November 2021

| IKAGENG MALULEKE, AGRICULTURAL ECONOMIST AT GRAIN SA |

|

This article will focus on futures hedging. Hedging is a marketing strategy done through futures or options. People who want to limit their risk of price movement must hedge, which includes producers and commodity users.

A hedge is an instrument used to reduce or cancel price risk. A futures contract is traded on Safex for delivery of grain at a future date. The contract specifies the item to be delivered and the terms and conditions of delivery.

SHOULD I HEDGE?

Before hedging, two questions need to be answered:

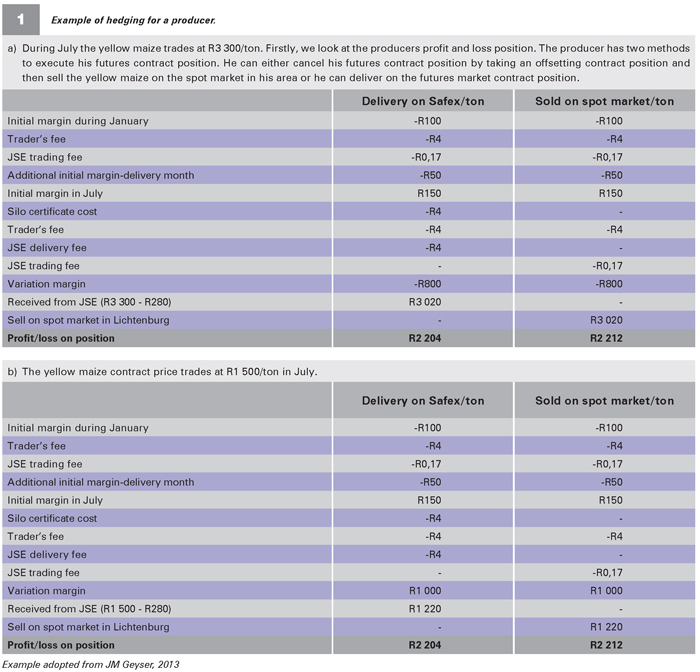

Table 1 indicates an example of a producer in North West who is worried that prices of yellow maize may drop during harvest season and would like to hedge against that price risk.

Suppose the producer takes a futures contract in January with July yellow maize trading at R2 100/ton. For a producer to determine the quantity of maize to hedge, the best thing to do would be to determine the percentage of his expected harvest at a certain price level required to cover the crop costs.

BENEFITS AND DRAWBACKS

Advantages of hedging include:

Disadvantages of hedging include:

Publication: November 2021

Section: Pula/Imvula