July 2023

| PIETMAN BOTHA, INDEPENDENT AGRI- CULTURAL CONSULTANT |

|

It is important to understand the different costs of a business – regardless of whether it is a one-man business or a company. In any business, including a farming business, there are two major types of expenditures – variable and overhead costs.

Some expenditures will change when the production increases or decreases. However, other costs will stay the same up to a certain point and are not influenced by an increase or decrease in production. Therefore, the costs are divided into the directly allocatable variable costs and the fixed or overhead costs to form the total cost of the business.

VARIABLE AND FIXED COSTS

Variable costs

The variable costs are directly related to the quantity produced per enterprise. If no production takes place, there will be no variable inputs and costs needed. The variable costs will increase when the production level increases – for example, seed, fertiliser, fuel and seasonal labour costs.

If maize is produced, it is easy to calculate the quantity of seed needed. The more you plant, the more seed will be needed. It is common knowledge that in maize production seed, fertilisers, herbicide pesticides, diesel, repairs and other inputs are needed. These inputs must be available during planting time.

Fixed costs

On the other hand, some costs must be paid on a monthly basis, such as the cellphone account, farmworkers’ salaries, groceries and other expenditures. These monthly costs are normally called fixed or overhead costs.

Fixed costs are the part of the total cost that will remain unchanged, regardless of whether production takes place or not. Normally it is not influenced by an increase or decrease in production.

To illustrate this, look at the example of your household needs. If more hectares of maize are planted, your household needs usually remain the same. If less hectares of maize are planted, it also remains the same. But on a hectare basis, the cost will change drastically – if more hectares are planted, the cost per hectare will decrease; and if less hectares are planted, the cost will increase. It does not matter how much is planted, the fixed costs must form part of the total cost for the enterprise.

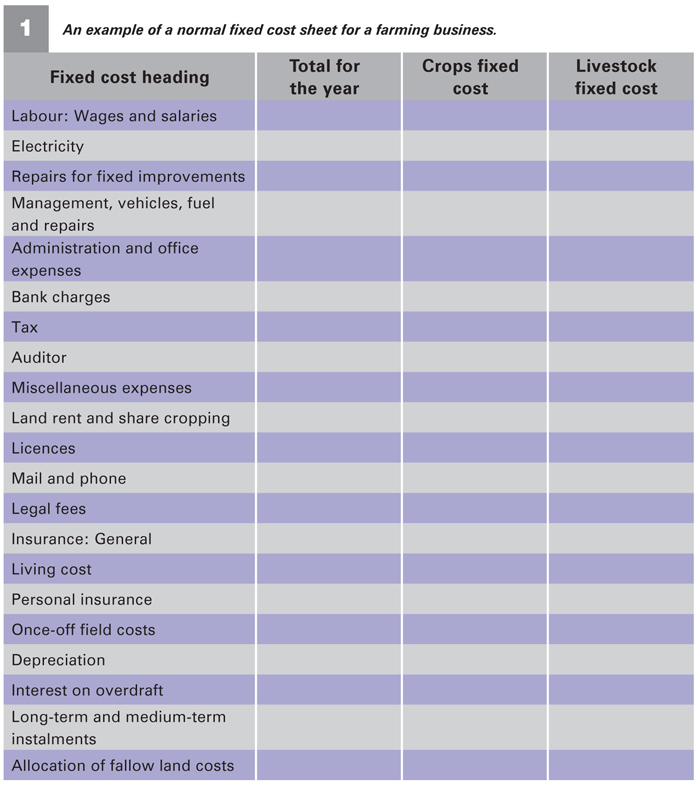

In Table 1 an example of the normal fixed cost sheet for a farming business is shown. It is important to understand that all farming businesses will have nearly all these costs, but there can be exceptions. For example, if a business does not own any tractors and entirely uses contractors to perform all the cultivation tasks, then there cannot be a depreciation cost for tractors.

These fixed costs are normally overlooked in the budgeting process. Sometime during the year the money in the bank will be finished, with a few months still left before the crops will be harvested. During this time, farmers will start to sell unmarketable cattle to generate cash for paying the labour and debit orders on the account.

These fixed costs are normally overlooked in the budgeting process. Sometime during the year the money in the bank will be finished, with a few months still left before the crops will be harvested. During this time, farmers will start to sell unmarketable cattle to generate cash for paying the labour and debit orders on the account.

BREAKEVEN PRICE PER TON PRODUCED

In the current grain marketing situation, it is important that every farmer must know what his breakeven price per ton produced must be. Remember, the crop prices are available daily on Safex and farmers can sell their crops on forward contracts.

It is important to know how much it is going to cost you to produce a ton of the crop. A farmer can then decide when to sell or what to plant. If you do not include all your fixed costs, you will not make the best decision for your business.

DIVIDING THE FIXED COSTS

Farmers must make sure that the fixed costs are divided fairly between the different farm enterprises. Firstly, the fixed or overhead costs must be allocated where possible to the different enterprises.

The fixed costs can be divided between the crops and livestock enterprises, according to the number of permanent workers in the enterprise. For example, if there are ten farm workers and two of them are livestock herdsmen, 20% of the fixed costs can be allocated to the livestock and 80% to the crop production.

When planting maize and sunflower, the fixed cost allocated to crops can be divided between the maize and sunflower according to the litre diesel used per hectare. By doing it this way, a crop that is using more diesel will carry a higher fixed cost.

CONCLUSION

Farmers may ask why the fixed cost is important and why depreciation must be included (like in the example about tractors). The main reason is that tractors will lose their value over time and extra money is needed to replace an older tractor with a newer one. So, depreciation is in a way a technique to help make provision for replacing older equipment. Everybody know that the old tractor needs to be replaced at a certain time and by adding depreciation as a cost, it will ensure that there is money available to replace the old tractor.

Never forget the fixed costs, as the small costs add up to an enormous amount that needs to be paid. For example, you pay R500 per month for your cellphone and at the end of the year it adds up to R6 000. Given today’s July maize price of R3 000 in the farmer’s bank account, it means that 2 tons of maize is gone. With a living cost of R120 000 per year, 40 tons of maize is gone. Start adding the costs up and in the end you will need a lot of maize to cover the overhead or fixed costs.

In the next article we will focus on the direct cost and total cost to produce grains and oilseeds.

The more you plant, the higher the variable costs will be.

Publication: July 2023

Section: Pula/Imvula