78

popular way of comparing the relative profitability of grains within a

farm. This section provides a guideline in terms of the profitability of

maize versus sunflower and soybeans. The responsibility still lies with

each producer to do his/her own gross margin calculations because

production costs radically differ from neighbour to neighbour. This is

due to each grain producer's own unique system, the type of farming

unit and production practices.

Establishing production budgets prior to planting crops, is becoming

increasingly necessary and should not be taken lightly when making

production decisions. No one can accurately predict the future with

all its risks and uncertainties as it is about plans for the future and

is based on forecasts, historical data, assumptions and experience.

In light of this, producers, as budget users, should be aware that

budgets, as well as the assumptions on which they are based, are

constantly subject to change.

The cost structure of the budgets consists of variable and fixed costs.

If you do not make use of certain variable costs, one can deduct it from

the total variable costs. Although fixed costs vary dramatically from

producer to producer, an x-amount is provided to calculate an estimated

total production cost.

Forecasting the commodity price for the coming year is extremely

difficult. The Safex future contract price used in the calculations are

as follows:

Maize for delivery in July 2020 = R2 700/ton

Sunflower for delivery in May 2020 = R5 120/ton

Soybeans for delivery in May 2020 = R5 300/ton

The 2020 futures prices were determined by calculating the average

price since the beginning of trading for that particular contract month.

Based on the location differential, handling costs and marketing

commission, a producer price was calculated.

Maize prices are currently supported by relatively low local production

as well as an increase in international prices that support local prices.

It is important to note that the maize prices, which have been trading at

relatively higher levels in the past year, can motivate producers locally

to plant more maize. However, the greatest risk for the coming season

will be the weather conditions that will determine the plantings for the

season. If the weather conditions are fairly normal and the planting takes

place normally, there may again be a greater downward commodity

price risk in the coming season.

