September 2022

| CHRISTIAAN VERCUIEL, INTERN: APPLIED ECONOMICS, GRAIN SA |  |

For the month of May 2022, oil prices traded on average at 1,35/barrel. This led to an increase in the diesel price for June 2022. The basic diesel price increased to R16,08/litre from R14,98/litre in May 2022. This is the real price of diesel.

The high diesel prices come after record prices were already reported in 2021, and the situation has just worsened in 2022. For June 2022, the wholesale diesel price was R23,09/litre.

Real data for the 2019/2020 season indicated that diesel expenses account for about 10% of a farmer’s total input cost. Diesel prices rose by 40% in 2021, and on top of this have increased by 28% in 2022 (until May), with more increases expected to come. The total input costs (including seed, fertiliser, agro-chemicals and fuel) increased by 50% on an annual basis.

HOW IS THE DIESEL PRICE DETERMINED?

The price determination of fuel in South Africa is a concept that very few South Africans are familiar with. The buying of petroleum products on the international market at import parity and the transport thereof are the main factors which influence the basic diesel price.

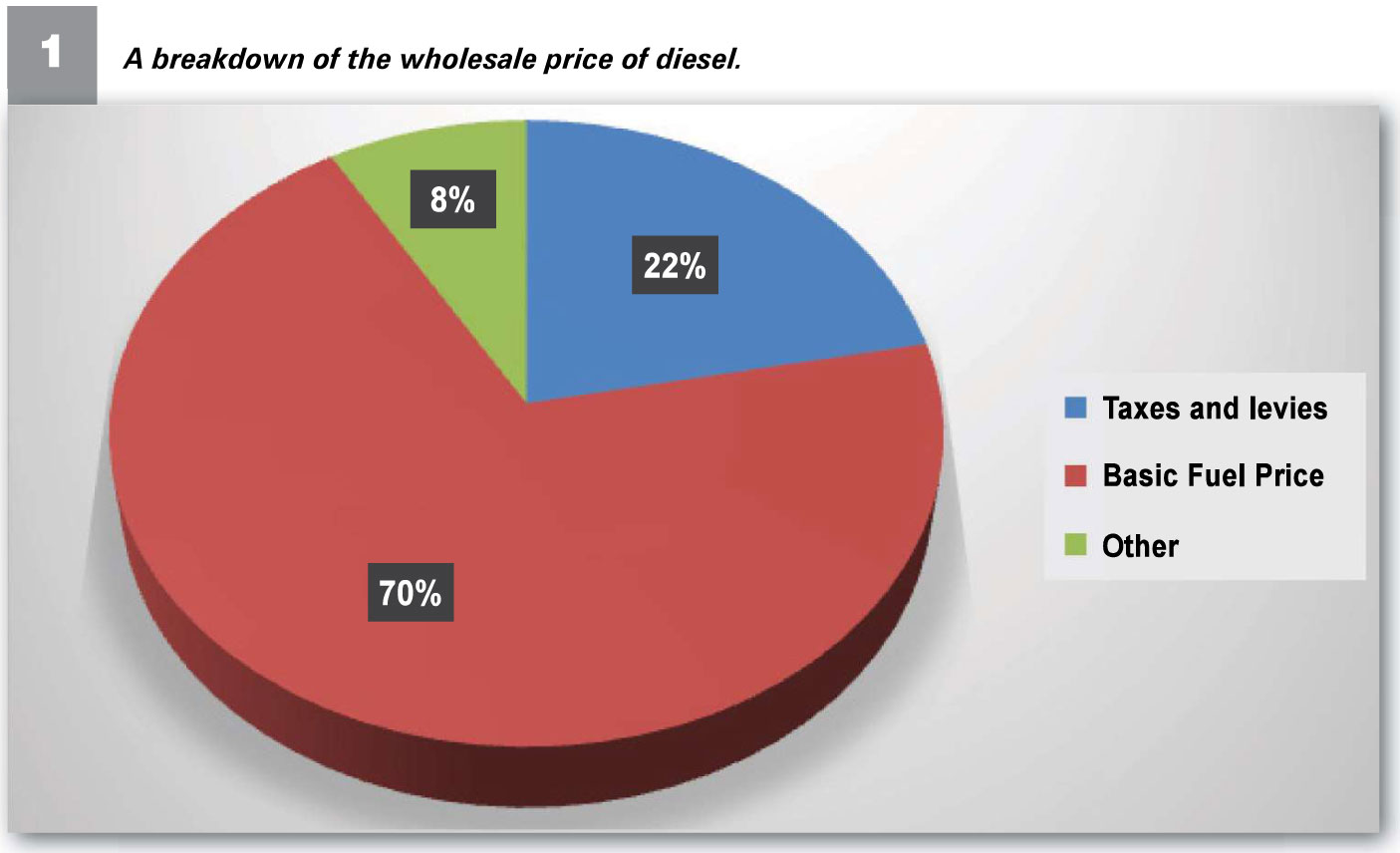

These two factors are heavily influenced by the international oil price and the rand/dollar exchange rate. From the basic fuel price, levies and taxes are added by the government. Graph 1 shows a breakdown of the wholesale price of diesel at 0,05% sulphur (S) against R23,09/litre (as on 1 June 2022), the following is clear:

Source: Department of Mineral Resources and Energy, 2021

TAXES AND LEVIES

The two biggest levies are the general fuel levy and the Road Accident Fund (RAF) levy.

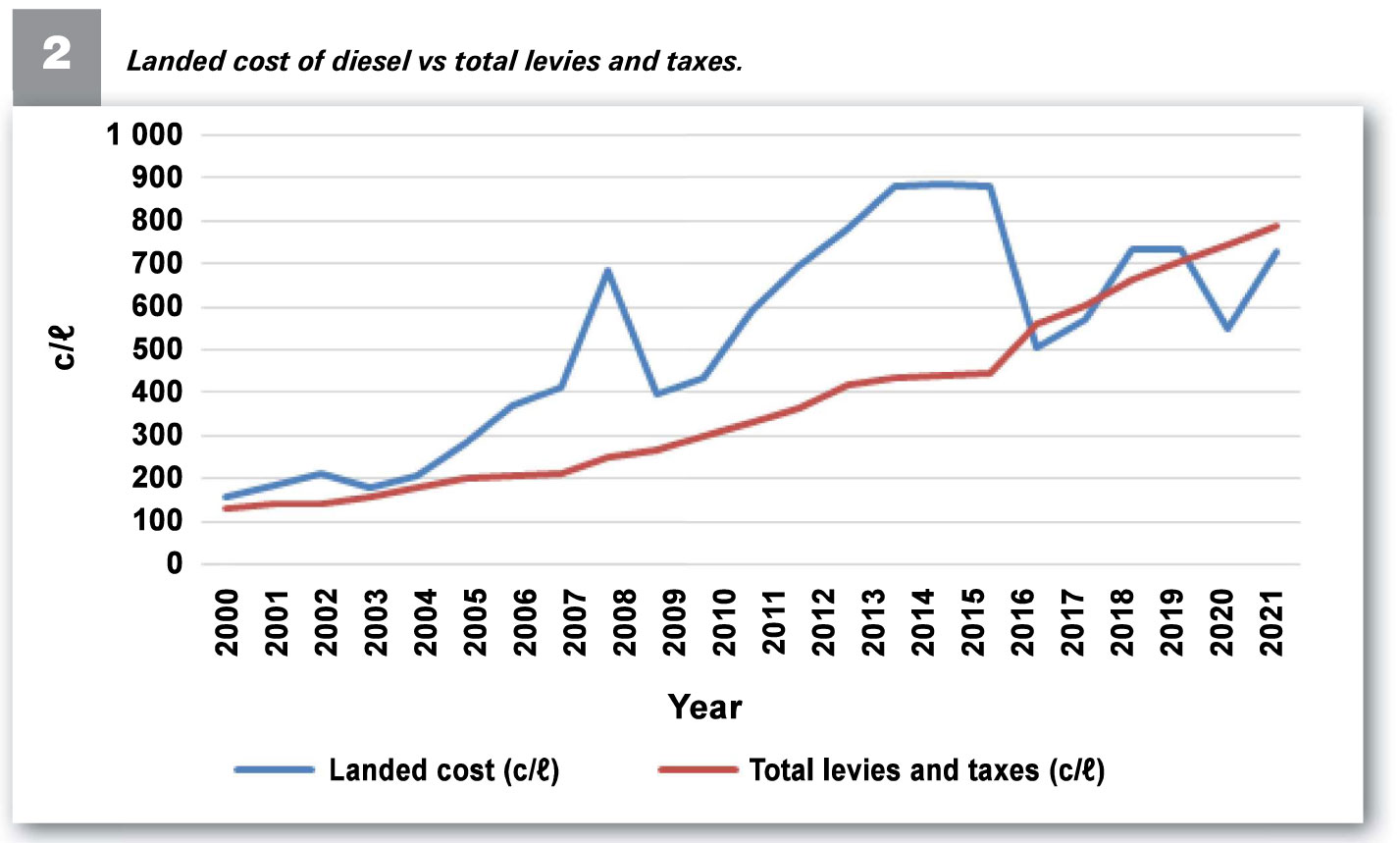

Graph 2 shows the relationship between landed cost and diesel, and also the movement of the landed cost and levies and taxes.

