September 2018

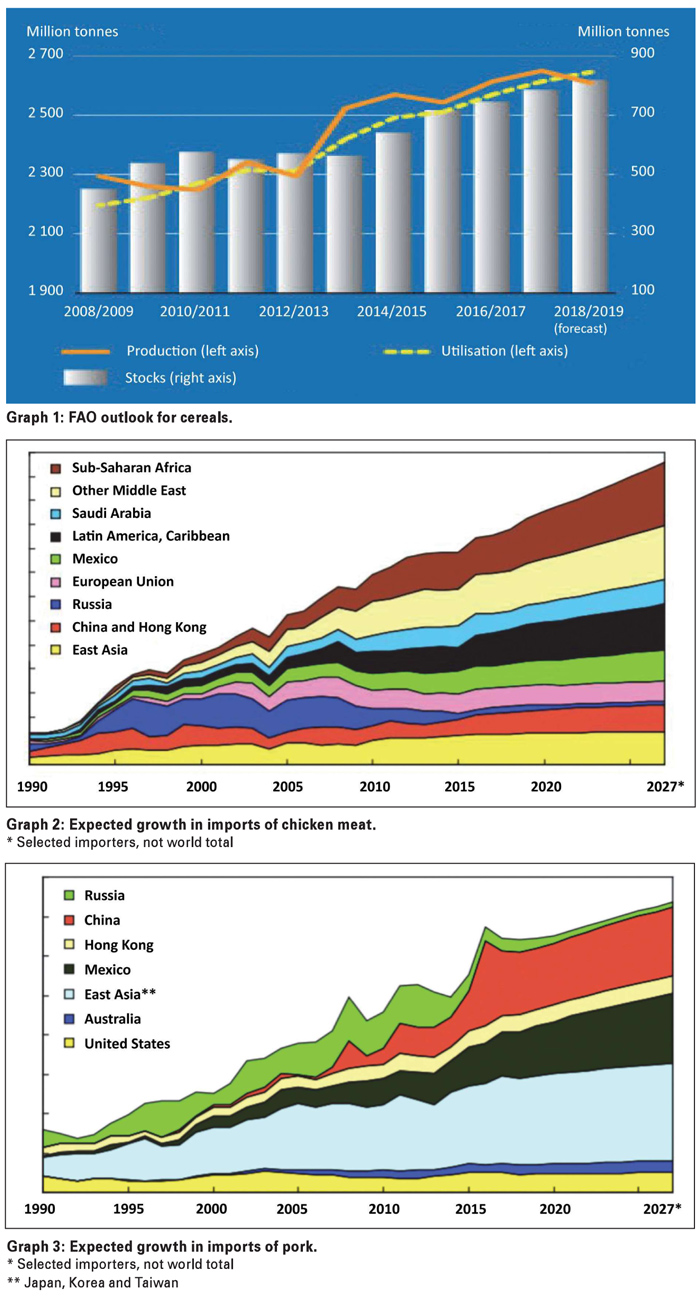

The Food and Agricultural Organization of the United Nations (FAO) recently updated its global forecast for cereal production, demand and stocks for 2018/2019. There was an interesting ‘crossing’ for grain producers to take note of.

The Food and Agricultural Organization of the United Nations (FAO) recently updated its global forecast for cereal production, demand and stocks for 2018/2019. There was an interesting ‘crossing’ for grain producers to take note of.

For the first time since 2012, the demand outstrips the production. For producers, this means prices are supposed to increase, but the message from Prof Marcos Fava Neves (Brazil) was very simple (but hard on the ear): ‘For the next ten years, you will have to build margins in a growing market at current prices’.

He was the keynote speaker at the 2018 Agbiz Congress.

The crossing of supply and demand was also supposed to lower the global stock levels, but no, China made some 33 million ton stock adjustment which caused global stocks to increase. The professor is a world leader in agricultural outlook and explained in detail how the demand for grains will continue to grow in future.

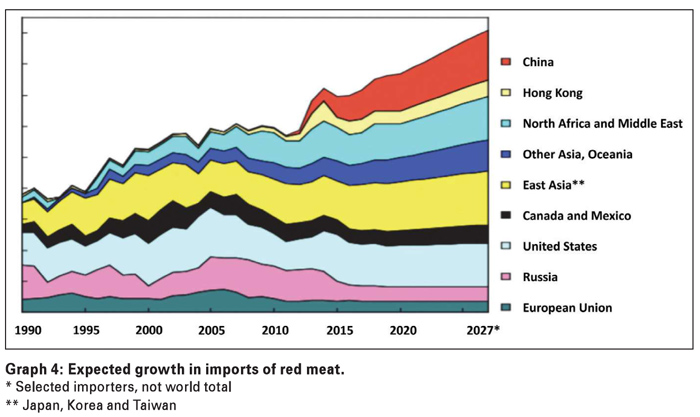

The growth will mainly stem from the growth in the demand for meat (chicken, red meat and especially pork consumption in China). The Chinese government decided to combat pollution with a 10% biofuel blend by 2020. This is good news for any grain producer.

Team Grain SA and the officials of the Department of Agriculture, Forestry and Fisheries (DAFF) are post-haste busy sorting out the outstanding protocols between South Africa and China to open this potential market for maize and soybeans.

The Indian population is growing by 2 million people per month. That basically means a new South Africa (±56 million) inside India every two and a half years. All those people need some food to live on.

What is important for grain producers, is that South Africa not only has access to these growing markets; we have preferential access – it means lower or no import duties for South African grains and meat. South Africa has in many instances a location advantage over the African and Middle Eastern countries and even some Asian countries. (It almost sounds like a dream that a location differential can work in a producer’s favour for a change.)

Lastly, he mentioned three ways to build margins in growing markets at current prices:

Conclusion

Conclusion

Initially the thought of grain prices remaining the same for ten years scared me a bit, but when the scientists took the floor and talked about gene editing and its potential, it seemed possible that yield increases could see us through to maintain sustainability.

One factor that we do not have to concern ourselves with is the growth in demand. Thus, if the demand grows and producers can’t keep pace with it, we shall end up with higher prices – and that will not be too bad.

Publication: September 2018

Section: Relevant