Junie 2018

70

The

inefficient

producer?

T

he term ‘competitiveness’ is best

understood as the ability of a sec

tor, industry, firm or farm to com

pete by trading their products

within the global environment while at least

earning the opportunity cost of resources

employed. For wheat producers in South

Africa, the empirical indicators of competi

tiveness seemingly tell a depressing story

while, on the other hand, depicting wheat

millers as sufficiently competitive on global

standards.

However, the operating environment within

which value chain stakeholders operate

either incentivises their business activity or

disincentivises it. These operating incen

tives in turn play a large role in the specific

stakeholder’s ability to be competitive.

We are able to quantify these incentives and

disincentives through a ‘distortion’ meas

urement. This is done through comparisons

of ‘perfect world’ free market prices and pre

vailed market prices in the domestic market.

Through doing this, the degree to which the

policy and operating environment has dis

torted incentives for individual stakeholders

to operate in is able to be determined and

quantified.

Quantifying distortions

Positive distortions prevail where the price

received by the specific value chain stake

holder is higher than the price that they

would have otherwise received in a ‘perfect

world’ free market. Consequently, such a

situation is interpreted as the policy and op

erating environment ‘supporting’ the value

chain stakeholder as their business opera

tion is incentivised.

Where the price received is lower than the

‘perfect world’ price, negative distortions

prevail and the situation is interpreted as the

policy and operating environment ‘taxing’

or inhibiting the value chain stakeholder.

