77

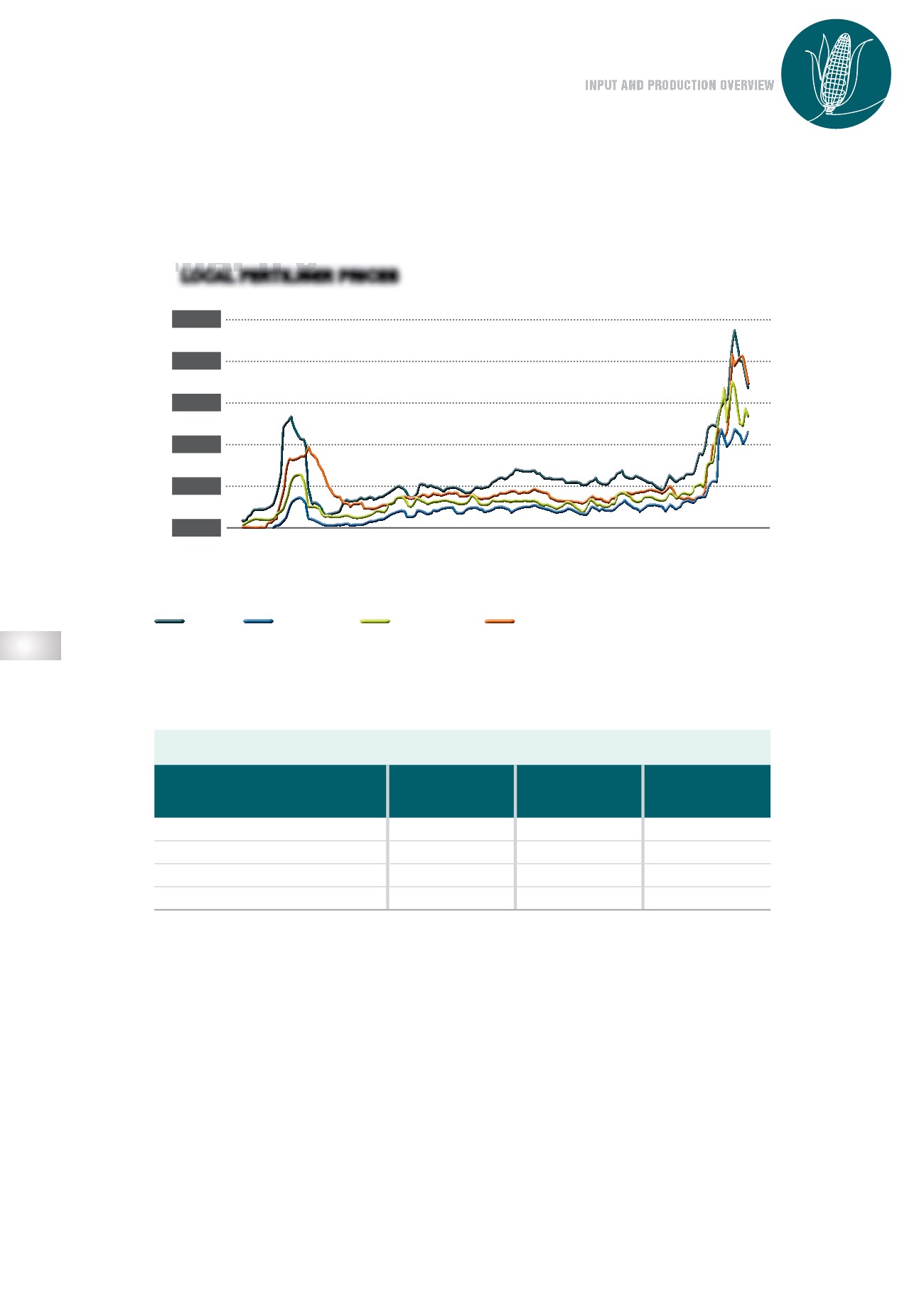

Because South Africa is a major importer of fertiliser, international availability and the price of fertiliser

have a direct impact on a producer’s bottom line. International fertiliser prices have hit record highs.

Some of the contributing factors for the dramatic increase in fertiliser prices are the Russian-Ukraine

war, which in effect had an impact on the availability of raw material, imposing of fertiliser bans,

closing of processing plants as well as drastic natural gas price increases.

Graph 4

(on page 78) shows the fertiliser price index compared to the maize price index since the

1985/1986 production season. At an estimated average producer price

[2]

of R3 667 per ton for the com-

ing production season (2022/2023), the gap between the maize price index and the fertiliser price index

continues to widen. This is no surprise given the sharp increase in fertiliser prices.

GRAPH 3

LOCAL FERTILISER PRICES

01/2007

01/2008

01/2009

01/2010

01/2011

01/2012

01/2013

01/2014

01/2015

01/2016

01/2017

01/2018

01/2019

01/2020

01/2021

01/2022

28 000

23 000

18 000

13 000

8 000

3 000

MAP

R/ton

LAN (28)

UREA (46)

POTASSIUM CHLORIDE (GRANULAR)

SOURCE: GRAIN SA

10/2022

TABLE 3

LOCA FERTILISER PRICES

Local fertiliser prices

FERTILISER

OCT 2021

R/TON

OCT 2022

R/TON

% CHANGE

LAN (28)

8 715

14 577

+67,3

Urea (46)

13 878

16 451

+18,5

MAP

15 286

19 812

+29,6

KCL

13 190

20 321

+54,1

[2]

Average producer price = Safex, July 2023 price, less (average differential cost + handling costs)