74

INPUT AND PRODUCTION OVERVIEW

THE SEED INDUSTRY

Seed is an important production input and depending on the plant density, constitutes between 10%

and 17% of a maize producer’s variable production costs. Given excellent research in genetics and

technology, seed remains one of the most important inputs to increase yields and productivity in

the grain industry. Grain SA continues to monitor seed prices annually to maintain transparency and

competitiveness in the industry. Ongoing discussions with seed companies and SANSOR are also

held to communicate the needs and concerns of Grain SA members. The consistent increase in

seed prices remains a major concern to grain producers and some seed companies might start

experiencing resistance to high prices. Therefore, this message is conveyed to seed companies before

they decide on seed prices for the coming season.

Seed prices

There are twelve wheat cultivars and 22 irrigation cultivars in total available for the northern dryland

production areas, while there are eight different cultivars commercially available for the Western Cape.

There are four barley cultivars from which producers in the Western Cape can choose.

Wheat seed prices increased by 9,06% on average in 2022. Some cultivars increased by as much as

14,5%, while the cultivars of other companies increased by a total of 5%. What is interesting is that in

the northern production areas, wheat seed costs R463 per 25 kg bag on average, while seed prices

in the Cape amount to R503 per 50 kg bag. Barley seed prices increased by 9,5% on average.

There is a total of 10 cultivars commercially available for canola producers to choose from. Three

new canola cultivars were commercially available to producers in 2022. The prices of canola seed

increased by 18,7% in the 2022 season.

Maize seed prices for the 2022/2023 production season rose by 3,3% on average. Sunflower seed

prices rose by 2,5% on average, sorghum seed prices by 4,9% and soybean seed prices by 4,7%.

A good barometer for assessing price increases is the producer price index (PPI). Up until May 2022,

when seed prices were published, the PPI was 11,9%. On an average basis seed prices therefore

increased at a lower rate than production cost inflation.

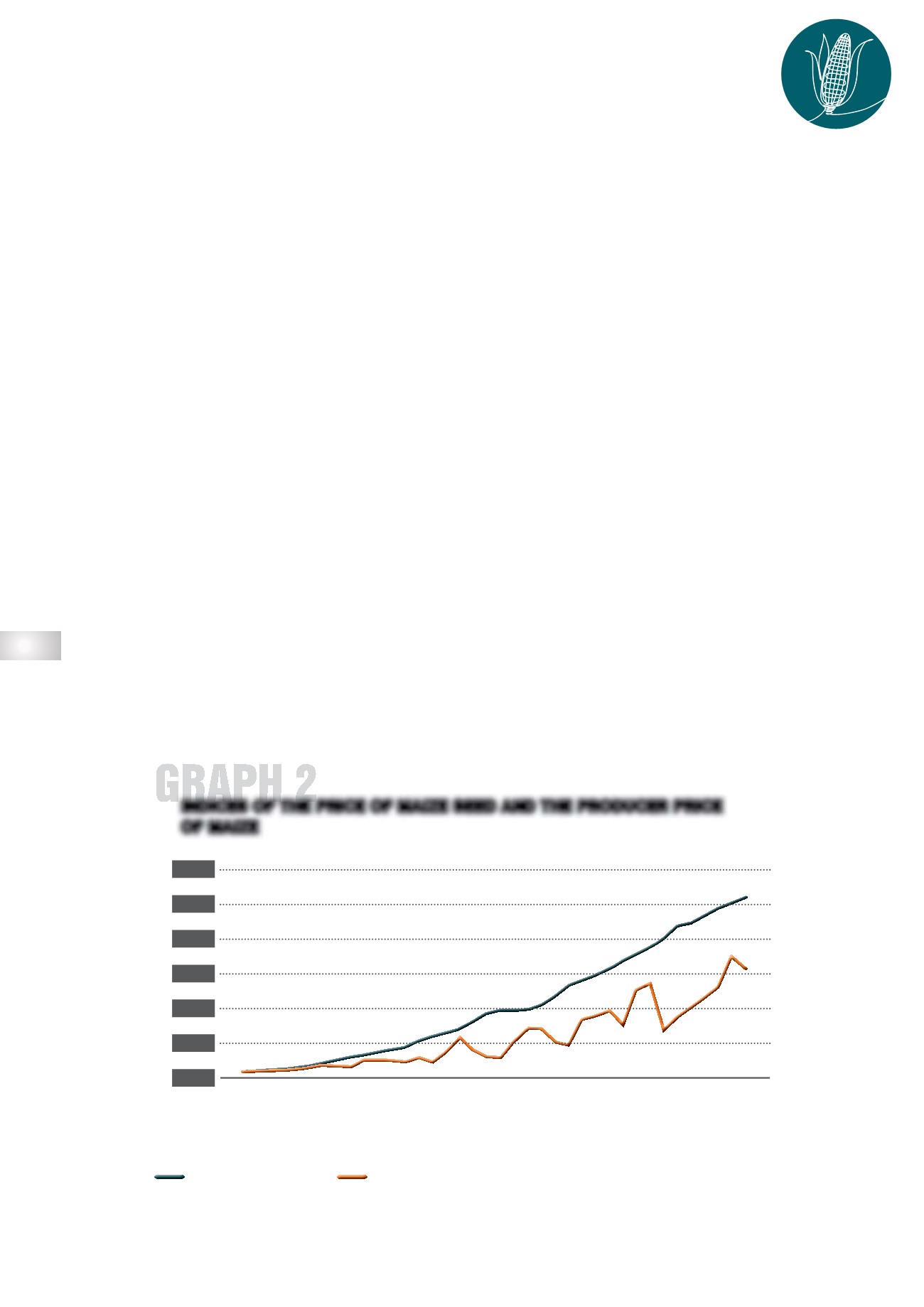

Maize seed prices can be analysed further by comparing them with maize prices. Since the 2001/2002

production season the maize price index (

Graph 2

) weakened significantly compared to the maize

seed price index. With an estimated average producer price

[1]

of R3 667 per ton for the coming season

(2022/2023), thanks to the commodity boom, a general divergence remains between the maize price

index and maize seed prices, with a widening gap between the two.

INDICES OF THE PRICE OF MAIZE SEED AND THE PRODUCER PRICE

OF MAIZE

1985/1986

1986/1987

1987/1988

1988/1989

1989/1990

1990/1991

1991/1992

1992/1993

1993/1994

1994/1995

1995/1996

1996/1997

1997/1998

1998/1999

1999/2000

2000/2001

2001/2002

2002/2003

2003/2004

2004/2005

2005/2006

2006/2007

2007/2008

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

2014/2015

2015/2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

2021/2022

2022/2023*

3 000

2 500

2 000

1 500

1 000

500

0

MAIZE SEED INDEX

Index

MAIZE PRICE INDEX

*Preliminary

SOURCE: GRAIN SA

[1]

Average producer price = Safex, July 2023 price, less (average differential cost + handling costs)

Indices: 1985/1986 = 100