March 2024

|

JOHAN TEESSEN, ECONOMIST INTERN, GRAIN SA AND CHRISTIAAN VERCUEIL, AGRICULTURAL ECONOMIST, GRAIN SA |

|

The article in the January/February issue focussed on the background of hedging. This article will delve deeper into put and call options. It not only clarifies the distinctions between them, but also offers a practical example for better understanding.

Before delving into options, it’s essential to grasp several key terms:

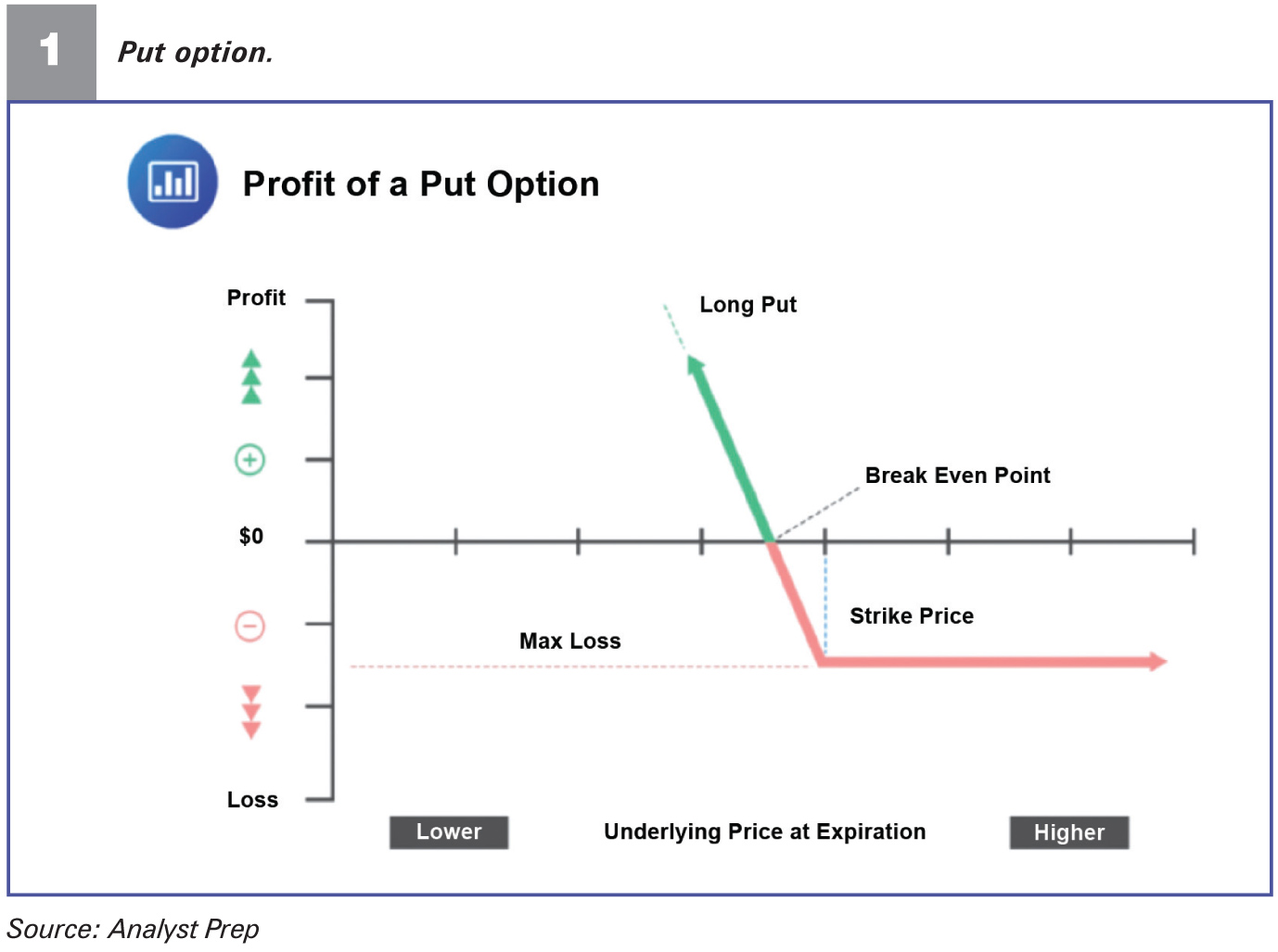

PUT OPTIONS

A put option is a contract granting the buyer the right, without an obligation, to sell a designated underlying asset (such as maize) at a predetermined price within a specified time frame.

