Junie 2018

72

Relevant

Indemnity

The opinions expressed in this magazine are those of the contributors and do not necessarily reflect the official opinion of Grain SA.

The

inefficient

producer?

Therefore, it is necessary to question the

core competitiveness abilities, given spe

cific proxies of wheat producers and millers

were they to be operating in an undistorted

environment (NRA = 0) free of collusion.

Implications: A worrying

trend

The high nominal rate of assistance and

high relative trade advantage values during

the years leading up to 2007/2008 are able to

be understood with the historic knowledge

of the active wheat milling cartel which was

able to manipulate the value chain operating

environment in its favour.

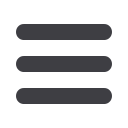

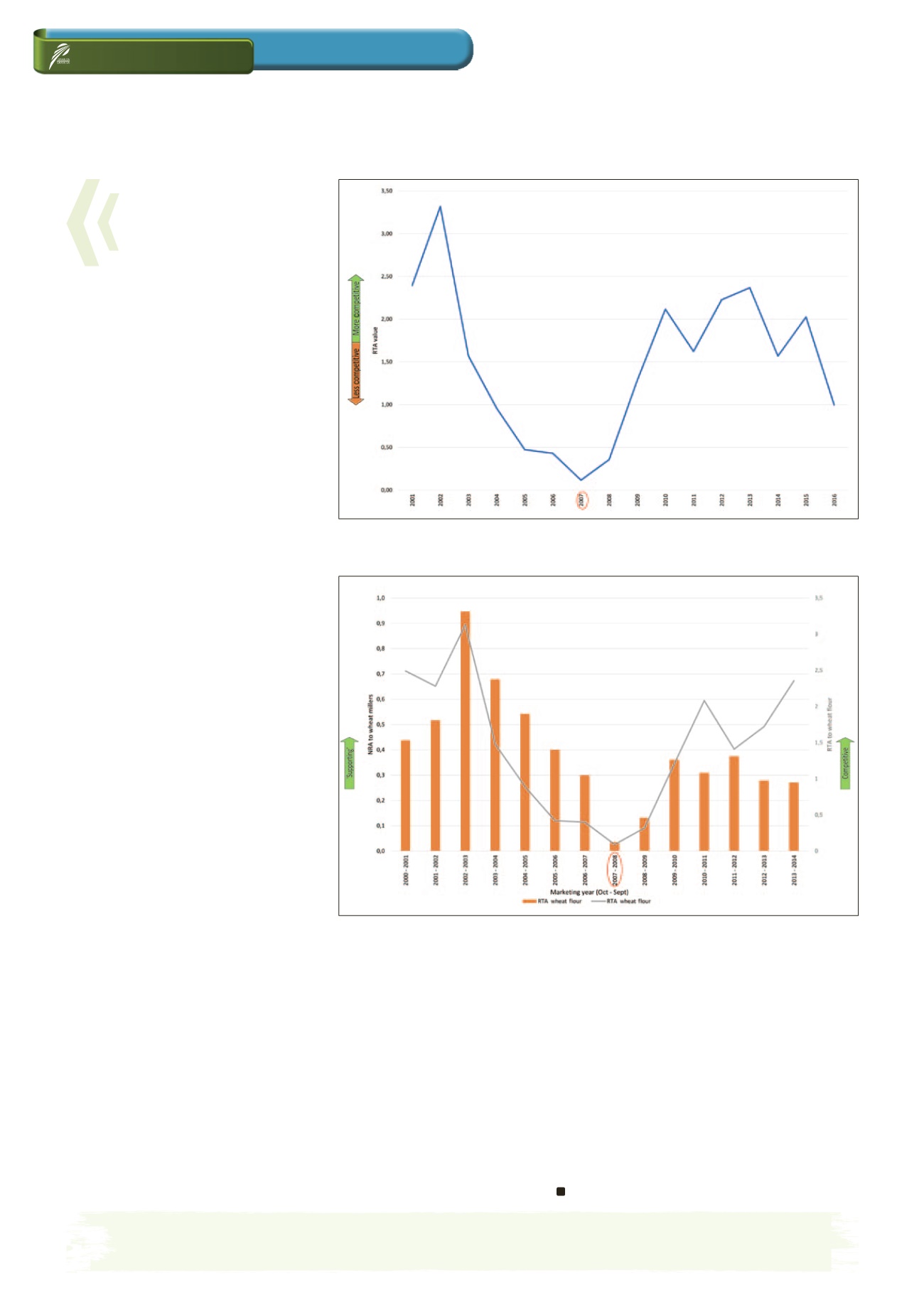

However, Graph 4 depicts how these com

petitiveness and distortion indicators for

wheat millers once again rose to similar lev

els as those seen during active cartel years

even beyond the 2007/2008 marketing year.

This questions the transparency of the mill

ing industry in its current state as well as

the regulations governing the wheat mill

ing industry post cartel bust. It furthermore

necessitates analysis in order to determine

why, in a supposedly free market, wheat

millers are still able to distort the incentives

in the value chain.

From Graph 1, it is clearly evident that the

manipulation of the value chain’s policy and

operating environment post cartel bust is

once again to the detriment of wheat pro

ducers and wheat flour consumers and in

favour of wheat millers.

From a producer’s perspective, it is ex

tremely difficult to improve competi

tiveness in an unconducive operating

environment where producers remain price

takers. (The difficulty to integrate vertically

in the value chain due to high barriers to

entry with regards to operating capital and

financing intensifies this challenging operat

ing environment.)

This while consumers of wheat flour are

forced to pay prices well above the would

be free market equilibrium price and in

crease the inefficient share of value adding

occurring at wheat processing level.

If the wheat sector sits back and accepts

that wheat producers are not competitive

and inefficient without probing why non-

competitiveness is observed, the South

African wheat value chain will grow in inef

ficiency as the big elephants of the wheat

value chain continue to manipulate and

self-regulate the incentives throughout the

chain.

It is well overdue to question the core com

petitiveness of the key wheat value chain

stakeholders and their perceived respec

tive (in)efficiencies. Deeper analysis of the

interaction of distortion indicators, compe

titiveness indicators and their link to

anti-competitive behaviour is needed to de

termine whether it is indeed a case of the

‘inefficient producer’ as opposed to a more

likely case of the ‘inefficient value chain’.

For more information contact Michael Day

at

michael@afrivalueconsulting.co.za

.

Source

Source of relative trade advantage competitiveness

indicator data: Boonzaaier, JDTL. 2017.

South African

wheat industry relative trade advantage data

to Day, MRB [Online], 28 August 2017.

Grain SA. 2017. Grain SA Market Report. Available:

http://www.grainsa.co.za/pages/industry-reports/

market-reports

(accessed 05 May 2017).

SAGIS (South African Grain Information Service).

2017. South African Grain Information Service In

formation/Data. Available:

http://www.sagis.org.za/

index.html

(accessed 04 August 2017).

Van Rooyen, CJ. 2008.

The competitiveness of the

South African agribusiness sector, 2008

. University

of Pretoria: Pretoria.

Graph 3: Nominal rate of assistance competitiveness indicator for wheat flour milling.

Source of relative trade advantage competitiveness indicator data: Boonzaaier, JDTL

Graph 4: Nominal rate of assistance to wheat millers and relative trade advantage of wheat flour,

South Africa, marketing years 2000/2001 to 2013/2014.

RTA = relative trade advantage

Source of relative trade advantage competitiveness indicator data: Boonzaaier, JDTL