February 2022

| JENNY MATHEWS, MANAGEMENT AND DEVELOPMENT SPECIALIST AND EDUCATOR |

|

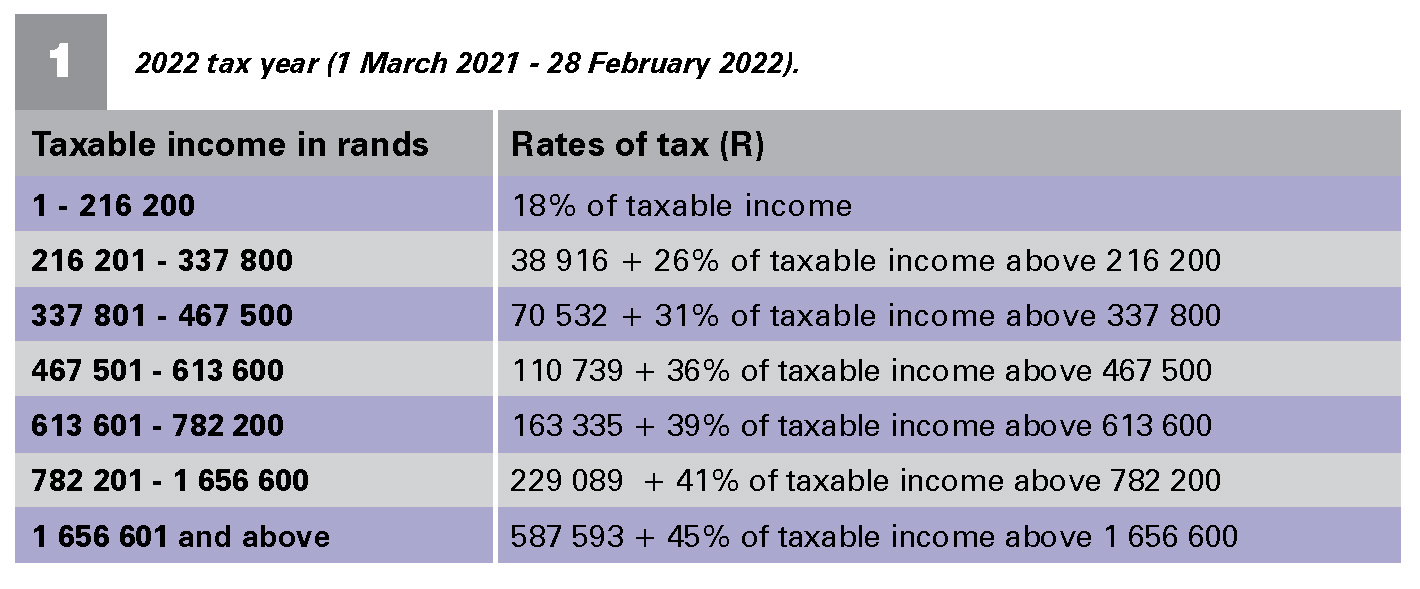

According to the law of our land, income acquired by any individual carrying on ‘pastoral, agricultural or other farming operations’ is indeed taxable, and must be combined with all taxable income that is collected from other streams of income to conclude the taxpayer’s taxable income for each year of assessment.

The latest figures on the South African Revenue Services (SARS) website indicate the rate of tax according to income received (Table 1).

Here is a list of some important words used in the world of bookkeeping:

ACCOUNTING

BALANCE SHEET

BALANCE SHEET

A balance sheet is a financial statement that reports a company's assets, liabilities and shareholder equity. It provides a snapshot of a company's finances – what it owns and owes on date of publication.

Financial statements are prepared at the end of every financial period (1 March to 28 February) and whenever else it’s needed. The main elements of a balance sheet are called accounts – such as cash, inventory list with current values, notes payable, and capital stock e.g. a farmer may still have grain stored in a silo. A balance sheet refers to the equality (or balance) of assets with the total of liabilities and owners’ equity.

Financial statements are prepared at the end of every financial period (1 March to 28 February) and whenever else it’s needed. The main elements of a balance sheet are called accounts – such as cash, inventory list with current values, notes payable, and capital stock e.g. a farmer may still have grain stored in a silo. A balance sheet refers to the equality (or balance) of assets with the total of liabilities and owners’ equity.

CASH FLOW

This is cash flow from earning profit or from operating activities the flow of money out and into the bank account.

DEBITS AND CREDITS

Accounting jargon for decreases and increases recorded in accounts.

FINANCIAL REPORTS

The financial reports of businesses include three primary financial statements namely, the balance sheet, income statement, and statement of cash flows.

FIXED ASSETS

These are recorded in an inventory list and include a wide variety of long-life, physical resources used by a business in conducting its operations e.g. land, buildings, machinery, equipment, furnishings, tools, and vehicles.

INCOME STATEMENT

This financial statement summarises income generated from sales and expenses/losses.

PROFIT

In an income statement, the preferred term for final or bottom-line profit is net income.

Accountants or bookkeepers keep the books ordered by systematically recording all financial activities of a business on a month to month basis. The financial statements of a business are then compiled for the accounting year which ends on the last day of February.

Publication: February 2022

Section: Pula/Imvula