December 2022

| CHRISTIAAN VERCUIEL, JUNIOR AGRICULTURAL ECONOMIST, GRAIN SA |  |

Without any tools used to change the situation, a producer is a price taker. Price takers have many risks, as the price which you are given does not take your production cost into account, and it does not matter whether the farmer is making a profit or a loss.

One of the most important concepts in farming is risk management. If a producer wants to keep his head above the water and stay profitable, he must therefore be able to manage his risk. An important tool for risk management is options – to be more specific, put and call options. These contracts come at a price known as a premium.

Some important terms to understand:

OPTIONS

A put option is a contract that is giving the buyer the right, but not the obligation, to sell a specific underlying asset (in this scenario, maize) at a specific price in a specific time frame. This tool helps farmers to protect themselves against decreasing prices – but the farmer thinks prices will increase, therefore it protects him against the downside. If the price falls, the worth of the put option increases.

A call option is a contract that is giving the buyer the right, but not the obligation, to buy a specific underlying asset (in this scenario, maize) at a specific price in a specific time frame. This tool helps millers to protect themselves against increasing prices – but the miller thinks prices will decrease, therefore it protects him against the upside. If the price increases, the worth of the call option increases.

Practical example

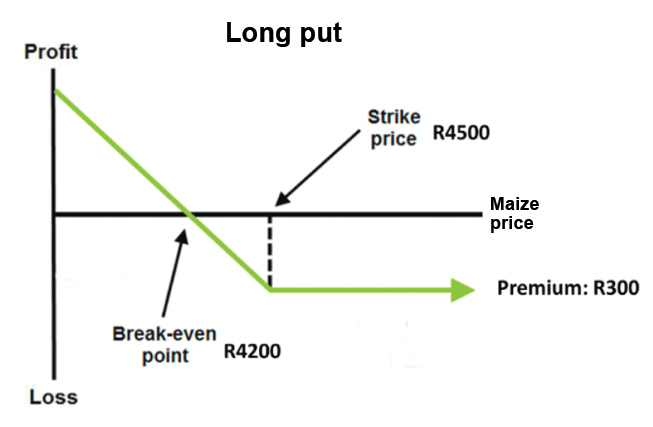

Imagine a scenario for the following season (2022/2023 production season). A farmer in Mpumalanga is planning to plant 50 hectares of yellow maize and buying his inputs for the planting season in September 2022. He calculates that his inputs will cost him R21 000/ha. The ten-year average yield for yellow maize is 6 t/ha. The current price for the July 2023 contract is R4 500/ton. The price of buying a put option is R300/ton.

Given

With the input costs at R21 000/ha, at a price of R4 500/t, a farmer needs to sell about 5 t/ha to cover the input costs. This means that a producer will buy a put option with a strike price of R4 500/ton, which will cost him R300/ton.

Scenarios (Figure 1):

Figure 1: Long-put option.

CONCLUSION

Options are tricky to understand but have many benefits to farmers in uncertain times to mitigate their risk, if used correctly. There is an upside and a downside to options, but if used in the correct strategy, the chances for major losses are minimised.

Publication: December 2022

Section: Pula/Imvula