Source: Grain SA

DIESEL REBATE

The diesel rebate is a refund system where people who are tax registered and work in the farming, mining and forestry sectors may apply for a refund on diesel used for these activities.

Steps to receive the diesel rebate

Persons who are registered for VAT can apply for registration with SARS to participate in the diesel refund system by completing the VAT101D form.

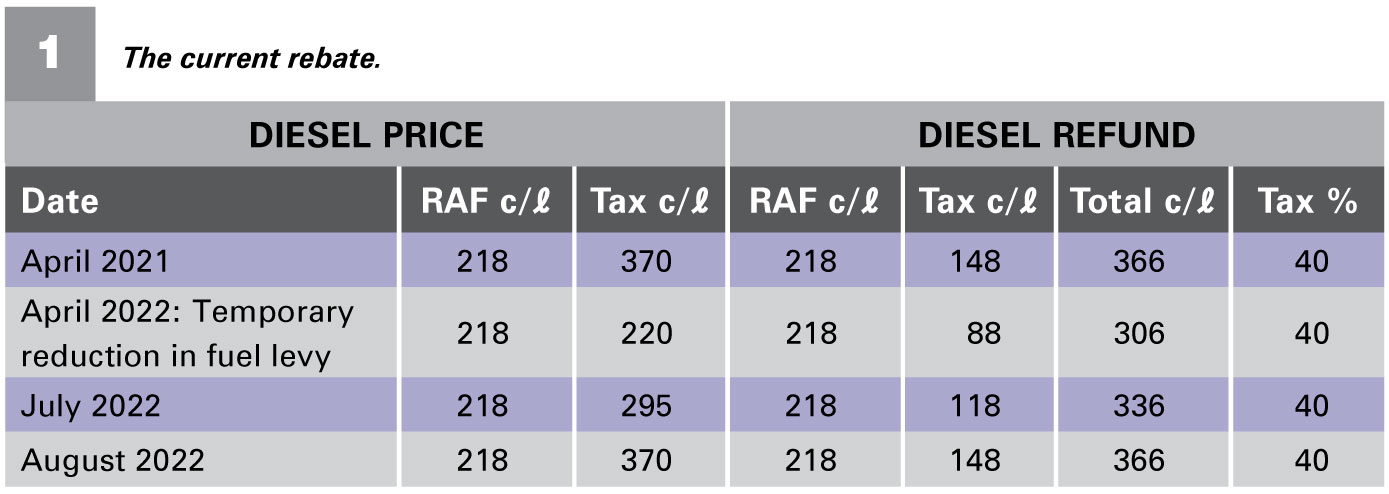

Click on the QR code to download the form: Since April 2021, the diesel rebate amounted to R3,66/litre. With the reduction of the general fuel levy by R1,50 to combat rising fuel prices, the National Treasury decided that the diesel rebate will also be reduced by 60 cents for April and June. In July 75 cents of the reduced levy will be added, which means that the rebate will increase to R3,36, and finally in August 2022 the full R1,50 will return, which means the diesel rebate will return to R3,66.

Since April 2021, the diesel rebate amounted to R3,66/litre. With the reduction of the general fuel levy by R1,50 to combat rising fuel prices, the National Treasury decided that the diesel rebate will also be reduced by 60 cents for April and June. In July 75 cents of the reduced levy will be added, which means that the rebate will increase to R3,36, and finally in August 2022 the full R1,50 will return, which means the diesel rebate will return to R3,66.

IN CLOSING

South Africa currently has the highest fuel price in history. This is not only a hurdle for farmers but for the whole value chain. Every product must move through the value chain to be processed into its final form. This means that the high diesel price causes the prices of products to rise, which in turn leads to higher inflation. This is an unpleasant circle, with the whole value chain feeling the pinch.

Publication: September 2022

Section: Pula/Imvula