64

concern to grain producers and some seed companies might start

experiencing resistance to high prices.

SEED PRICES

A total of 34 wheat cultivars are available for the northern production

areas (irrigation included), while nine different cultivars are available

commercially for the Western Cape. Western Cape producers have a

choice between eleven available barley cultivars.

Wheat seed prices increased by an average of 6,5% since last year.

Some cultivars increased by up to 9,4%, while others decreased by as

much as 4%. What is interesting is that in the northern production areas,

wheat seed costs R367 per 25 kg bag on average, while seed prices in

the Cape amount to R409 per 50 kg bag. Barley seed prices increased

by 4,6% on average.

Canola producers have a choice between 16 cultivars that are commer-

cially available. The prices of canola seed remained virtually unchanged

in the 2019 season.

Maize seed prices for the 2019/2020 production season rose by 4,5%

on average. Sunflower seed prices increased by 4,3% on average, grain

sorghum seed prices by 2,5%, while soybean seed prices decreased by

1,9%. A good barometer for assessing price increases is the producer

price index (PPI). Up until May 2019, when seed prices were published,

the PPI was 5%. This means that seed prices did not exceed production

cost inflation on an average basis.

Maize seed prices can be analysed further by comparing them with the

price of maize. Since the 2001/2002 production season the maize price

index (

Graph 2

) weakened significantly compared to the maize seed

price index. With an estimated average producer price

1

of R2 370 per

ton for the coming season (2019/2020), the maize price index minimally

increased more than maize seed prices.

BREEDING AND TECHNOLOGY LEVY

According to seed companies, roughly 80% of soybean plantings

and 70% of wheat plantings are annually planted with seed that was

held back. The holding back of seed – which is legal – causes a

vicious cycle that limits and to a great extent prevents investment

in the soy and wheat seed industry (in virtually all open-pollinated

crops). According to seed companies it takes about twelve years and

great expenses to introduce a new cultivar to the market. Without a

proper funding model, the practice of holding back seed prevents

new cultivars and the latest technology from coming to South Africa.

1

Average producer price = Safex, July 2020 price - average differential cost - handling costs

1

Gemiddelde produsenteprys = Safex, Julie 2020-prys - gemiddelde differensiële koste - hanteringskoste

