March 2020

| Ikageng Maluleke, Junior Economist, Grain SA. Send an email to Ikageng@grainsa.co.za |  |

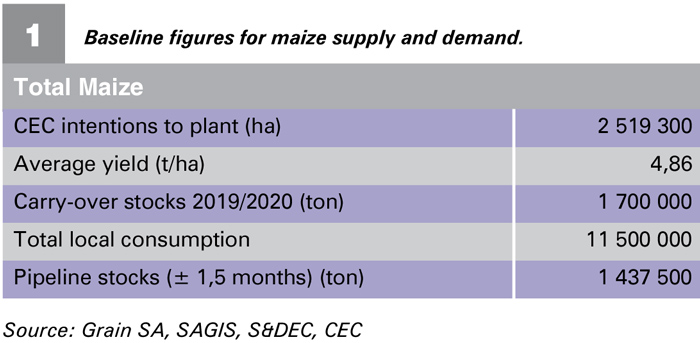

As we know production determinants are area planted as well as yield; however, these two variables are contingent on weather. Considering the uncertainty brought by the weather on intentions to plant, this article hypothesises different scenarios using the crop estimate’s committee (CEC) area planted and average yield as the baseline (Table 1).

Furthermore, Table 1 shows the 2019/2020 consumption of 11,5 million tons, which is about a 20% increase compared to the previous three season’s average of 10,1 million tons. Area intended for planting has also increased by about 10% compared to the previous season.

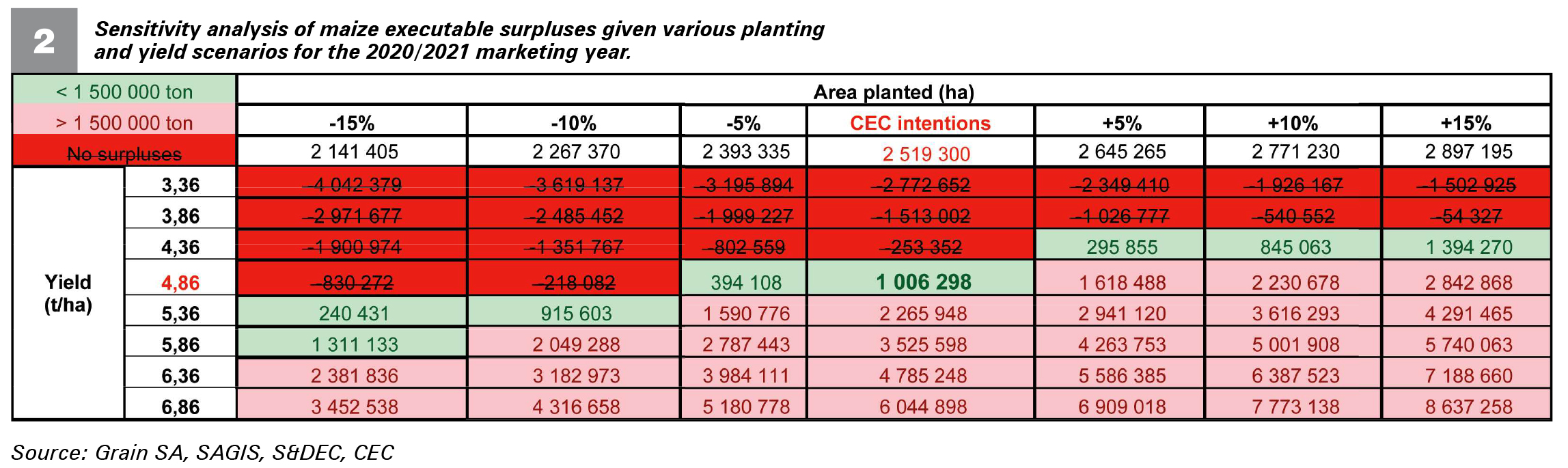

Table 2 indicates the CEC’s estimated maize area of production at 2 519 300 hectares (horizontal axis), with an average yield of 4,86 t/ha (vertical axis), which would ideally give a surplus of 1 006 298 tons. The exportable surpluses shown in the sensitivity analysis are green when there are less than 1,5 million tons for the season and red when there are more than 1,5 million tons. Without exportable surpluses, the cells are indicated in red with a strikethrough.

Going towards the right of the CEC intentions, if area planted deviates by +5%, +10% or +15% above the intentions at the average yield of 4,86 t/ha, this could leave us with an exportable surplus of between 1 618 488 and 2 842 868 tons. With the current weather conditions, this is likely to happen. Going towards the left of the CEC intentions, if area planted deviates by -5%, -10% or -15% less than the intentions at an average of 4,86 t/ha, the surplus could only be 394 108 tons at -5% deviation, while no surpluses can be expected at -10% and -15% deviations. With the same hectare deviation but lower yield, there are no surpluses expected at all.

As we have already established, supply and demand of a commodity, in this instance of maize has a direct impact on prices. With an exportable surplus above 1,5 million tons, prices will be at export parity level (lower); this is due to surplus production. With at an exportable surplus below 1,5 million tons, prices will be at import parity level (higher); this is due to a shortage in production. With the current weather conditions, production is most likely going to be according to CEC intentions or just above the intentions, which could lead to price suppression.

Publication: March 2020

Section: Pula/Imvula