Widespread rains have generally occurred since last week. It brought relief to crops that were beginning to struggle in the Western parts of the country but it also brought producers who have systematically started harvesting, to a standstill again. Summer grains generally appear very good and good yields are expected. Producers are concerned about the occurrence of diseases due to the wet climatic conditions, specifically leaf diseases on maize and Sclerotinia on soybeans and sunflower.

View the full agricultural production conditions as of 25 March 2021 here

Click on the image above for a complete update

On 24 March, Grain SA together with Johann Strauss from the University of the Free State had a workshop with the JSE to discuss the possible Alternative system. Several more workshops will have to take place, with the aim of discussing the feasibility of the model and also answering all the JSE's questions.

Grain SA Congress has decided to stay with the differentiated levies on different crops. The levies in Table 1 show the new levy amount per commodity as from 1 March 2021. It was further determined to pay a one-off additional COVID levy of R1.50 / ton for all crops for the 2021/22 season. This levy is already included in the levies indicated in Table 1.

Table 1: The Grain SA operating levy for 2021

| CROP | LEVY |

| Maize | R4,85 |

| Soybeans | R8,10 |

| Sunflower | R8,10 |

| Sorghum | R4,85 |

| Groundnuts | R14,10 |

| Wheat | R5,40 |

| Canola | R6,75 |

| Barley | R5,40 |

| All other grains | R5,40 |

Members of the Grain SA Sunflower and Soybean Working Group were invited by Bayer to view the confined field trials where the new Intacta and RR2 technology for controlling bollworm on soybeans are being tested. The trials are being done as part of the registration of the new technology on soybeans but also to test new cultivars for possible registration. A total of 18 new cultivars were tested and incorporated with the new technology. An international seed company also presented experiences with Intacta RR2 in countries such as Brazil, as well as their intention for SA. In countries such as Brazil, 80% of the crop is already planted with cultivars containing this technology. Due to the Breeding and Technology levy, South Africa can also now have access to the additional gene pool.

The barley industry was under a lot of pressure during the year for various reasons. With the most recent - the risk regarding the storage of barley. There are currently several disputes between buyers and grain storage operators and as a result one silo indicated that they could not reach an agreement to establish a contract for the season. This has a particular impact on the Swartland and irrigation production areas. Although this is a issue between a buyer and a storage operator, it has significant consequences for the producer, especially given that planting time is around the corner. The outcome leaves the producer without assurance where the product will be delivered and who will facilitate the purchases.

This outcome is extremely negative for the sustainability of the industry and may result in barley not being planted in these areas this season. This is not a good scenario given crop rotation systems and already limited crop cultivation options in the winter grain regions.

Grain SA has been in discussion with both parties throughout and will continue to try to find solutions for the challenges. Although the buyer has indicated that they will persist with the purchase mandate, the challenge would arise with the practicality of it. It is a pity that the quality requirements became so high that local production is affected, especially after the past three year’s hard work to establish production in an area such as the Swartland, even following indications on several occasions that it is a risk for the local industry.

The industry will urgently need to explore solutions to limit further negative impacts on producers' risk and production.