16

15,75

15,5

15,25

15

14,75

14,5

14,25

14

13,75

13,5

13,25

13

90

85

80

75

70

65

60

55

50

45

40

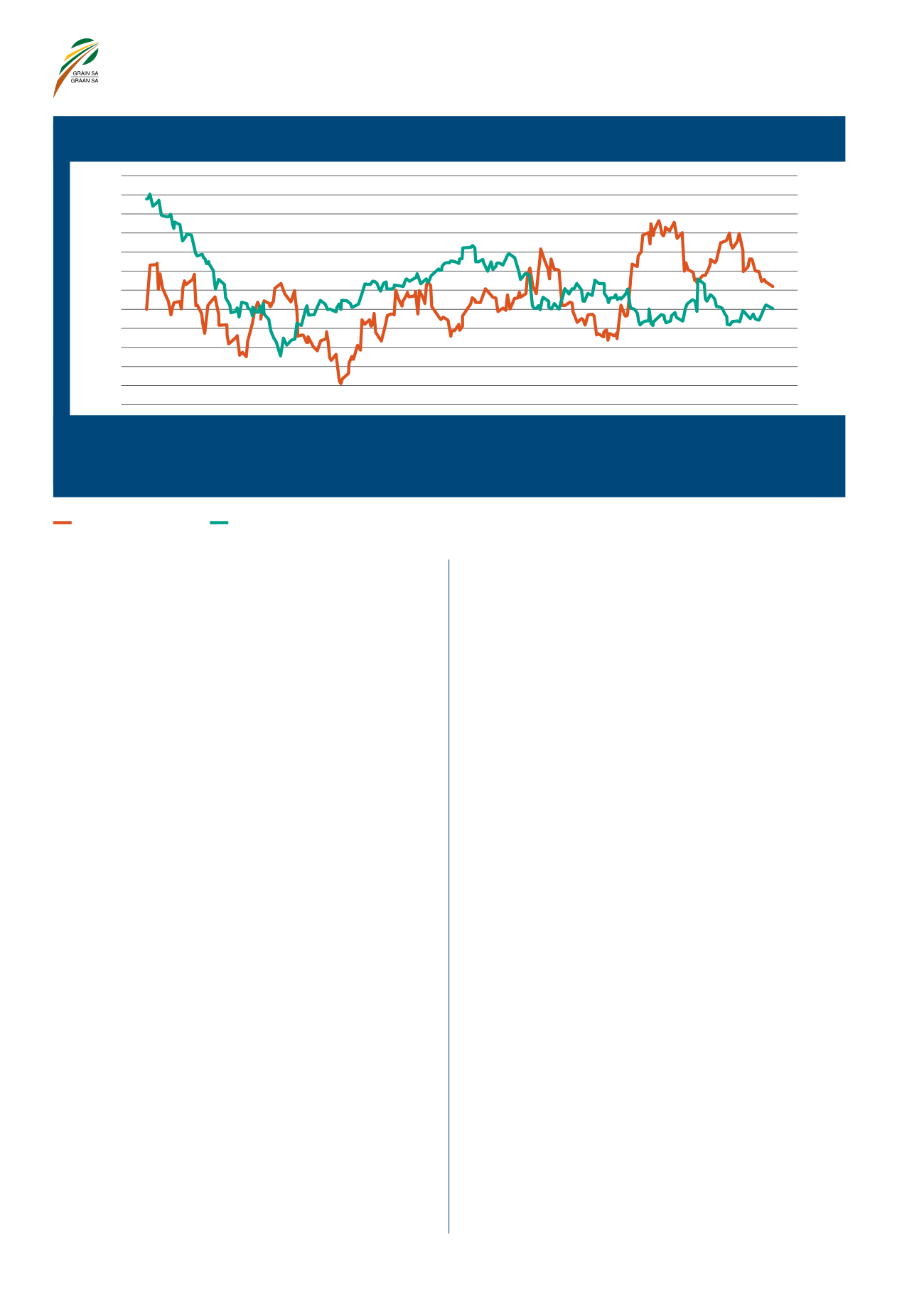

Brent crude oil price

Brent-ruolieprys

R/$ exchange rate

R/$-wisselkoers

GRAPH 1 – R/$ exchange rate and Brent crude oil price.

GRAFIEK 1 – R/$-wisselkoers en prys van Brent-ruolie.

01/10/2018

15/10/2018

29/10/2018

12/11/2018

26/11/2018

10/12/2018

24/12/2018

07/01/2019

21/01/2019

04/02/2019

18/02/2019

04/03/2019

18/03/2019

01/04/2019

15/04/2019

29/04/2019

13/05/2019

27/05/2019

10/06/2019

24/06/2019

08/07/2019

22/07/2019

05/08/2019

19/08/2019

02/09/2019

16/09/2019

30/09/2019

14/10/2019

28/10/2019

R/$ exchange rate

R/$-wisselkoers

Brent crude oil price

Brent-ruolieprys

Source: Grain SA

Bron: Graan SA

bekommernis vir graanprodusente, en sommige saadmaatskappye kan

begin om weerstand teen hoë pryse te ervaar.

SAADPRYSE

’n Totaal van 34 koringkultivars is beskikbaar vir die noordelike produ-

serende gebiede (besproeiing ingesluit), terwyl nege verskillende

kultivars vir die Wes-Kaap kommersieel beskikbaar is. Wes-Kaapse

produsente het ’n keuse van elf beskikbare garskultivars.

Koringsaadpryse het sedert verlede jaar op ’n gemiddelde basis met

6,5% gestyg. Sommige kultivars het tot 9,4% gestyg, terwyl ander weer

met soveel as 4% gedaal het. Wat interessant is, is dat koringsaadpryse

in die noordelike produksiegebiede gemiddeld R367 per 25 kg-sakkie

kos, terwyl saadpryse in die Kaap R409 per 50 kg-sakkie beloop.

Garssaadpryse het op ’n gemiddelde basis met 4,6% gestyg.

Kanolaprodusente het ’n keuse van 16 kultivars wat kommersieel

beskikbaar is. Pryse van kanolasaad het vir die 2019-seisoen bykans

onveranderd gebly.

Mieliesaadpryse vir die 2019/2020-produksieseisoen het gemiddeld met

4,5% gestyg. Sonneblomsaadpryse het gemiddeld met 4,3% gestyg en

graansorghumsaadpryse met 2,5%, terwyl sojaboonsaadpryse met 1,9%

gedaal het. ’n Goeie barometer vir die evaluering van prysverhogings is

die produsenteprysindeks (PPI). Tot en met Mei 2019, toe saadpryse ge-

publiseer is, het die PPI met 5% gestyg. Dit beteken dat saadpryse nie op

’n gemiddelde grondslag produksiekoste-inflasie oorskry het nie.

Mieliesaadpryse kan verder ontleed word deur dit met mieliepryse te ver-

gelyk. Sedert die 2001/2002-produksieseisoen het die mielieprysindeks

(

Grafiek 2

) vergeleke met die mieliesaadprysindeks beduidend verswak.

Met ’n geraamde gemiddelde produsenteprys

1

van R2 370 per ton vir die

komende seisoen (2019/2020), het die mielieprysindeks net effens meer

as mieliesaadpryse gestyg.

TELING- EN TEGNOLOGIEHEFFING

Volgens saadmaatskappye word ongeveer 80% van sojaboonaanplan-

tings en 70% van koringaanplantings jaarliks geplant met saad wat

teruggehou is. Hierdie terughouding van saad – wat wettig is – veroorsaak

’n bose siklus wat belegging in die sojaboon- en koringsaadbedryf (in

feitlik alle oop-bestuifde gewasse) beperk en in ’n groot mate voorkom.

Volgens saadmaatskappye neem dit ongeveer twaalf jaar en groot

onkoste om ’n nuwe kultivar op die mark te plaas. Sonder ’n behoorlike

befondsingsmodel verhinder die praktyk om saad terug te hou dat nuwe

kultivars en die jongste tegnologie na Suid-Afrika gebring word.