This instrument shields farmers from potential price declines, even if they anticipate price rises. If prices indeed fall, the put option not only safeguards the farmer from losses but also sees an increase in value. Conversely, if prices rise as anticipated, the farmer retains the ability to engage in the market at the elevated price level.

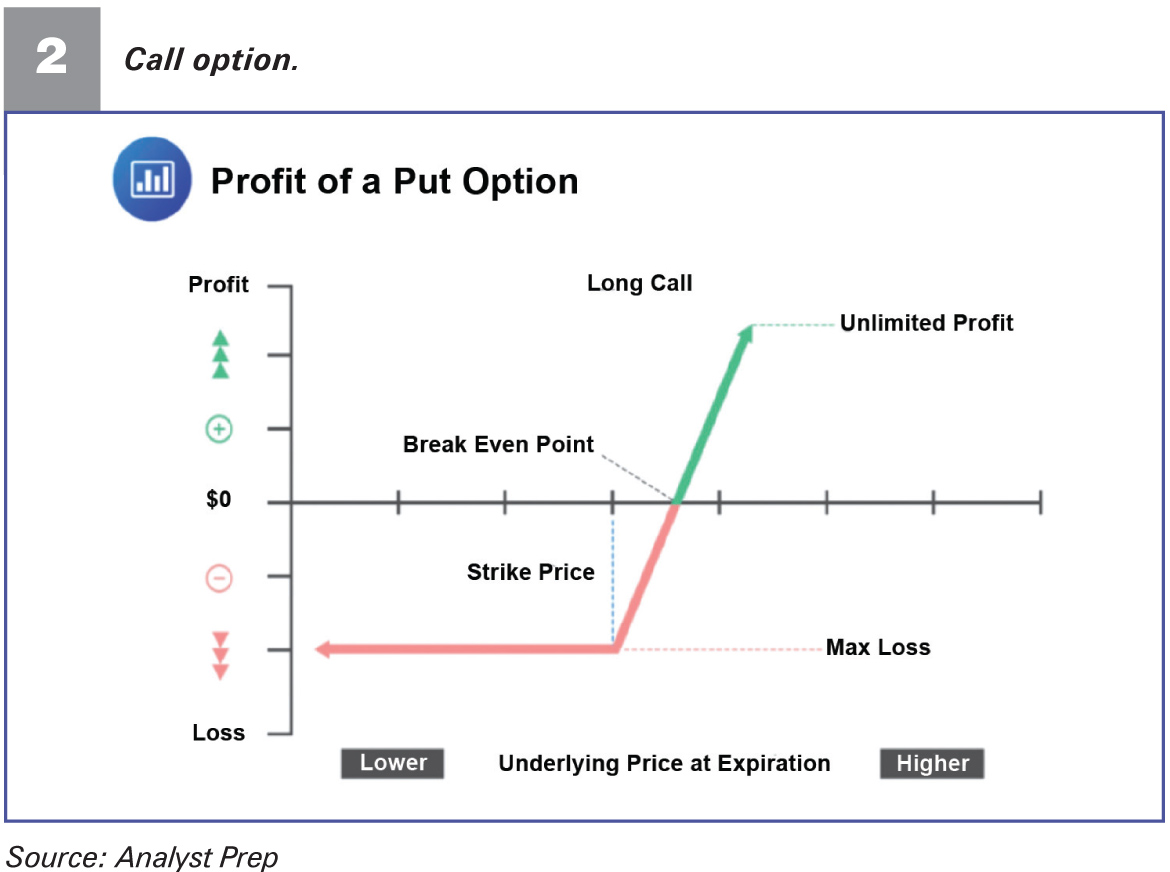

CALL OPTIONS

A call option is a contract that grants the buyer the right, without an obligation, to purchase a designated underlying asset (such as maize) at a predetermined price within a specified time frame.

This instrument aids millers in safeguarding against potential price hikes, even if they anticipate price declines. If prices indeed increase, the call option not only shields the miller from the higher prices but also experiences an appreciation in value. Conversely, if prices decrease as anticipated, the miller still retains the opportunity to engage in the market at a lower price point.

