April 2018

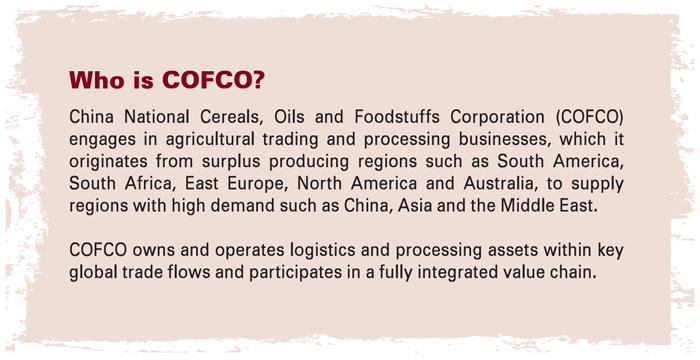

Guest speaker, Mr Ronald Jetten, is head of China National Cereals, Oils and Foodstuffs Corporation (COFCO) South Africa, a member of COFCO International, previously Noble Agri.

Malthusian theory on its head?

Malthusian theory on its head?

Jetten commented on the predictions of Malthus (1798) who said, ‘short term gains in living standards would inevitably be undermined as human population growth outstripped food production, and thereby drive living standards back towards subsistence’ i.e. food could never catch up with demand. Clearly he was mistaken as the reverse actually happened and we now live in a world of surpluses.

Malthus overlooked technological advancement, which would allow human beings to keep ahead of the population curve, because production doesn’t only depend on access to land but also on innovation.

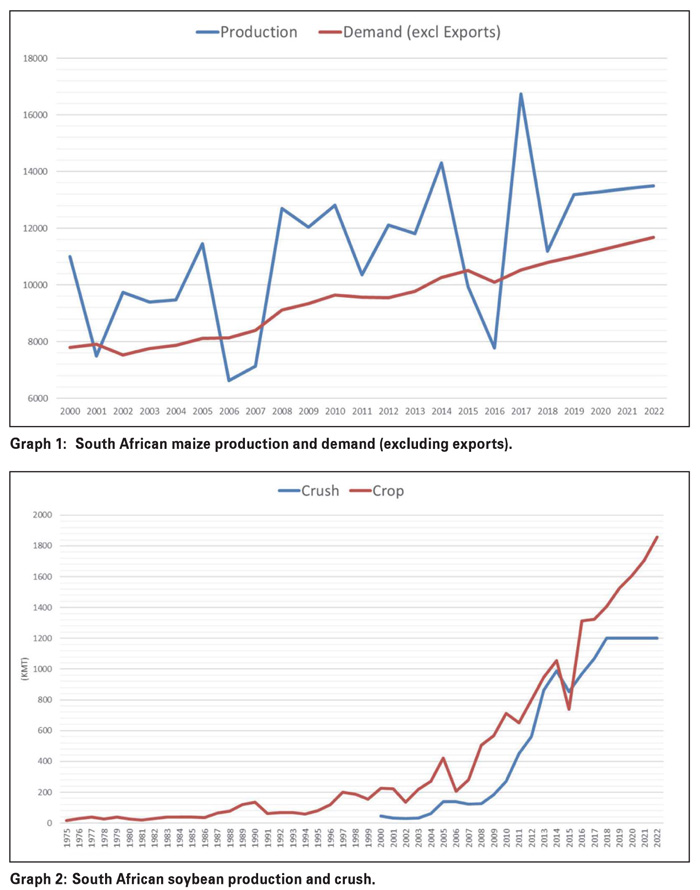

‘Producers have been incredible innovators throughout the world – not the least in South Africa – and the farming community has outpaced the demand for goods.’ The result is growing world stock levels which are increasingly burdensome. With reference to maize and soybean production, Jetten says producers are producing better yields, but the problem is demand has struggled to keep up with supply.

South African maize production is therefore experiencing a ‘supply push’ and for South African soybeans the ‘supply has caught up’ (Graph 1 and Graph 2.)

What’s the future?

Jetten says what should happen when supply outpaces demand, you either have to increase demand – which is difficult but not impossible as was seen with the advent of the biofuels industry, or supply needs to be rationed.

The incredibly high cost of producing maize and soybeans in South Africa compared to the opportunity in the rest of the world, makes competing in the market that much harder. There is a huge gap.

