71

June 2018

Competitiveness and

distortions

As alluded to in the introductory comments

of this article, a value chain stakeholder’s

competitiveness can be seen as a function

of the operating and policy environment in

which the specific stakeholder operates.

Empirically quantifying distortions enables

us to measure the incentives or disincen

tives facing individual value chain agents

and thus begin to answer the question re

garding why some value chain stakeholders

are deemed to be more competitive than

others.

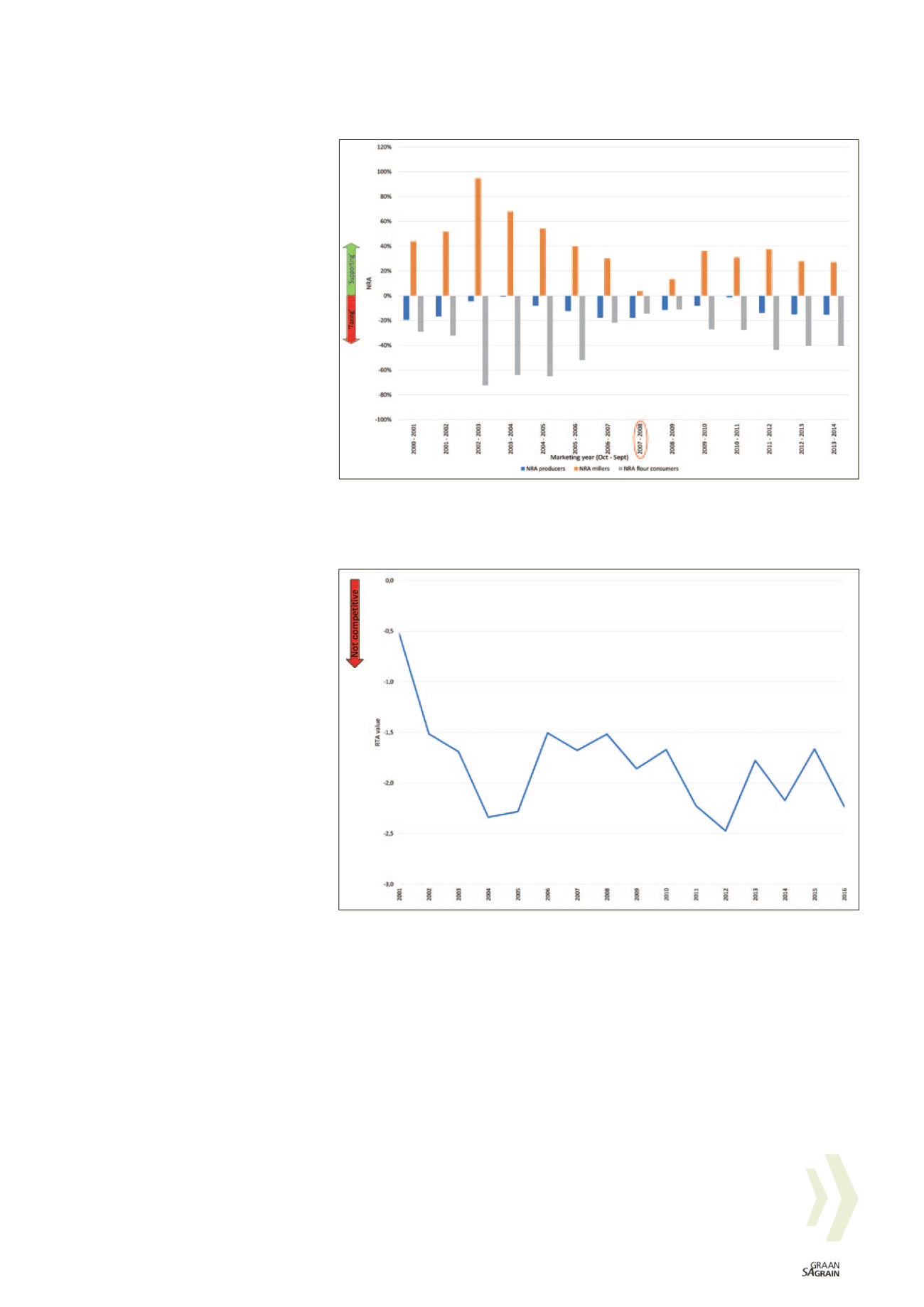

The relative trade advantage (RTA) is an in

dicator or proxy of competitiveness where

positive relative trade advantage values re

flect competitiveness and negative relative

trade advantage values reflect non-compet

itiveness. (The relative trade advantage is

a measure of overall industry competitive

ness and should not be confused with farm

level profitability. Thus, a negative relative

trade advantage does not imply that every

wheat farm in South Africa is operating at

a loss.)

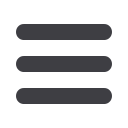

Graph 2

and

Graph 3

illustrate the non-

competitiveness of wheat producers and

the competitiveness of wheat millers re

spectively.

If one focuses on the distortions facing

wheat producers and millers in conjunc

tion with their perceived competitiveness,

we are able to progress past simply stating

whether a specific value chain stakeholder

is competitive or not and propose reasons

why we observe certain competitiveness

levels amongst value chain stakeholders.

For wheat producers, their non-competitive

ness (Graph 2) was experienced while they

operated in an environment disincentivising

their existence (Graph 1). It is therefore no

surprise that wheat producers were unable

to increase their competitiveness under

such a ‘taxing’ operating environment.

The link between wheat millers’ competi

tiveness and distortion indicators exhibit a

concerning trend. When we compare wheat

millers’ nominal rate of assistance indica

tors and relative trade advantage indicators

it becomes evident that during years of per

ceived high competitiveness (high positive

relative trade advantages), large positive

distortions (nominal rate of assistances)

were also present.

Both these large positive distortions as well

as wheat millers’ competitiveness declined

to near zero during the cartel bust year of

2007/2008. The distortion and competitive

ness indicators are contained in

Graph 4

.

From the analysis of wheat millers’ competi

tiveness and distortions, it is plausible to

propose that a possible reason why wheat

millers were deemed to be competitive dur

ing the cartel years was because they were

able to manipulate the entire wheat value

chain’s operating and policy environment in

their favour.

As the market power strength of the

wheat flour cartel decreased leading up to

2007/2008, so did the ability of the wheat

millers to distort the value chain incentives

in their favour. This resulted in wheat mill

ers being deemed to be less competitive

because they were being forced to operate

in a freer market without collusion.

The cartel bust year of 2007/2008 can pos

sibly be considered as the closest that

the wheat value chain has come to a per

fectly free market due to the competition

commission’s investigation of the industry.

During this marketing period, wheat mill

ers were operating in a marginally distort

ed market (such a small distortion can be

deemed negligible) and their competitive

ness was near zero, indicating marginal

competitiveness.

This evidence re-enforces the prior suspi

cion that a large reason for wheat millers’

perceived competitiveness was because

they were distorting the value chain operat

ing environment in their favour.

Graph 1: Nominal rate of assistance per selected agent in the wheat value chain – marketing years,

South Africa, 2000/2001 to 2013/2014.

NRA = nominal rate of assistance

Source of input data for calculations: Department of Agriculture, Forestry and Fisheries (DAFF). (2016).

Abstract of Agricultural Statistics.

DAFF: Pretoria, South Africa

Graph 2: Nominal rate of assistance competitiveness indicator for wheat production.

RTA = relative trade advantage

Source of relative trade advantage competitiveness indicator data: Boonzaaier, JDTL