73

Input environment

INTRODUCTION

S

outh Africa’s reliance on the import of production inputs has shown how vulnerable

the local market can be to price and availability changes in the international market.

Prices spiked on the global oil market after Russia invaded Ukraine, which triggered a

wave of international sanctions against Russia, one of the world’s leading exporters of

crude oil.

Except for the Brent crude situation, the world experienced an exceptional increase in natural gas

prices due to the sanctions and Russia therefore restricting the flow of natural gas to Europe, which

pushed international natural gas prices to new highs. The above disrupted trade flows directly

affected international and local markets, especially energy markets.

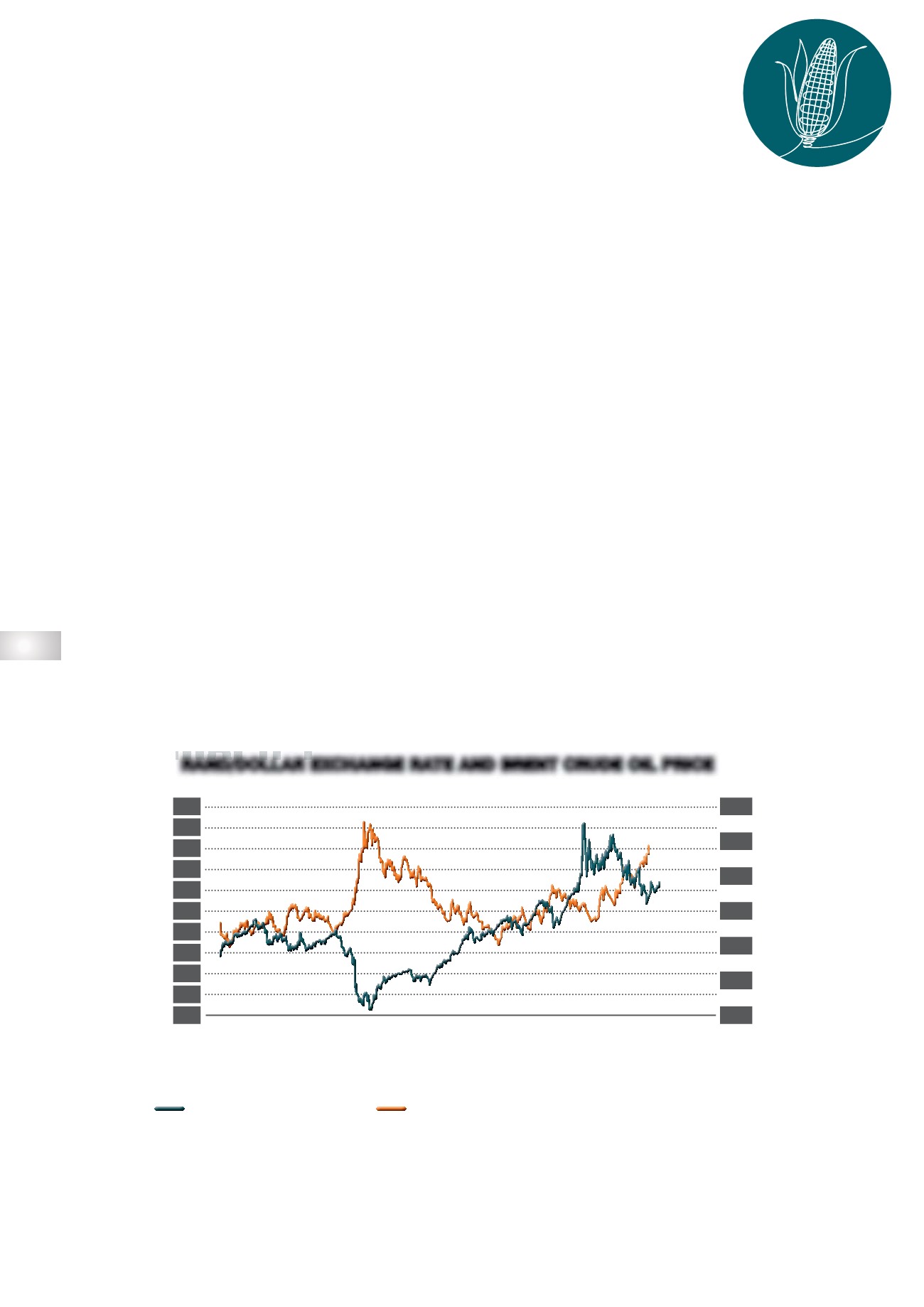

During the reporting period, the rand weakened by 20,3% from R14,59/$ in September 2021 to R17,55/$

in September 2022, which resulted in even higher local input prices. Brent crude oil prices increased

throughout the same period from $74,74 in September 2021 to $90,37/barrel in September 2022

(20,9%). The purchasing of inputs was very challenging due to the exceptional increase in international

market prices and the uncertainty of supply.

Graph 1

indicates volatility in the exchange rate and the

Brent crude oil price.

INPUT AND PRODUCTION OVERVIEW

AFFECTED

DISRUPTED TRADE FLOWS

directly

MARKETS

02/10/2018

01/12/2018

30/01/2019

31/03/2019

30/05/2019

29/07/2019

27/09/2019

26/11/2019

25/01/2020

25/03/2020

24/05/2020

23/07/2020

21/09/2020

20/11/2020

19/01/2021

20/03/2021

19/05/2021

18/07/2021

16/09/2021

15/11/2021

14/01/2022

15/03/2022

14/05/2022

13/07/2022

11/09/2022

10/11/2022

20

19

18

17

16

15

14

13

12

11

10

140

120

100

80

60

40

20

GRAPH 1

AND/DOLLAR EXCHANGE RATE AND BRENT CRUDE OIL PRICE

BRENT CRUDE OIL PRICE

R/$ EXCHANGE RATE

Rand/dollar exchange rate

Brent crude oil price

SOURCE: GRAIN SA

Dispute resolution

As a member benefit, Grain SA assisted various members during the reporting period – particularly with

respect to dispute resolution. Disputes on seed quality, agrochemical damage, VAT, the diesel rebate

and fertiliser quality were dealt with in collaboration with Grain SA members.