Maart 2018

106

Factors affecting price of maize meal

S

outh Africa has processed between

4,095 and 4,361 million tons of

white maize for human consump-

tion over the past three years.

This constitutes between 75 kg and 81 kg

of white maize per capita per year for this

period. Therefore, white maize plays a vital

role with regards to food security. The white

maize meal value system is highly complex

and contributes to the wellbeing of a lot of

South Africans. Low-income groups are

highly dependent on white maize meal in

South Africa.

South Africa experienced very high white

maize prices through the 2016/2017 sea-

son due to a shortage of maize in one of

the worst droughts ever. The maize price

in South Africa can also be highly volatile.

Many role-players in the market argue that

when white maize prices decrease, the price

of maize meal does not react at the same

pace as when it increases. The industry is

also highly competitive and concentrated

and provides a huge differentiation of prod-

ucts with regards to size of package and

type of meal.

This article is the first of two articles on

maize meal. This article elucidates the maize

meal industry, the value chain and the fac-

tors affecting maize meal prices in South

Africa. The second article will provide in-

sight on the trend of maize prices and white

maize meal prices as well as on how maize

meal prices is monitored. It also explains

how the National Agricultural Marketing

Council calculates the farm to retail price

spread and the farm value share in maize

meal and also lists the challenges and po-

tential for improvement.

Maize meal producers

and capacity

According to

Who-Owns-Whom

(WOW)

South Africa has an average milling capacity

of 3,7 million tons. According to the Depart-

ment of Agriculture, Forestry and Fisheries

(DAFF), the potential capacity is approxi-

mately 5 million tons. The top 20 milling

companies produce more than 80% of the

maize meal consumed in South Africa.

Who-Owns-Whom

(WOW) reported that

the leading four role-players, namely Pio-

neer, Premier Foods, Pride Milling and Tiger

Brands together mill approximately 75% of

the maize meal produced in South Africa.

The agro-processing unit of the Department

of Trade and Industry (DTI) established 24

new micro mills from 2013 to 2015. Their ca-

pacity is unknown.

In South Africa close to 200 maize millers

are registered with the South African Grain

Information Service (SAGIS). These millers

need to report stock and production figures

to SAGIS monthly. The millers can be di-

vided into three tiers, namely mega millers,

medium size millers and micro millers or in-

formal millers.

The market share of the top 75% millers is

illustrated in

Table 1

.

Usage of white maize

White maize is mainly used to produce

white maize meal. Various types of white

maize meal for human consumption fea-

ture in the South African market. The most

popular is super, followed by special maize

meal. Due to the different extraction rates,

the price between these two types of maize

meal differ.

White maize can also be used in the feed

market, depending on the price. In the past

white maize normally traded above yellow

maize prices. This phenomenon changes

when a surplus of white maize is produced,

as was the case in the 2017/2018 marketing

season.

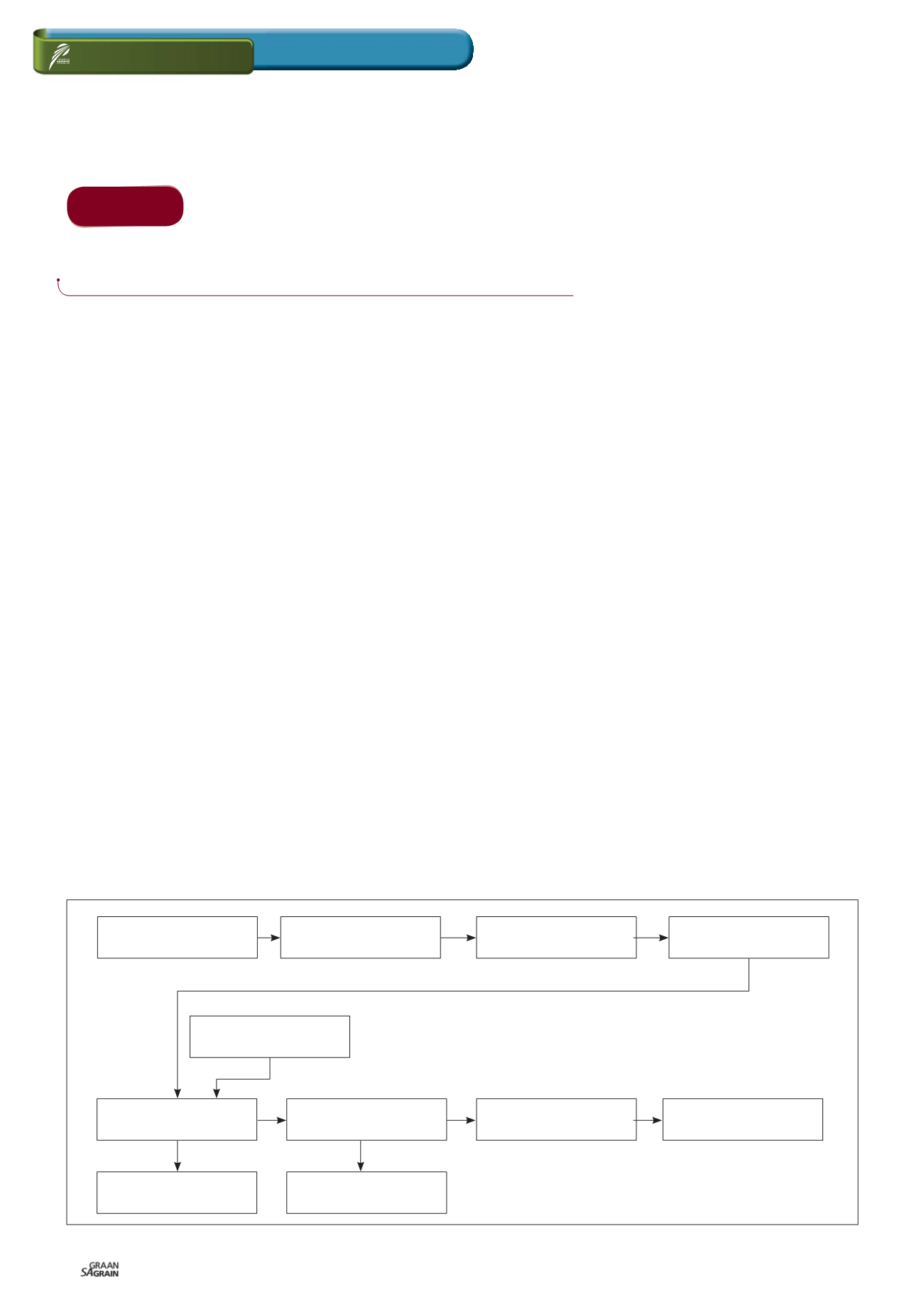

The value chain of the

white maize milling

industry

It is also important to understand how the

value chain functions to better understand

how prices are formed at the different levels

of distribution. The value chain is well devel-

oped and in certain parts highly concentrat-

ed. I shall only refer to white maize milling.

The value chain is depicted in

Figure 1

.

RELEVANT

DR CHRISTO JOUBERT,

manager: Agro Food Chains, Market and Economic Research Division,

National Agricultural Marketing Council

Part 1

Research and

biotechnology

Imports of whole

maize

Input suppliers

Local market

Wholesale

Retail

Maize milling

industry

Exports of whole

maize

Exports of maize

products

Producers

Storage in silos

Figure 1: The value chain of the white maize milling industry.