So let’s carry the grain

Jetten said in attempting to resolve the supply issue, traders decided to carry the grain. He agrees the current 4 million tons of carry-over stock is a lot, but insisted there has been no incentive to sell grain around the world.

What will change the dynamic of world supply?

What will change the dynamic of world supply?

Argentina impacts world markets. Close to 15 million tons of soybeans and about 6 million tons of maize are being written off this season. Chicago Board of Trade (CBOT) prices are responding accordingly but this is not enough to change the dynamics of world supply and demand and it is also only a one-year solution. In years to come grain trading will continue in a space where we need to deal with in an environment of oversupply. We need to learn to compete in an economically hostile environment.

(Re)Balancing the equation

The wisdom of contracting supply

Less supply means higher prices so the situation needs to be resolved with increased exports (if price is low enough).

Planting less

Other structural solutions would be either planting less or increasing demand in the country.

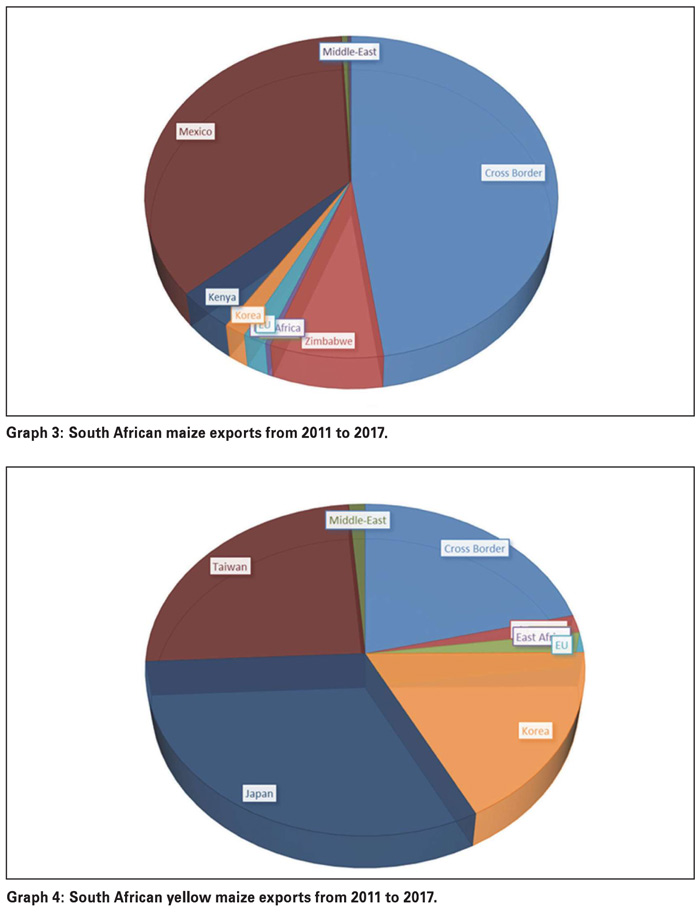

Export destinations

Our exports have traditionally flowed regionally, cross-border but exports are moving sideways at present (Graph 3 and Graph 4). Recent exports to Mexico could be a once-off as the USA usually supplies them. In most instances we are competing with the USA, so South African producers are always on the back foot.

Other influences

Freight spreads – cost of freight influences our ability to compete with the competition.

Freight spreads – cost of freight influences our ability to compete with the competition.Differentiation and cost leadership

There is no great opportunity for differentiation on any grain commodity:

Value-adding

Crush capacity

Increased crush capacity has absorbed increased production – but not everything. This limitation is based on the absorption of local meal in the feed industry.

Vertically integrated value chain

There are substantial volumes of frozen chicken imports. This needs to be stopped and translated into local poultry production which consumes locally produced grain. This would make a significant impact and will assist both maize and soybeans in local markets.

Ethanol from maize

Ethanol from maize

Support for the ethanol industry is a logical choice.

Legislation which supports the use of surplus maize for fuel (which is in short supply) is needed. This would greatly benefit local grain markets.

Maize-to-ethanol is profitable in the USA without subsidy and the distiller's dried grains with solubles (DDGS) is excellent animal feed.

The challenge for the future remains world surpluses. We need to challenge the cost of production otherwise the local industry will always be on the back foot.

Publication: April 2018

Section: Review on Congress