle 50 000 ton ships. At Island View (DBS and BPO sections), the aim is to deepen the harbour to 16m from the current 12.5m. This will provide the opportunity to handle 70 000 – 80 000 ton vessels. This will increase import and export efficiency, further providing additional opportunities for more effective export management. Proposals to extend the current lease agreements with the private port operators would incentivise the private sector to invest in infrastructure.

Figure 7: Transport components for soybeans

Figure 7: Transport components for soybeans

Source SAGIS (2015)

According to BFAP’s 2020 baseline, soybean production is projected to exceed 2.2 million tons by 2029, supported by continued area expansion and an average yield growth of about 4% annually. There has been a positive response from producers to increas production, while crushing capacity has also been ramped up. The next step in this equation is to take advantage of available and new export markets, to increase job creation and export earnings for the sector.