August 2020

| Ikageng Maluleke, Agricultural Economist, Grain SA. Send an email to Ikageng@grainsa.co.za |

|

The global community is currently fighting the Covid-19 pandemic, and while the focus is on health, the economic and social implications are far-reaching. This comes at a time where the global economy was already sluggish.

Since March 2020 when the pandemic hit South African shores, the rand took a nosedive. In addition, we have observed the collapse in crude oil exacerbated by global lockdowns. These have a great impact on imports of chemical and fertiliser prices.

Crude oil plays a major role in input prices. Even before Covid-19, we saw an oversupply in the crude oil market. Then, OPEC and non-OPEC allies failed to reach an agreement as Russia refused to back even a moderate cut. Between March and April 2020, there was exponential growth in Covid cases, forcing global lockdowns, which led to the destruction of oil demand on a scale never seen before. This forced OPEC countries to meet again in April when they decided to cut supplies further. The implications are noted by stronger crude oil prices since early May 2020. The rand depreciated by 25,6%, from May 2019 to May 2020, the impact of the depreciation can be seen in the increase of chemical and fertiliser prices in rand terms.

INSECTICIDE PRICE TRENDS

INSECTICIDE PRICE TRENDS

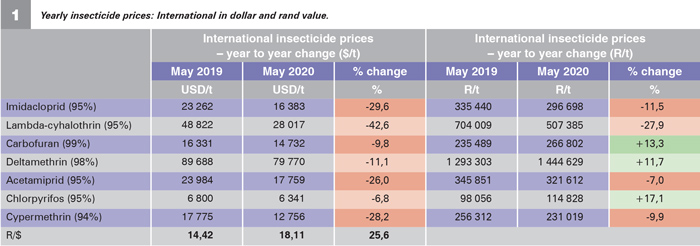

Looking at insecticide prices from May 2019 to May 2020, there have been significant decreases in most of the insecticides in dollar terms; with Lambda-cyhalothrin (42,6%), Imidacloprid (29,6%), Cypermethrin (28,2%) and Acetamiprid (26%) showing some of the highest decreases. Looking at the same inputs in rand terms, the following shows a similar decreasing trend, Lambda-cyhalothrin (27,9%), Imidacloprid (11,5%), Cypermethrin (9,9%) and Acetamiprid (7%). The rest show an opposite trend, we see an increase of up to 17,1% for Chlorpyrifos, and this is mainly attributed to a weaker rand.

HERBICIDE PRICE TRENDS

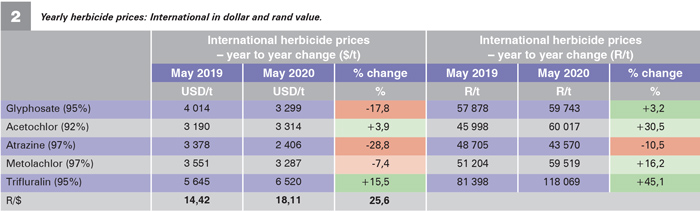

Yearly herbicide prices from May 2019 to May 2020 also show a general decrease in the prices of most active ingredients except Glyphosate and Trifluralin that shows an increase in dollar terms. In rand terms, we see the opposite; prices show increases of about 3% to 45% over the same period, except for Atrazine, which shows a decrease. These increases in rand terms can be attributed to the weaker rand.

Source: Grain SA

Source: Grain SA

*Data as at May 2020

FERTILISER PRICE TRENDS

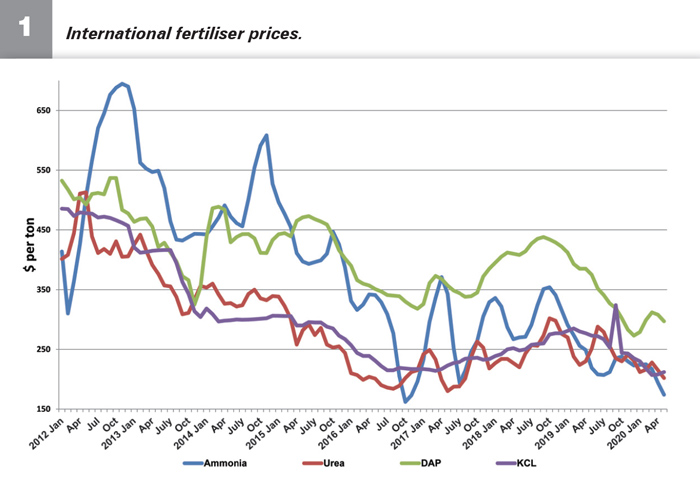

International fertiliser prices in dollar terms from May 2019 to May April 2020 show a general downward trend; KCL prices decreased the most at 22,3%, followed by DAP 20,8%, while Ammonia and Urea decreased by 20,5% and 19,5% respectively. In rand terms, the same chemicals followed the international trend and show a decrease for KCL, DAP and Ammonia while Urea shows a minor increase mainly due to a depreciation in the rand.

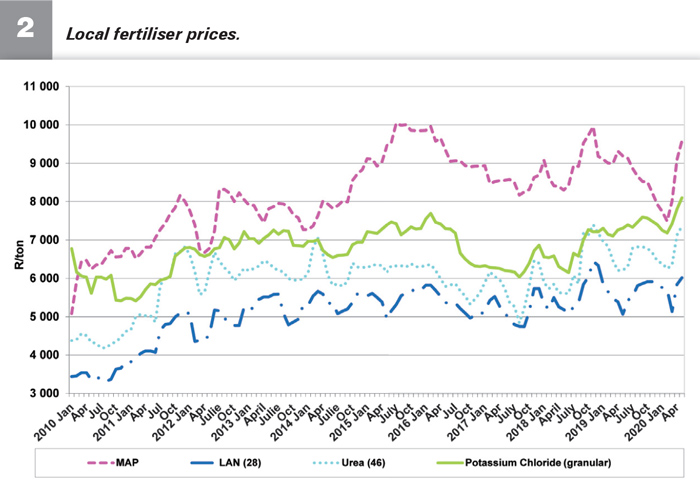

Average domestic fertiliser prices in rand terms for June 2019 to June 2020, show an opposite trend to international prices and shows an increase in local fertiliser prices for the period; Urea (10,2%), LAN (5,8%), and KCL (1,1%), while MAP is the only one showing minor decreases of about 1,3%.

CONCLUSION

It is unknown as to when or how things will end with this global pandemic, however, we can already see that the global economy remains under pressure. This brings a lot of uncertainty in the market. Global prices for both chemicals and fertiliser are low due to uncertainties related to planting as well as the oversupply of some inputs; the only redeeming feature for South Africa would be a stronger rand, which would give reprieve to farmers. Brent crude prices, which also have an impact on international input prices, could keep added pressure on prices. The key for the summer production season would be the trend in the exchange rate.

Publication: August 2020

Section: Pula/Imvula