89

se lede oor te dra. Die deurlopende verhoging in saadpryse was

nog altyd ’n groot bekommernis vir graanprodusente, en sommige

saadmaatskappye kan begin om weerstand teen hoë pryse te ervaar.

Die saadpryse van maatskappye soos Seed Co, Agri-Seed, Delta

Seed en United Seed is in die 2018/2019-produksieseisoen vir die

eerste keer ingesluit.

SAADPRYSE

Sewe nuwe koringkultivars en twee nuwe garskultivars is in 2018

vrygestel. 33 kultivars (insluitend besproeiingskultivars) is in die

noordelike produksiestreke kommersieel beskikbaar, terwyl nege

verskillende kultivars in die Wes-Kaap beskikbaar is. Elf garskultivars

is beskikbaar vir produsente in die Wes-Kaap om te plant.

Koringsaadpryse het gemiddeld op ’n jaargrondslag met 3,7%

gestyg. Sommige pryse het met 14% gestyg, terwyl ander met soveel

soos 6,7% gedaal het. Dit is interessant om daarop te let dat koringsaad

in die noordelike produksiegebiede gemiddeld R344 per 25 kg-sak kos,

terwyl saad in die Wes-Kaap R379 per 50 kg-sak kos. Die prys van

garssaad het met 0,5% gedaal. Kanolasaadpryse was gemiddeld 5%

hoër as verlede jaar. Daar was pryse van kanolakultivars wat sywaarts

beweeg het, terwyl ander met tot 25% gestyg het.

Mieliesaadpryse vir die 2018/2019-produksieseisoen het gemiddeld

met 1,8% gestyg. Sonneblomsaadpryse het gemiddeld met 4,7%

gestyg, graansorghumsaadpryse met 7,5%, en sojaboonsaadpryse met

0,5%.’n Goeie barometer vir die evaluering van prysverhogings is die

produsenteprysindeks (PPI). Tot met Mei 2018, toe saadpryse gepubliseer

is, was die PPI 4,4%. Met ander woorde, op ’n gemiddelde grondslag

het die saadpryse van veral sonneblom en graansorghum skerper as

die produksiekoste-inflasie van Suid-Afrika gestyg.

