76

THE FERTILISER INDUSTRY

South Africa imports more than 80% of its fertiliser needs, therefore local and international prices are

expected to follow a similar trend. Local fertiliser price movements are mainly influenced by international

fertiliser prices and the value of the rand. The fertiliser market experienced a lot of pressure over the

past two years. The Russian invasion of Ukraine in March 2022 influenced the international market, as

Russian fertilisers did not find their way around the world. Russia is the second largest producer of

ammonia, urea, and potash and the fifth largest producer of processed phosphates. In terms of their

share of the global export market, Russia accounts for 23% of ammonia, 14% of urea, and 21% of

potash, as well as 10% of processed phosphate exports. Russia further supplies approximately one-third

of Europe’s natural gas, the main feedstock to produce nitrogen fertilisers. Because of Russia’s

large fertiliser production and its role as a global fertiliser supplier, the removal of Russian products

from the global marketplace has had an enormous impact on the international supply and prices.

The Chinese government also imposed a ban on fertiliser exports, which further caused uncertainty

in the international fertiliser market. Due to the above-mentioned, international fertiliser prices

increased significantly over the past year and local fertiliser prices followed a similar trend.

Fertiliser prices

From September 2021 to September 2022 international prices of fertiliser increased significantly with

double digits – between 16% and 64%.

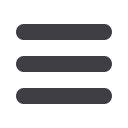

Table 1

shows the year-on-year changes of international

fertiliser prices in dollar terms.

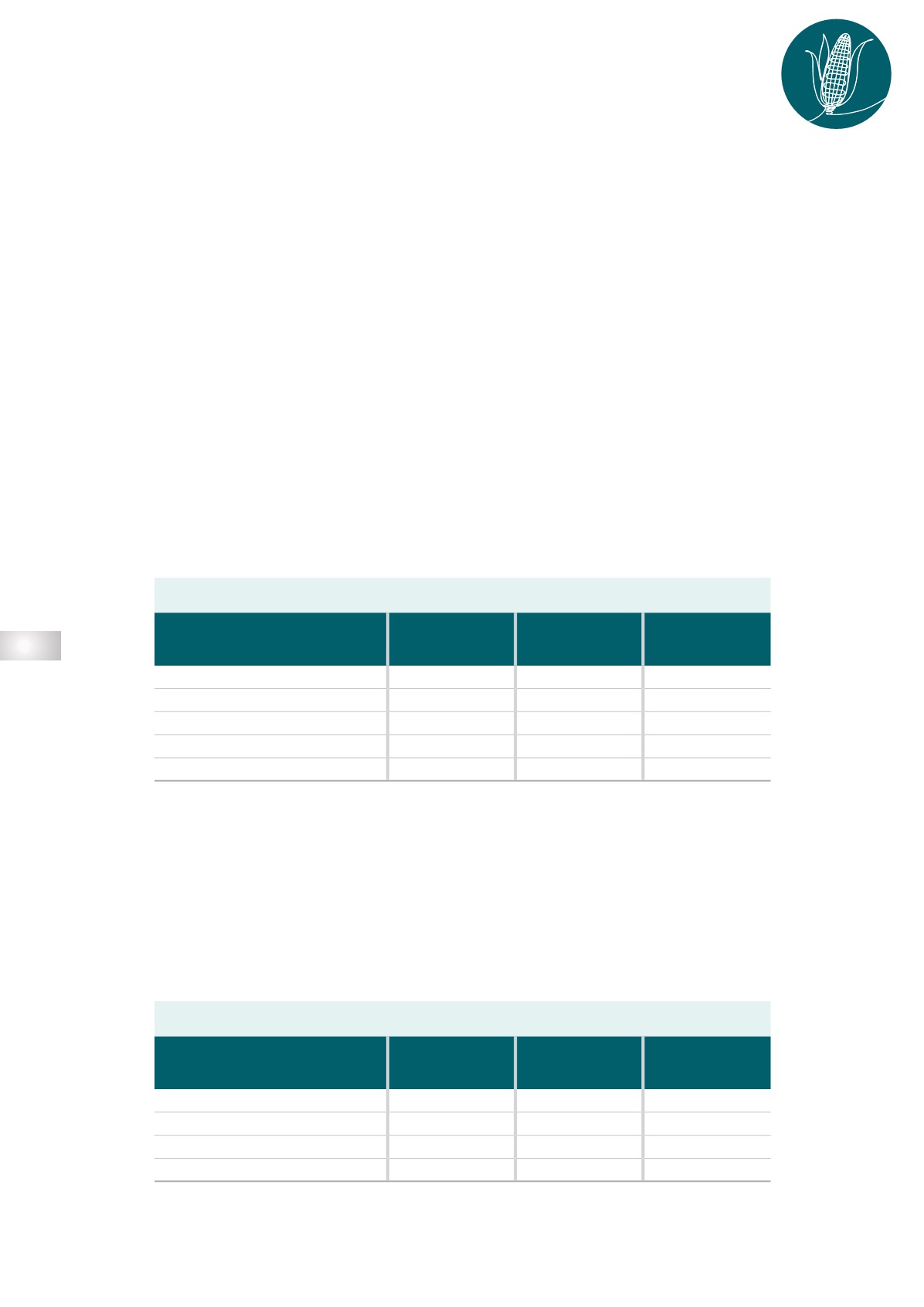

During the period under review, the exchange rate weakened by 20,3%. Fertiliser prices in rand terms

followed a similar trend to that of the dollar pricing, but the effect of a depreciation in the rand from

R14,59/$ in September 2021 to R17,55/$ in September 2022 caused further increases in rand value.

Table 2

indicates international fertiliser prices in rand terms, with the effect of the weaker exchange rate

on prices.

Graph 3

(on page 78) also indicates the sharp increase in international fertiliser prices for

the past year.

TABLE 1

TABLE 2

INTERNATIONAL FERTILISER PRICES IN DOLLAR TERMS

INTERNATIONAL FERTILISER PRICES IN RAND TERMS

International fertiliser prices in dollar terms

FERTILISER

SEP 2021

DOLLAR/TON

SEP 2022

DOLLAR/TON

% CHANGE

Ammonia (Middle East)

587

964

+64,2

Urea (46) (Eastern Europe)

490

610

+24,5

DAP (USA Gulf)

673

784

+16,5

KCL (CIS)

533

738

+38,5

Rand/dollar exchange rate

14,59

17,55

+20,3

International fertiliser prices in rand terms

FERTILISER

SEP 2021

RAND/TON

SEP 2022

RAND/TON

% CHANGE

Ammonia (Middle East)

8 564

16 918

+97,5

Urea (46) (Eastern Europe)

7 149

10 706

+49,7

DAP (USA Gulf)

9 819

13 759

+40,1

KCL (CIS)

7 776

12 952

+66,6

INPUT AND PRODUCTION OVERVIEW