March 2021

| Ikageng Maluleke, Agricultural Economist, Grain SA. Send an email to Ikageng@grainsa.co.za |  |

Producers should remember that a successful marketing strategy requires a commitment to a unique marketing plan, based on the farm’s individual needs. Crucial to success is active involvement in all aspects of marketing, that is gathering market information, analysing market trends, preparing a plan and putting the plan into action.

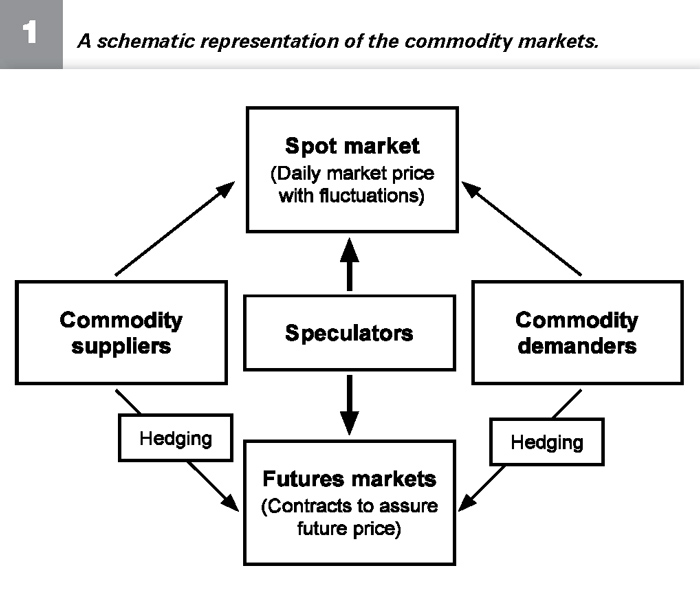

In part one of the marketing channels series, we discussed direct marketing channels available to producers. The focus was on non-futures exchange marketing. In this article we focus on futures exchange marketing.

FUTURES EXCHANGE CONTRACTS THROUGH SAFEX

FUTURES EXCHANGE CONTRACTS THROUGH SAFEX

This marketing strategy involves hedging (futures or options). A hedge is an instrument used to reduce or cancel price risk.

A futures contract is traded on Safex for delivery of grain at a future date. The contract specifies the item to be delivered and the terms and conditions of delivery.

An option is a contract whereby one party has the right, but not the obligation, to buy or sell the maize at a predetermined price at any time within a specified period. This contract or option gives the buyer the right but not the obligation to exercise the contract, while the seller of the option has the obligation to honour the contract if the contract holder wants to exercise it.

There are two distinct types of options, put and call options:

SAFEX MARKETING COSTS

Futures contracts have an implication on the cash flow of the producer. In the case of a futures contract, the buyer or seller has to pay an initial margin that is refunded when the transaction is done. Variation margins also apply to futures contracts.

If the futures contract price moves against your position, you need to deposit a variation margin in order to maintain your position. If prices move R20/ton against your position, you need to deposit the money within 24 hours. In the case of options contracts, you need to pay the premium; no variation margins apply to options contracts.

If a producer combines a forward contract and a hedging contract, the company purchasing from him/her normally carries the initial margin and the variation margin. Then you have a situation where you have quantity and price locked in.

Marketing costs include broker fees, interest, transport and handling costs.

Source: Mark A. Ethlen

Publication: March 2021

Section: Pula/Imvula