August 2021

| IKAGENG MALULEKE, AGRICULTURAL ECONOMIST AT GRAIN SA |

|

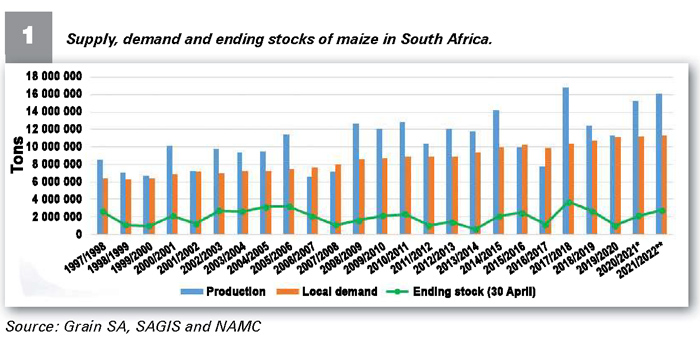

The 2020/2021 marketing year that ended on 30 April marked the end of a good season for South Africa’s maize production. The harvest yielded a crop of 15,3 million tons, which is the second largest after the 2017/2018 crop of 16,8 million tons and 35,7% higher than 2019/2020.

On average, the local market demands about 11,2 million tons of maize, with about 5,6 million tons for human consumption, 5,6 million tons for animal feed and the rest for gristing.

The exports for the 2020/2021 season totalled 2,8 million tons which is 55% more than the 2019/2020 season. The majority of white maize was exported to Zimbabwe (370 113 tons), Botswana (239 289 tons), Mozambique (132 075 tons) and Italy (127 901 tons). The top destinations for yellow maize were Korea (363 625 tons), Taiwan (323 189 tons), Zimbabwe (144 813 tons) and Vietnam (106 068 tons).

Closing stocks also rose significantly for the 2020/2021 season to 1,94 million tons which is 94% higher than the previous season. With average processing of about 935 000 tons, these stock levels were enough to last just over two months. Despite the bumper crop, higher exports and closing stocks, prices remained resilient at export parity levels, mainly driven by international factors, like China’s demand for feedstock and unfavourable weather conditions in certain parts of the world.

Looking at prospects for the new season that started on 1 May 2021, according to the Crop Estimates Committee’s fourth production estimate, about 16,1 million tons of maize is expected for the 2021/2022 season with 8,9 million tons of white maize and 7,1 million tons of yellow maize. If realised, this will be the second-largest crop on record for South Africa (Graph 1). With the expectation of a good harvest this season, local demand is approximated to increase moderately by about 1%, driven by the category for human consumption. Exports are expected to remain relatively the same at about 2,8 million tons. Ending stocks are estimated to increase by 41% at the end of the season, which would be sufficient for almost three months of demand.

The harvest season for maize is in full swing and producers are working hard to get the product into silos. With the expected bumper crop, the Safex price is currently at the export parity level. The expectation is that there should be a bit of pressure on prices, following historical trends during the harvest period. However, if the previous season is anything to go by, there could still be some spill over from the international markets, which would support prices higher for the next few months. This can be attributed to drought conditions in Brazil and parts of the USA. In addition, China is demanding significant amounts of maize from the USA, which is squeezing global supplies, sending international prices to an eight-year high. The local average price movement between May 2020 and May 2021 was 34% for yellow maize and 28% for white maize.

Publication: August 2021

Section: Pula/Imvula