70

in September 2018 to US$62,02 per barrel in September 2019. Over

the same period, the rand weakened against the dollar from R14,69

to R14,84. The decrease in the Brent crude oil price together with a

moderate depreciation of the rand, led to a decrease in the domestic

wholesale price of diesel.

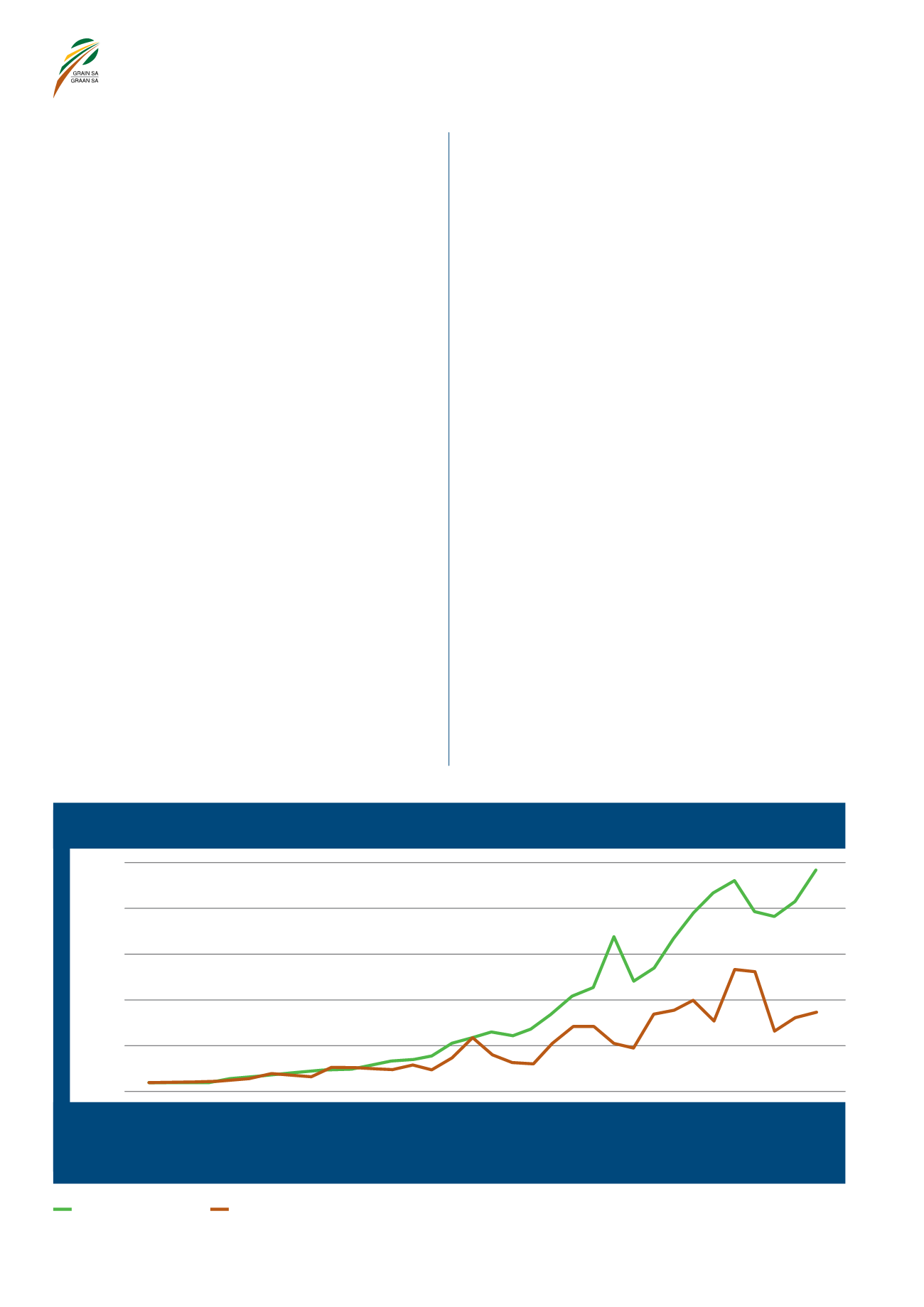

The maize price index and the diesel price index are shown in

Graph 6

. Given an expected producer price

3

of R2 370 per ton for

maize for the coming season and together with minor increases in

diesel prices, the ratio between the diesel price and the maize price

weakened further.

DIESEL REBATE

The diesel rebate for which producers qualify comprises 40% of the

general fuel tax and 100% of the Road Accident Fund levy.

In February 2019 the Minister of Finance announced that the general

fuel levy and the Road Accident Fund levy would increase by five

cents per litre and 15 cents per litre respectively in April 2019. A further

announcement was made regarding a levy on exhaust gases, which

meant that the tax on diesel increased by another two cents per litre.