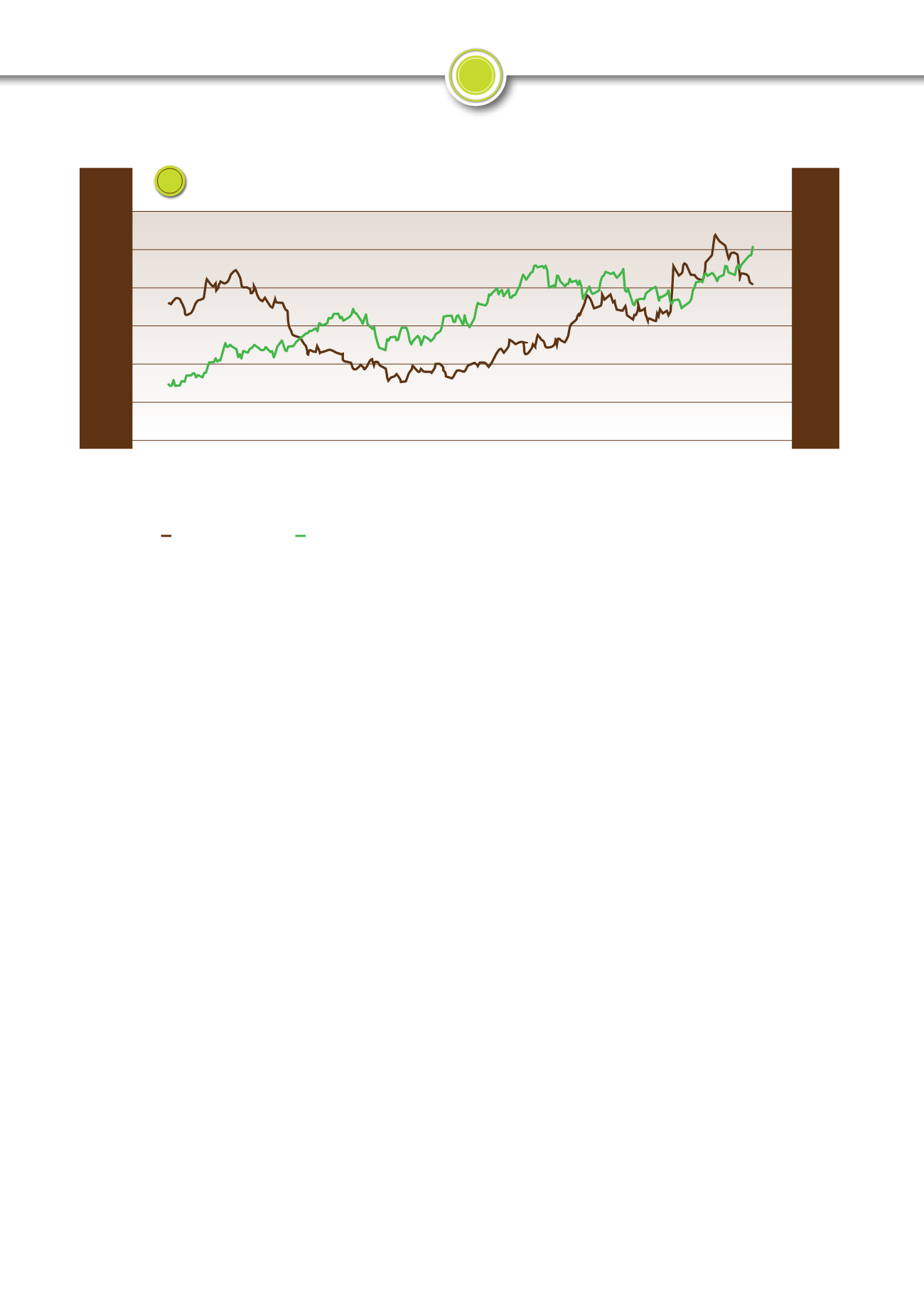

Mieliesaadpryse kan verder ontleed word deur dit met mieliepryse

te vergelyk. Sedert die 2001/2002-produksieseisoen het die mielie

prysindeks (

Grafiek 2

op bladsy 90) vergeleke met die mieliesaad

prysindeks beduidend verswak. Met ’n geraamde gemiddelde

produsenteprys

1

van R1 984/ton vir die komende seisoen (2018/2019),

het die mielieprysindeks minimaal meer as mieliesaadpryse gestyg.

R/$ exchange rate and Brent crude oil price

R/$-wisselkoers en prys van Brent-ruolie

02/10/2017

02/11/2017

02/12/2017

02/01/2018

02/02/2018

02/03/2018

02/04/2018

02/05/2018

02/06/2018

02/07/2018

02/08/2018

02/09/2018

R/$ exchange rate

R/$-wisselkoers

Brent crude oil price

Brent-ruolieprys

1

1

Average producer price = Safex, July 2018 price - average differential cost - handling costs

1

Gemiddelde produsenteprys = Safex, Julie 2018-prys - gemiddelde differensiële koste - hanteringskoste

90

85

80

75

70

65

60

55

50

45

Brent crude oil price/Brent-ruolieprys

R/$ exchange rate/R/$-wisselkoers

consistent increase in seed prices has always been a major concern

to grain producers and some seed companies might start experiencing

resistance to high prices.

Seed prices of companies such as Seed Co, Agri-Seed, Delta

Seed and United Seed were included in the 2018/2019 production

season for the first time.

SEED PRICES

Seven new wheat cultivars and two new barley cultivars were

released in 2018. 33 wheat cultivars are commercially available in the

northern production regions (including irrigation cultivars), whilst there

are nine different cultivars in the Western Cape. Eleven barley cultivars

are available for producers to plant in the Western Cape.

Wheat seed prices increased 3,7% on average on an annual basis.

Some prices increased by 14%, while others decreased by as much

as 6,7%. It is interesting to note that wheat seed prices in the northern

production areas on average cost R344 per 25 kg bag, while seed

prices in the Western Cape are R379 for a 50 kg bag. The prices of

barley seed decreased by 0,5%. Canola seed prices were on average

5% higher than last year. There were canola cultivars that moved

sideways, while others increased by up to 25%.

Maize seed prices for the 2018/2019 production season increased

by 1,8% on average. Sunflower seed prices increased by 4,7% on

average, grain sorghum seed prices by 7,5% and soybean seed

prices by 0,5%. A good barometer for assessing price increases is the

producer price index (PPI). Up until May 2018, when seed prices were

published, the PPI was 4,4%. In other words, seen on an average basis

– seed prices of especially sunflower and grain sorghum – increased

more sharply than the production cost inflation of South Africa.

Maize seed prices can be analysed further by comparing them with

maize prices. Since the 2001/2002 production season the maize price

index (

Graph 2

on page 90) weakened significantly compared to the

maize seed price index. With an estimated average producer price

1

of

R1 984/ton for the coming season (2018/2019), the maize price index

increased minimally more than maize seed prices.

16

15

14

13

12

11

10