March 2018

South Africa has processed between 4,095 and 4,361 million tons of white maize for human consumption over the past three years. This constitutes between 75 kg and 81 kg of white maize per capita per year for this period. Therefore, white maize plays a vital role with regards to food security. The white maize meal value system is highly complex and contributes to the wellbeing of a lot of South Africans. Low-income groups are highly dependent on white maize meal in South Africa.

South Africa experienced very high white maize prices through the 2016/2017 season due to a shortage of maize in one of the worst droughts ever. The maize price in South Africa can also be highly volatile. Many role-players in the market argue that when white maize prices decrease, the price of maize meal does not react at the same pace as when it increases. The industry is also highly competitive and concentrated and provides a huge differentiation of products with regards to size of package and type of meal.

This article is the first of two articles on maize meal. This article elucidates the maize meal industry, the value chain and the factors affecting maize meal prices in South Africa. The second article will provide insight on the trend of maize prices and white maize meal prices as well as on how maize meal prices is monitored. It also explains how the National Agricultural Marketing Council calculates the farm to retail price spread and the farm value share in maize meal and also lists the challenges and potential for improvement.

Maize meal producers and capacity

According to Who-Owns-Whom (WOW) South Africa has an average milling capacity of 3,7 million tons. According to the Department of Agriculture, Forestry and Fisheries (DAFF), the potential capacity is approximately 5 million tons. The top 20 milling companies produce more than 80% of the maize meal consumed in South Africa.

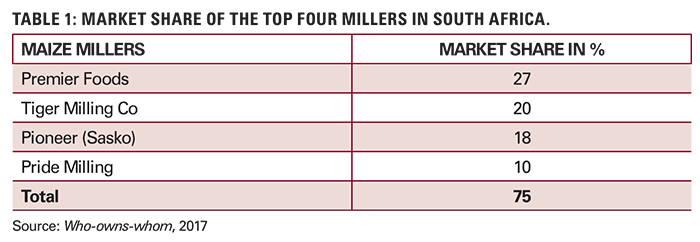

Who-Owns-Whom (WOW) reported that the leading four role-players, namely Pioneer, Premier Foods, Pride Milling and Tiger Brands together mill approximately 75% of the maize meal produced in South Africa. The agro-processing unit of the Department of Trade and Industry (DTI) established 24 new micro mills from 2013 to 2015. Their capacity is unknown.

In South Africa close to 200 maize millers are registered with the South African Grain Information Service (SAGIS). These millers need to report stock and production figures to SAGIS monthly. The millers can be divided into three tiers, namely mega millers, medium size millers and micro millers or informal millers.

In South Africa close to 200 maize millers are registered with the South African Grain Information Service (SAGIS). These millers need to report stock and production figures to SAGIS monthly. The millers can be divided into three tiers, namely mega millers, medium size millers and micro millers or informal millers.

The market share of the top 75% millers is illustrated in Table 1.

Usage of white maize

White maize is mainly used to produce white maize meal. Various types of white maize meal for human consumption feature in the South African market. The most popular is super, followed by special maize meal. Due to the different extraction rates, the price between these two types of maize meal differ.

White maize can also be used in the feed market, depending on the price. In the past white maize normally traded above yellow maize prices. This phenomenon changes when a surplus of white maize is produced, as was the case in the 2017/2018 marketing season.

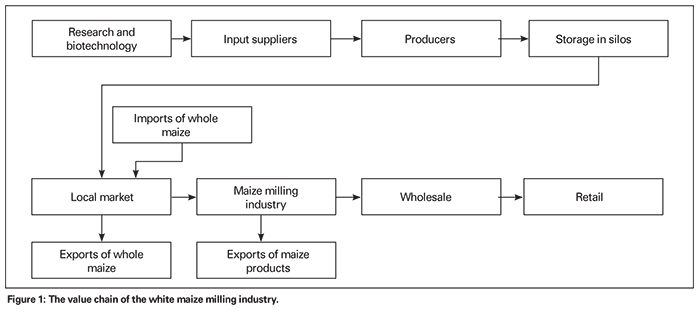

The value chain of the white maize milling industry

It is also important to understand how the value chain functions to better understand how prices are formed at the different levels of distribution. The value chain is well developed and in certain parts highly concentrated. I shall only refer to white maize milling. The value chain is depicted in Figure 1.