This meant that the diesel rebate increased from 321,8 cents per litre

to 333,6 cents per litre in April for 80% of legal use.

Graph 7

illustrates

how the diesel rebate increased over time.

DIESEL REBATE SYSTEM

The diesel rebate once again received priority attention during this

reporting period. Delays in the payment of the diesel rebate and VAT

claims caused producers to experience major cash flow problems.

Some delays in pay-outs was without reason given by SARS, whilst

others were due to audits been done; problems with communication

and interpretation of logbook entries. Frequent meetings were held with

SARS head office in this regard. During the end of 2018, Grain SA also

participated in industry workshops held by SARS and the Treasury to

review the current diesel rebate and to create a better functioning diesel

rebate system.

Grain SA also designed and participated with Agri SA and SAIT in a

questionnaire, where valuable information was obtained that could be

taken up with SARS and the Treasury. Frequent discussions were also

held with the Tax Ombud to bring problems experienced with delays to

his office’s attention.

3

Average producer price = Safex, July 2020 price - average differential cost - handling costs

3

Gemiddelde produsenteprys = Safex, Julie 2020-prys - gemiddelde differensiële koste - hanteringskoste

US$79,13 per vat in September 2018 tot US$62,02 per vat in September

2019. Oor dieselfde tydperk het die rand vanaf R14,69 tot R14,84 teen

die dollar verswak. Die daling in die prys van Brent-ruolie, tesame met ’n

matige vermindering in die waarde van die rand, het tot ’n daling in die

plaaslike groothandelprys van diesel gelei.

Die mielieprysindeks en die dieselprysindeks word in

Grafiek 6

getoon.

Gegee ’n verwagte produsenteprys

3

van R2 370 per ton vir mielies vir

die komende seisoen, en saam met geringe verhogings in dieselpryse,

is die verhouding tussen die dieselprys en die mielieprys nog swakker.

DIESELRABAT

Die dieselrabat waarvoor produsente kwalifiseer, bestaan uit 40% van die

algemene brandstofbelasting en 100% van die Padongeluksfondsheffing.

Die Minister van Finansies het in Februarie 2019 aangekondig dat

die algemene brandstofheffing en die Padongeluksfondsheffing in

April 2019 met vyf sent per liter en 15 sent per liter onderskeidelik

gaan toeneem. ’n Verdere aankondiging is gemaak van ’n heffing vir

uitlaatgasse, wat meegebring het dat die belasting op diesel met ’n

verdere twee sent per liter toegeneem het. Dit alles het meegebring

dat die dieselrabat vanaf 321,8 sent per liter na 333,6 sent per liter

toegeneem het – vir 80% van regmatige gebruik.

Grafiek 7

toon hoe die

dieselrabat oor tyd toegeneem het.

DIESELRABATSTELSEL

Die dieselrabat het weer eens in hierdie verslagdoeningstydperk

prioriteitsaandag ontvang. Vertragings in die betaling van die diesel-

rabat en van BTW-eise het veroorsaak dat produsente ernstige

kontantvloeiprobleme ervaar het. Sekere vertragings in uitbetalings

het voorgekom sonder dat die SAID redes verskaf het, terwyl ander

veroorsaak is deur oudits wat uitgevoer is, probleme met kommunikasie

en die vertolking van logboekinskrywings. Gereelde vergaderings is met

die SAID se hoofkantoor in hierdie verband gehou. Aan die einde van

2018 het Graan SA ook deelgeneem aan bedryfswerkswinkels wat deur

die SAID en die Tesourie gehou is om die huidige dieselrabat te hersien

en ’n beter-funksionerende dieselrabatstelsel te skep.

Graan SA het saam met Agri SA en SAIT ’n vraelys ontwerp wat waarde-

volle inligting verkry het wat met die SAID en Tesourie opgevolg kan word.

Gereelde gesprekke is ook met die Belastingombud gevoer om probleme

wat met vertragings ervaar word onder sy kantoor se aandag te bring.

2 500

2 000

1 500

1 000

500

0

Index

Indeks

GRAPH 6 – Indices of the producer price of maize and the wholesale price of diesel.

GRAFIEK 6 – Indeks van die produsenteprys van mielies en die groothandelprys van diesel.

1985/1986

1986/1987

1987/1988

1988/1989

1989/1990

1990/1991

1991/1992

1992/1993

1993/1994

1994/1995

1995/1996

1996/1997

1997/1998

1998/1999

1999/2000

2000/2001

2001/2002

2002/2003

2003/2004

2004/2005

2005/2006

2006/2007

2007/2008

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

2014/2015

2015/2016

2016/2017

2017/2018

2018/2019*

Diesel price index

Dieselprysindeks

Maize price index

Mielieprysindeks

* Preliminary/Voorlopig

Source: Grain SA

Bron: Graan SA

Indices/Indekse:

1985/1986 = 100