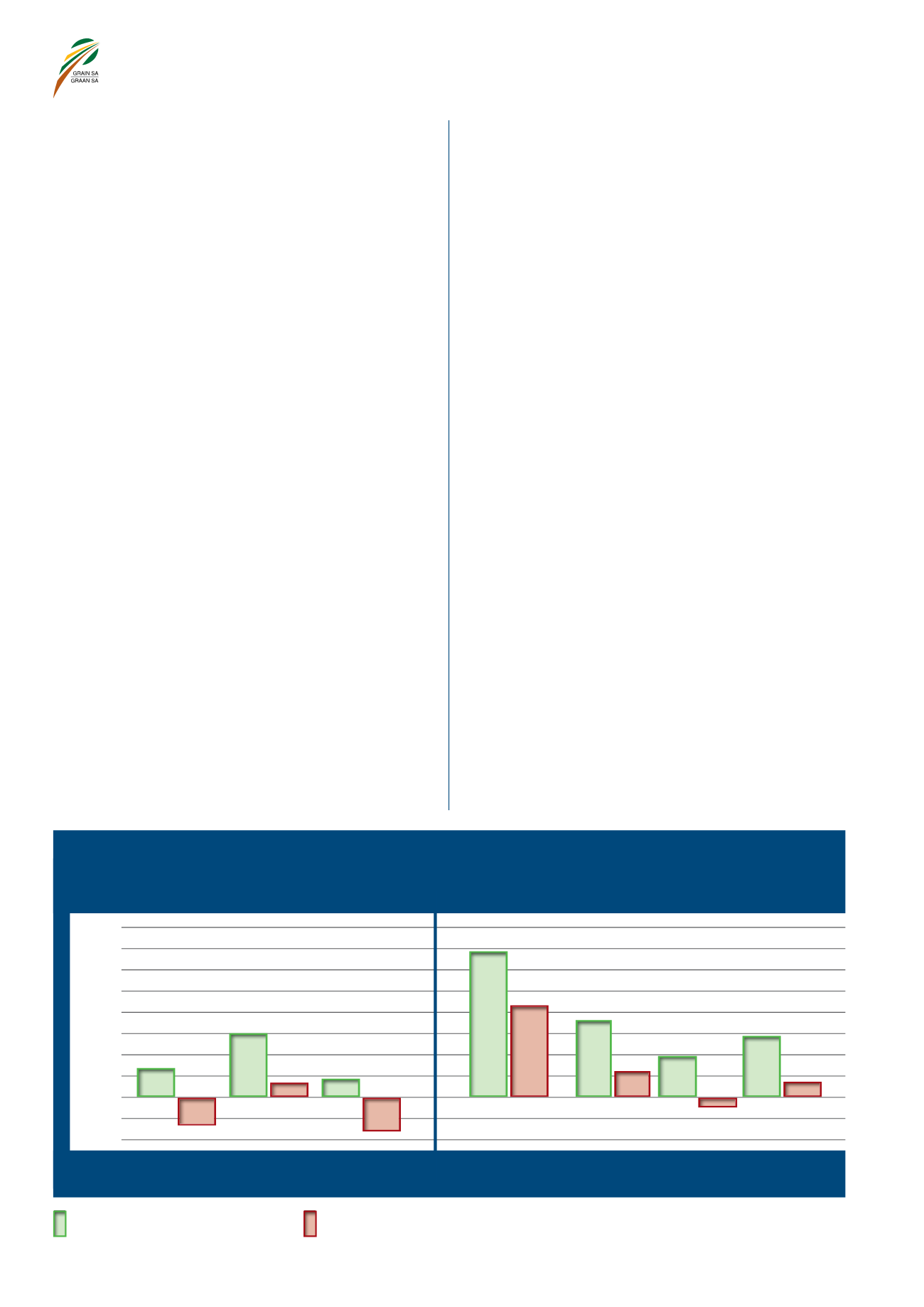

An illustration of the maize budgets and their performance against other

crops are shown in

Table 7

to

9

. The yield scenarios were based on

8 000

7 000

6 000

5 000

4 000

3 000

2 000

1 000

0

-1 000

-2 000

R

North West Province

Noordwes Provinsie

North West Central Free State

Noordwes-Sentraal-Vrystaat

Maize

Mielies

Maize

Mielies

Sunflower

Sonneblom

Sunflower

Sonneblom

Soybeans

Sojabone

Soybeans

Sojabone

Maize (higher yield)

Mielies (hoër opbrengs)

Net margins (total costs = variable + fixed costs)

Netto marge (totale kostes = veranderlike + vaste kostes)

Gross margins (variable costs only)

Bruto marge (slegs veranderlike kostes)

GRAPH 18 – Margin comparison for summer grain crops in the North West Province and North West

Central Free State for the 2019/2020 season.

GRAFIEK 18 – Margevergelyking vir somergraangewasse in Noordwes en die Noordwes-Sentraal-Vrystaat

vir die 2019/2020-seisoen.

en gewilde manier om die relatiewe winsgewendheid van graan op

’n plaas te vergelyk. Hierdie afdeling verskaf ’n riglyn ten opsigte van

die winsgewendheid van mielies teenoor sonneblom en sojabone. Die

verantwoordelikheid lê steeds by elke produsent om hulle eie bruto

marge te bereken, aangesien produksiekoste drasties van een buurman

tot die volgende een verskil. Dit is toe te skryf aan elke graanprodusent

se unieke stelsel, die tipe boerdery-eenheid en produksiepraktyke.

Dit word toenemend nodig om produksiebegrotings op te stel voordat

gewasse geplant word, en moenie ligtelik opgeneem word wanneer

produksiebesluite geneem word nie. Niemand kan die toekoms met

al sy risiko’s en onsekerhede akkuraat voorspel nie, aangesien dit

oor planne vir die toekoms gaan en op voorspellings, historiese data,

aannames en ervaring gegrond is. In die lig hiervan moet produsente

as die gebruikers van begrotings daarvan bewus wees dat begrotings,

sowel as die aannames waarop dit gegrond is, voortdurend verander.

Die kostestruktuur van die begroting bestaan uit veranderlike en vaste

koste. As sekere veranderlike koste nie gebruik word nie, kan dit van die

totale veranderlike koste afgetrek word. Hoewel vaste koste dramaties

van een produsent tot die volgende verskil, word ’n x-bedrag verskaf om

’n geraamde totale produksiekoste te bereken.

Dit is uiters moeilik om die kommoditeitsprys vir die komende jaar te

voorspel. Die Safex-termynkontrakprys wat in die berekenings gebruik

word, is soos volg:

Mielies vir lewering in Julie 2020 = R2 700/ton

Sonneblom vir lewering in Mei 2020 = R5 120/ton

Sojabone vir lewering in Mei 2020 = R5 300/ton

Die 2020-termynkontrakpryse is bepaal deur die gemiddelde prys sedert

die begin van verhandeling vir daardie spesifieke kontrakmaand te

bereken. ’n Produsenteprys is aan die hand van die liggingsdifferensiaal,

hanteringskoste en bemarkingskommissie bereken.

Mieliepryse word tans ondersteun deur relatief lae plaaslike produksie,

asook ’n styging in internasionale pryse, wat plaaslike pryse ondersteun.

Dit is belangrik om daarop te let dat die mieliepryse, wat die afgelope

jaar op relatief hoër vlakke verhandel, plaaslike produsente kan motiveer

om meer mielies aan te plant. Die grootste risiko vir die komende

seisoen sal egter die weerstoestande wees, wat die aanplantings vir die

seisoen sal bepaal. Indien die weerstoestande redelik normaal is en die

aanplanting normaal plaasvind, kan daar in die komende seisoen weer

’n groter afwaartse kommoditeitsprysrisiko inhou.

’n Illustrasie van die mieliebegrotings en hulle prestasie teen ander gewas-

se word in

Tabel 7

tot

9

getoon. Die opbrengsscenario’s is op aannames

R1 322

-R1 288

-R1 591

R2 974

R619

R816

R6 834

R4 262

R3 608

R1 151

R1 888

R2 839

R660

-R468