Research and acceptance of new technology throughout the chain, play a very important role. The adoption and implementation of more advanced techniques provide millers with the ability to produce maize meal more efficiently than in the past. The capital outlay to erect a new proper mill with a milling capacity of 1 ton per hour is estimated between R4 million and R5 million.

Factors affecting the price of maize meal

The retail price of maize meal is influenced by several factors, namely:

The time of the month of sale

It is a fact that consumers buy more maize meal towards the end of and the beginning of the next month when they receive salaries, wages and grants.

The brand

Some consumers are more brand sensitive than others. Consumers in South Africa tend to prefer and buy certain brands, depending on their available income, at specific times of the year. It is also the opinion of millers that consumers switch to a cheaper brand when maize meal prices increase.

The type of maize meal – super or special

Mainly two types of maize meal are sold in South Africa, namely super and special. I am also of the opinion that the lower end consumer tends to switch to special maize meal when maize meal prices increase. Special maize meal has a higher extraction rate and therefore more product can be retrieved, which normally makes it cheaper.

The packaging costs

It would appear as if poorer consumers tend to move to bigger packages, either 10 kg or 12,5 kg – and even to a 25 kg package. The typical rule of thumb is that more than 70% of maize meal is bought in 10 kg bags and bigger. Certain millers report that packages more than 10 kg comprise 90% of their sales.

Transport and distribution costs

The transport from the mill to the retail outlet also plays an imperative role. The further the distance from the mill, the higher is this part of the costs.

The operational cost to mill maize

The operational cost can differ from area to area. For example, the operational cost of a mill in an urban area will be much higher than that of a mill in the rural areas, due to factors such as municipal rates and different structures for electricity tariffs.

Machinery cost

The capital cost to erect a maize mill can easily be R5 million for a mill with a capacity of a ton per hour.

Maintenance cost

The maintenance cost to operate a mill can easily be up to 10% of the capital cost.

The price of maize

The price of maize is probably one of the most determining factors of maize meal. Prices normally increase when shortage is expected in the market. It is also at this stage that maize millers start contracting for longer periods in advance – either on Safex, with producers or with maize storage owners.

Storage cost

South Africa has a well-developed storage infrastructure. The cost to store maize differs from silo owner to silo owner. Alternative facilities also exist, like on-farm storage, silo bags and bunkers.

Hedging cost

Millers explain that they need to hedge or either procure maize on contract basis to ensure they have enough stock for their clients. Therefore, there is a difference between the maize meal price and the maize price. When surpluses exist, the difference period is normally shorter compared to longer periods when shortage exists.

Retailers and retail margins

The South African retail system is highly concentrated and has been investigated by the South African competition authorities several times. They normally come under crossfire from producers and from consumers.

It is important to note that they contribute to the very well-developed food system of South Africa. The competition is tight and there are many barriers to entry in the market. Retailers normally contract millers in advance to mill a specific quality of maize and to supply a certain quantity. Retailers need a constant flow and a reliable supplier who consistently supplies a quality product. Retail margins can differ from retailer to retailer and from time to time.

Shelf life

The shelf life of maize meal is short. The closer maize meal comes to its sell by date the cheaper it becomes – and then it is normally offered as special offer.

Rebates paid to retailers

If in the negotiation process a retailer wants to take up a certain quantity of maize meal from a miller, rebates are negotiated and need to be paid back to the retailer. The percentage differs from negotiation process to negotiation process and from quantity to quantity.

Summary

Maize meal is an important source of starch for many South Africans. It also plays a vital role in the rural economy of South Africa. The maize meal industry is well developed and is also highly concentrated, as is evident from this article.

The industry received a lot of attention in the past due to uncompetitive behaviour. Some of the stakeholders were heavily fined in the past. It was also reported that numerous maize meal firms went out of business when the white maize price increased to above R3 000/ton in the 2016/2017 marketing season.

The next article will focus on maize meal trends as well as the price transmission effect thereof and how the National Agricultural Marketing Council (NAMC) reports thereon.

Publication: March 2018

Section: Relevant