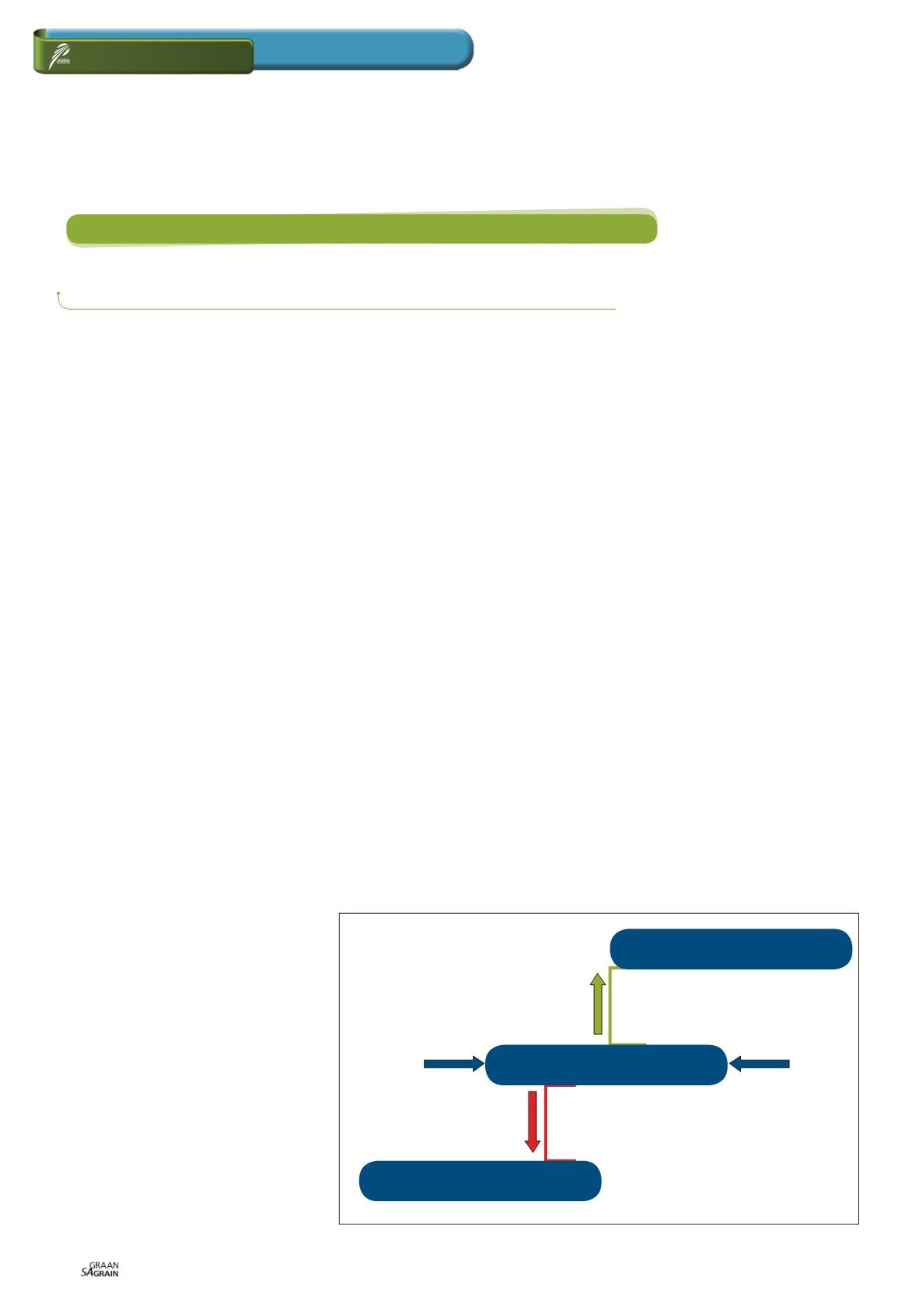

An empirical indicator known as the nominal

rate of assistance (NRA) is used to quantify

the magnitude of distortions. In broad terms,

the nominal rate of assistance indicates the

percentage by which gross incomes have

been raised or lowered from the level that

these incomes would otherwise have been

at in an intervention free (undistorted) oper

ating and policy environment.

These nominal rate of assistance distortion

indicators are able to be calculated for indi

vidual agents in a vertical value chain such

as producers, millers and consumers in or

der to quantify the degree to which each of

these agents’ operating activities are ‘sup

ported’ or ‘taxed’.

A positive nominal rate of assistance value

for a specific agent indicates a positive dis

tortion (‘supporting’ in

Figure 1

) whereas a

negative nominal rate of assistance value

indicates a negative distortion (‘taxing’ in

Figure 1).

Distortion values for the

wheat value chain

The distortion values for wheat producers,

millers and flour consumers are depicted in

Graph 1

. Clearly evident from the nominal

rate of assistance values is that over the

time period analysed, wheat millers enjoyed

the luxury of an operating and policy envi

ronment which provided tremendous sup

port towards their business operation.

On the other hand, wheat producers and

flour consumers were faced with an envi

ronment in which their existence and sur

vival was disincentivised or ‘taxed’.

An interesting trend in the distortion in

dicators is the decline of the nominal rate

of assistance to millers leading up to the

2007/2008 marketing year in which the

wheat flour cartel was exposed.

Over a five-year period between 2002/2003

and 2007/2008, wheat millers went from

receiving incomes 95% higher than they

would otherwise receive in a perfect collu

sion free market to receiving incomes just

4% higher than would be received in a per

fect market.

Thus, if the cartel bust marketing year of

2007/2008 is interpreted as a year with no

collusion present in the wheat milling in

dustry, the high positive nominal rate of as

sistance values prior to 2007/2008 can likely

be attributed to the collusion at processing

level which the cartel used to distort the in

centives throughout the wheat value chain.

In simple terms, through collusion, the

wheat milling industry was able to manipu

late the operating environment and policy

environment to the disfavour of all other

value chain agents, but in favour of the

wheat milling industry. This is re-iterated

in the negative nominal rate of assistance

in Graph 1 for wheat producers and wheat

flour consumers who throughout the stud

ied period found themselves being forced

to operate in an operating and policy envi

ronment which disincentivised their exist

ence and operation.

Relevant

Questioning the South African wheat value chain’s core competitiveness

Michael Day,

managing director, AfriValue Consulting; research conducted in fulfilment of MSc (Agric),

Agricultural Economics at Stellenbosch University

Price received

(production incentivised)

Free market price (perfect world)

Positive distortion

‘supporting’

Negative distortion

‘taxing’

Price received

(production disincentivised)

Figure 1: Illustration of a price distortion.