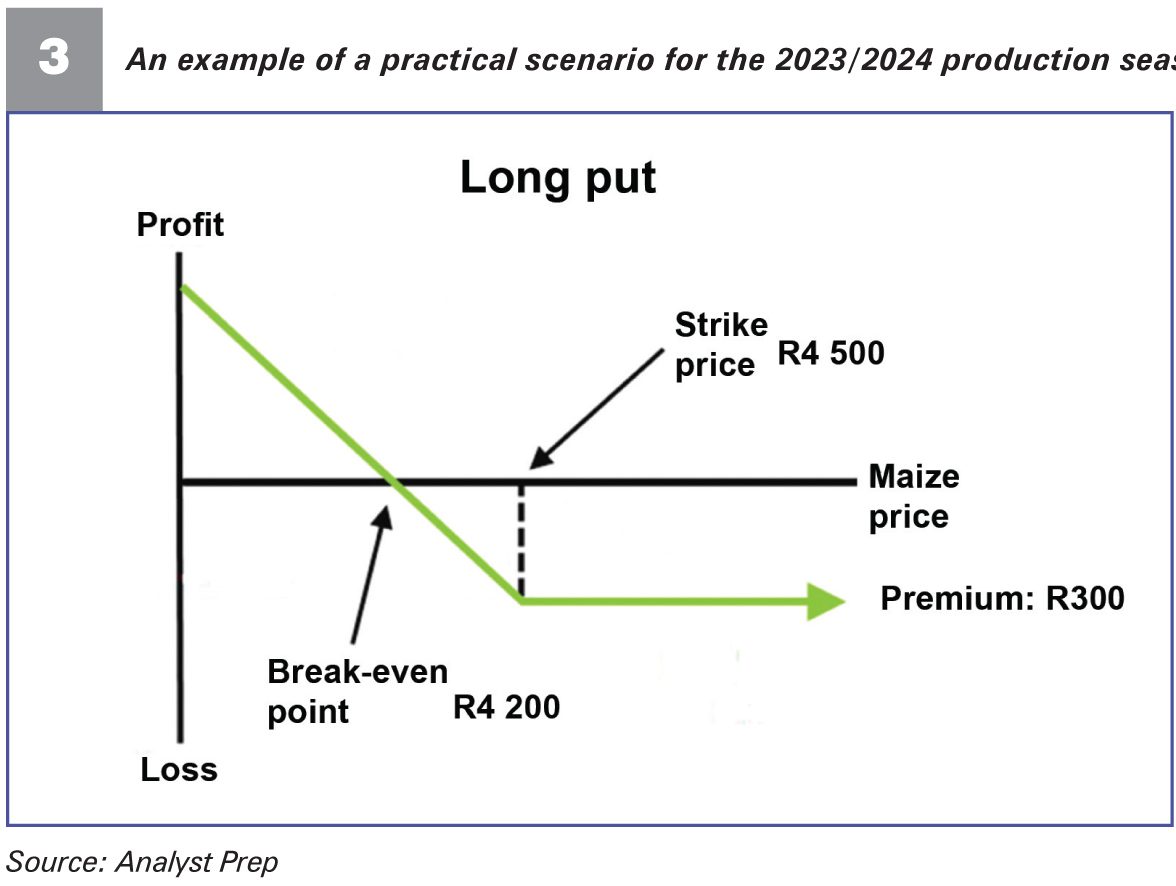

A PRACTICAL EXAMPLE

Consider the following scenario for the 2023/2024 production season: A farmer in Mpumalanga intends to cultivate 50 hectares of yellow maize and is set to buy inputs for the planting season in September 2023. He estimates that his input expenses will amount to R21 000/ha. With the ten-year average yield for yellow maize stand-ing at 6 t/ha, the current price for the July 2024 contract is R4 500/t. The cost of purchasing a put option is R300/t.

Given:

Given input expenses of R21 000/ha and a price of R4 500/t, a farmer must sell approximately 5 t/ha to offset input costs. Consequently, a farmer will opt to purchase a put option with a strike price of R4 500/t, incurring a cost of R300/t.

Scenarios

CONCLUSION

Understanding options can be somewhat challenging, but they offer significant benefits to farmers during uncertain periods, aiding in risk mitigation when employed effectively. While options present both advantages and disadvantages, employing them within a sound strategy minimises the likelihood of substantial losses.

Publication: March 2024

Section: Pula/Imvula