26

Jaarverslag 2018

annual report 2018

Die heffing per ton per gewas vir

2018/2019

is soos volg:

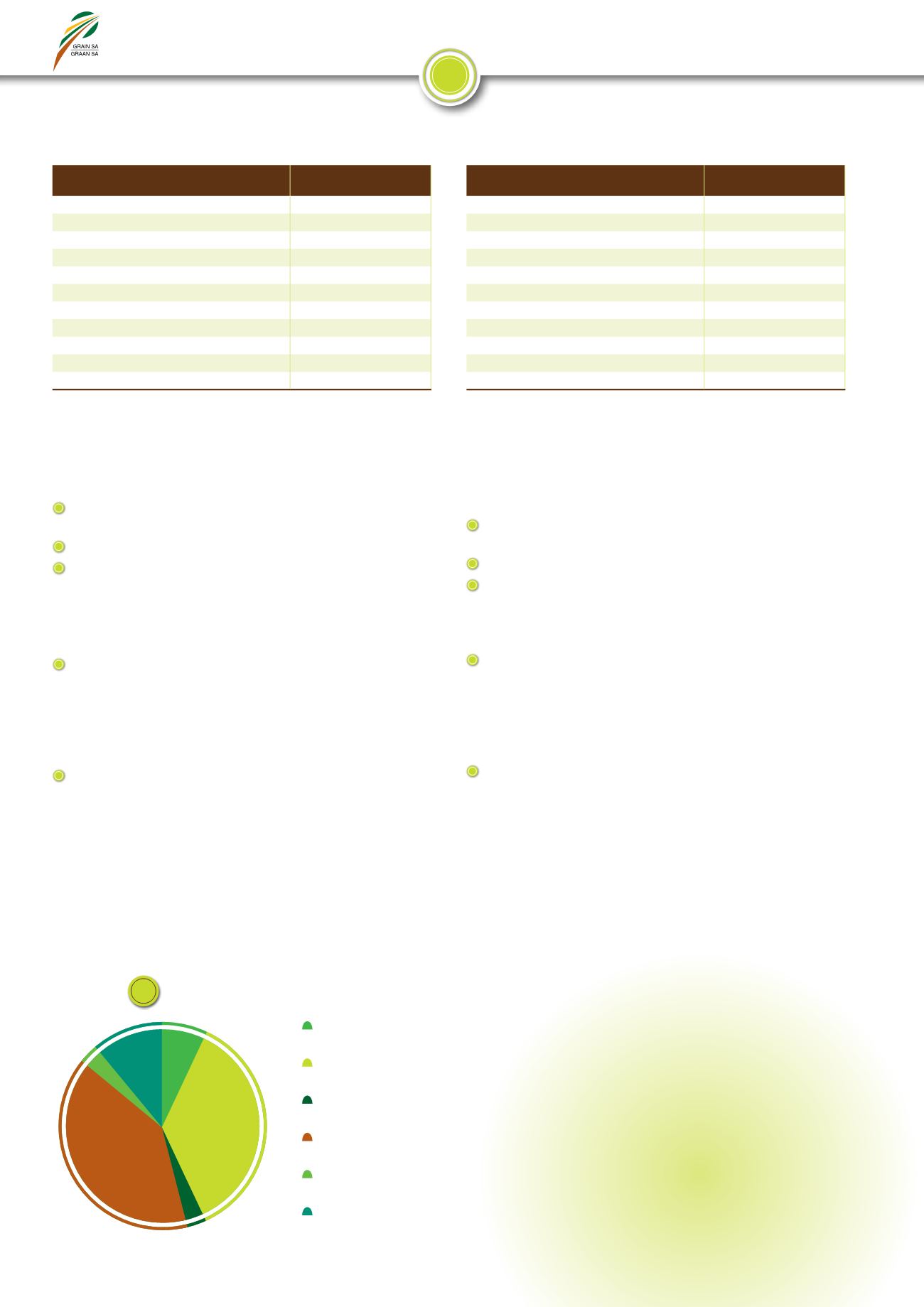

Employment of levy in the 2017/2018 marketing year

Aanwending van heffings in die 2017/2018-bemarkingsjaar

1

Collection commission

Agentekomissie

Grain SA management fee

Graan SA-bestuursfooi

Branch funding

Takbefondsing

Grain economy and research

Graanekonomie en -navorsing

Member benefits

Ledevoordele

Marketing

Bemarking

The levy per ton per crop for

2018/2019

is as follows:

7%

36%

3%

40%

3%

11%

Gewas

Heffing per ton

Somergrane

Mielies

R2,85

Sorghum

R2,85

Sojabone

R5,70

Sonneblom

R5,70

Grondbone

R11,00

Wintergrane

Koring

R3,35

Kanola

R4,50

Gars

R3,35

Ander grane

R3,35

Crop

Levy per ton

Summer grains

Maize

R2,85

Sorghum

R2,85

Soybeans

R5,70

Sunflower

R5,70

Groundnuts

R11,00

Winter cereals

Wheat

R3,35

Canola

R4,50

Barley

R3,35

Other grains

R3,35

Please note: VAT is excluded on the above amounts

Let wel: BTW is uitgesluit op bogenoemde bedrae

New era farmers who produce grain can also become members of

Grain SA by paying the same set fees as commercial members.

Exclusive benefits were also created for new members:

The Momentum policy package was revised and adjusted to

members’ needs.

Ford offers Grain SA members special prices on any vehicle.

The Grain SA app offers marketing information only to Grain SA

members.

Collection of levy

Levies are collected in the following ways:

By the collection agents

Collection agents are companies to whom grain is delivered. Grain SA

concludes contracts with the organisations in which they undertake

to collect levies at the first point of delivery with the agreement of the

producers and to pay over these levies to Grain SA within a stipulated

period. The logos of the Grain SA partners appear on page 27.

Direct transfers

Members can also pay their levies directly to Grain SA by way of

a cheque, a bank deposit or an electronic transfer. This payment

method is particularly suitable where farmers market their grain to

parties who do not form part of the Grain SA levy structures.

Employment of levy

The employment of the levy is approved by members only at the

annual Congress. The following graph indicates how the levy was

employed during the Congress year.

Nuwe era-boere wat graan produseer kan ook ’n lid van

Graan SA word deur die neergelegde gelde (dieselfde as dié vir

kommersiële lede) te betaal.

Eksklusiewe voordele is ook vir nuwe lede geskep:

Momentum se polispakket is hersien en aangepas volgens lede

se behoeftes.

Ford bied spesiale pryse op enige voertuig vir Graan SA-lede aan.

Die Graan SA-app bied bemarkingsinligting slegs vir Graan SA-lede.

Invordering van heffing

Heffings word op die volgende wyses ingesamel:

Deur vorderingsagente

Vorderingsagente is maatskappye waar graan gelewer word.

Graan SA sluit kontrakte met die organisasies, waar hulle onderneem

om met toestemming van die produsente heffings te verhaal by die

eerste punt van lewering en dit binne ’n sekere tyd aan Graan SA oor

te betaal. Die logo’s van Graan SA se vennote verskyn op bladsy 27.

Direkte oorbetalings

Lede kan ook hul heffings direk aan Graan SA oorbetaal by wyse

van tjek, deposito of elektroniese oorbetaling. Die metode van

betaling is veral gepas waar produsente se graan aan partye bemark

word wat nie deel van Graan SA se heffingstrukture vorm nie.

Aanwending van heffing

Die aanwending van die heffing word alleenlik deur lede tydens die

jaarlikse Kongres goedgekeur. Die volgende grafiek dui aan hoe die

heffing tydens die Kongresjaar aangewend is.