February 2024

| JOHAN TEESSEN, ECONOMIST INTERN, GRAIN SA |

|

With the marketing season starting soon, it is important to begin thinking about marketing your grain and how to do it. Therefore, this article series will start by giving the background of hedging and why you should know about it.

WHAT IS HEDGING?

To explain hedging, you must first understand the risks involved in being a grain farmer. Marketing risks are a group of risks that are associated with selling grain and include the price risk, basis risk and delivery/production risk.

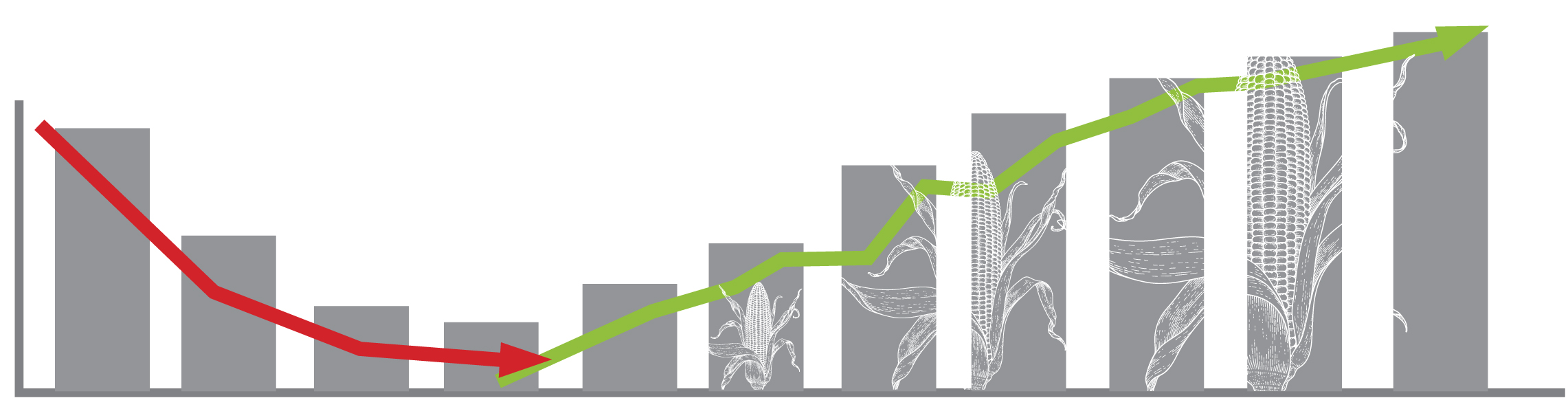

The price risk is the most important when considering hedging. From a farmer’s perspective, the price risk entails the risk that the market price of a commodity that you want to sell will decrease – therefore selling at a lower price and making lower profits, or in some cases, making a loss.

Hedging is a term used when you mitigate the risk of price changes through forward contracts, future contracts and options. These concepts will be defined later in this article.

BENEFITS

In the last few years, input costs have increased. Although costs such as fertiliser are lower than last year, it is still steadily increasing and on a higher level, making it more difficult to be profitable and much more important to protect yourself against price risks.

Benefits of hedging include:

Each of these benefits is linked to an element of hedging, with some elements utilising more than one benefit.

ELEMENTS OF HEDGING

As mentioned above, hedging includes different elements that each serves its own purpose and will be defined below. These elements will be discussed in more depth in future articles.

Physical/cash market

The physical market, or cash market, is when you take the grain that has already been harvested and sell it directly to the market at the current market price per ton.

An example of this is: When a farmer has harvested his grain today, he will then transport it to the nearest silo, where the grain will be graded and sold to the silo at the current market price.

Forward contracts

A forward contract is an agreement between a buyer (the farmer) and a seller (the silo or miller) to purchase a specific amount of grain with a specific quality, delivered on a specific date in the future, and sold at a specific price.

An example is that the farmer goes to his neighbour who wants to buy grain at the beginning of March. They agree that he will sell him 50 tons of grade 1 yellow maize at a price of R3 500/t, which should be delivered by the end of July.

Future contracts

A future contract is a contract with set regulations for how many tons must be sold (100 ton) at a specific price and with a specific quality, which should be delivered by a specific date. The Johannesburg Stock Exchange (JSE) manages the transaction, and therefore you have the right and obligation to sell your grain.

An example is that you go to a trader in the beginning of June and buy a 1 July future contract of white maize (100 tons) that must be grade 1 white maize and must be delivered at the end of July at a price of R3 700/t.

Options

An option contract gives the option holder (the farmer) the right, but not the obligation, to exercise the option. The regulations that accompany an option are that you set a price in the future for a specific amount of grain, delivered at a specific date, with a specific quality. With this option, there is a premium that you must pay to be able to be an option holder.

If the market is lower than the set price at the time of delivery, you can exercise the option and receive the set price. If the market is higher than the set price at the time of delivery, you can let the option expire and sell your maize at the higher price.

CONCLUSION

In the uncertain economic times that farmers are in now, it is very important to make use of hedging to mitigate the price risk and protect yourself against prices that can fall and result in lower profits or a loss.

The following article will cover options, the third the physical market and the fourth future markets.

Publication: February 2024

Section: Pula/Imvula