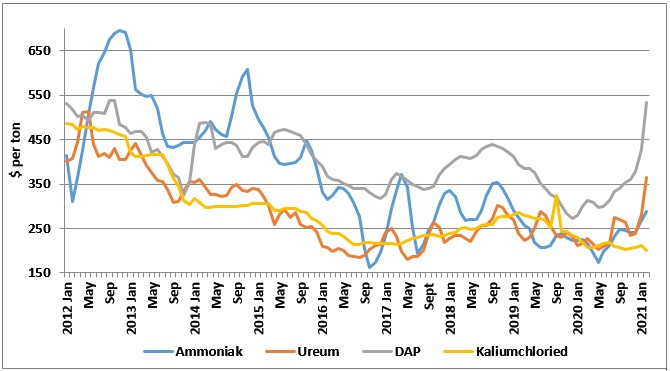

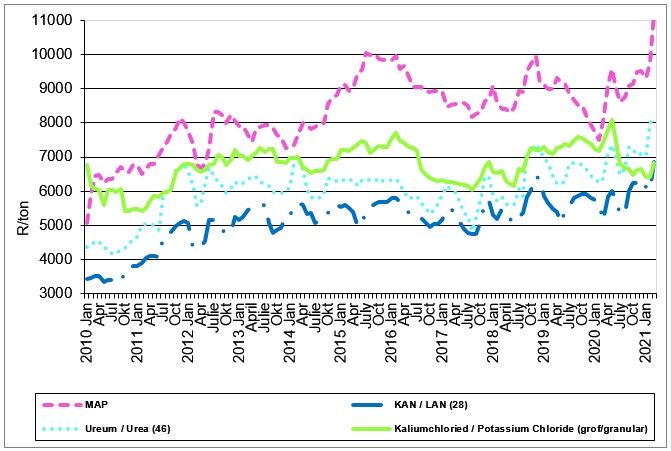

It has been over a year since the world started fighting the COVID-19 pandemic and exactly one year since the pandemic hit South African shores. The ongoing repercussions can be seen in different economies and specifically with increasing input prices. International fertilizer prices, except for potassium chloride, are currently (March 2021) at the highest levels in more than 24 months (figure 1). According to market analysts prices have increased mainly due to low stock levels due to COVID-19, rising natural gas prices and earlier applications in the US and EU, which temporarily increased demand for fertilisers. Other factors can be attributed to the following;

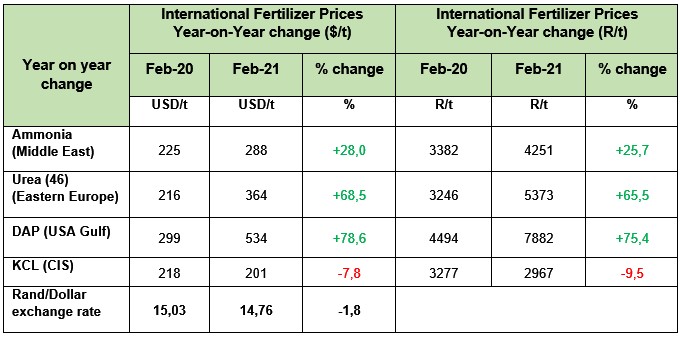

Table 1 depicts international fertilizer prices in dollar terms (left) and Rand terms (right) from February 2020 until February 2021 as well as rand/dollar exchange, which strengthened for the same period. Looking at the past year, there is a significant increase in international fertilizer prices, except for potassium chloride, which shows a moderate decrease of 7.8%. Ammonia, Urea and DAP increased by 28%, 68.5% and 78.6% respectively. The same fertilisers in Rand terms also follow a similar trend, although the increase is to a lesser extent, which can be attributed to a stronger Rand.

Table 1: International fertilizer prices (year on year)

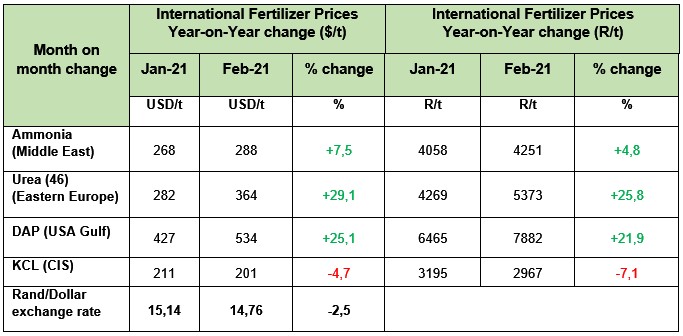

Table 2 depicts international fertilizer prices in dollar terms and Rand terms between January 2021 and February 2021 as well as rand/dollar exchange, which strengthened for the same period. Looking at month-to-month basis, there is a similar trend to the year on year trend, with substantial increases in international fertilizer prices, except for potassium chloride, which shows a moderate decrease of 4.7%. Ammonia, Urea and DAP increased by 7.5%, 29.1% and 25.1% respectively. The same fertilisers in Rand terms also follow a similar trend, although the increase is to a lesser extent, which can be attributed to a stronger Rand.

Table 2: Table 1: International fertilizer prices (Month on month)

Figure 1 is a graphic representation of international fertiliser prices over time and we can see upward trend over the past eight months or so.

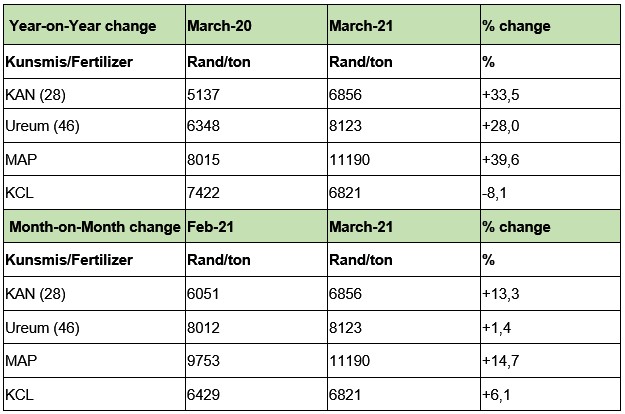

Table 3 illustrates average domestic fertiliser prices in Rand terms for March 2020 to March 2021 as well as February 2021 to May 2021. The trend is similar to international prices and shows an increase in fertilizer prices for the yearly term, while the monthly period, shows an increase in potassium chloride as well.

Table 3: Local fertilizer prices

Figure 2 shows local fertiliser prices over time and it is clear that MAP is at the highest level ever on the recorded data, since 2010.

Figure 2: Local fertiliser prices

Figure 2: Local fertiliser prices

Source: Grain SA

In conclusion, for fertiliser prices to normalise, and taking into account the fundamental factors in the fertiliser market, production needs to be higher than the expected demand for the rest of 2021 (hopefully this could happen after planting of summer crops in the Northern Hemisphere). In addition, the exchange rate has to strengthen further, to reduce the pressure on prices. Factors that can further support fertilizer prices include crude oil prices that continue to rise; this would support nitrogen and MAP prices. With fertilizer, having a major transportation cost component, crude oil prices may have this cost component also further exacerbated. Additionally, a weakening of the exchange rate during the course of 2021 could further create pressure on prices.

LEAF has been assigned by the Department of Agriculture, Land Reform and Rural Development to inspect grains and grain products. Their inspection involves grading of raw grains and grain products, something that is already done by industry. This would imply duplication of the current self-regulatory grading system, at an estimated cost of R200 million (R4 per ton on raw grain for producers) for the industry.

On 24 March, Grain SA, with the mandate of Congress, voiced its opinion strongly against this duplication of not only services, but also costs. Should LEAF go ahead with implementing the inspection in its current form, Grain SA would be forced to seek legal recourse (also mandated by Congress).

In February 2021, SARS and Treasury released a 2nd draft for a new proposed diesel rebate system for comment. Some of the most important changes in the proposed system is as follows:

In general, the new proposal is an improvement on the current system, especially with regard to the current grey areas and problems with communication.

Producers are encouraged to download the free reporting app for different pests, diseases and migratory. The “Biosecurity Africa” Application lets you instantly and quickly report pest sightings for quick decision making and rapid response to outbreaks.

Important pests that can be reported through this app includes (just to name a few):

Everyone can help map pests by using your phone to submit sightings. GPS coordinates are captured automatically, and you can record sightings in online or offline mode. You can even place a marker on a map if you had a sighting but could not capture it in the field.

By using the “Biosecurity Africa” application, you help to establish distribution maps which will be linked to weather data for forecasting and Early Warning Alerts on your mobile device specific to your crops. This is an important step in managing invasive species or pest outbreaks and track migratory patterns across the African continent. Your cooperation will lead to effective surveillance, control and eradication.

Follow this link to download the app on Android, IOS or Huawei: http://www.cropwatch.africa/biosecurityafrica-apps/

Biosecurity Sighting Application Quick Steps

The latest issues of the 2021 April edition of Pula Imvula, Grain SA's magazine for emerging farmers, has been loaded on the website. Be sure to read any of the editions for the latest news and articles. Simply click on one of the links below.

| Pula Imvula English | Pula Imvula Sesotho | Pula Imvula Tswana | Pula Imvula Xhosa | Pula Imvula Zulu |

|