18

HEFFINGSAFDELING

Bedryfsheffing

Groot dank word uitgespreek aan lede van Graan SA wat die

afgelope jaar hul heffings getrou betaal het. Die heffinginkomste

bly steeds die belangrikste bron van inkomste vir Graan SA. Die

2017/2018-bemarkingsjaar het die eerste druk gevoel van die lae

kommoditeitspryse in die binneland sowel as die droogte in die Kaap.

Nietemin het produsente steeds getrou hul heffings betaal. Graan SA

bedank alle lede wat lojaal hul bydraes op al hul tonne maak. Lede kan

egter verseker wees dat uitgawes daadwerklik besnoei is, om sodoende

te kompenseer vir die kleiner inkomste van die bedryfsheffings.

Lidmaatskap van Graan SA

Graan SA se grondwet maak voorsiening vir kommersiële lede sowel

as studiegroeplede. In terme van die grondwet is lidmaatskap vir

kommersiële lede onderhewig aan die betaling van ’n bedryfsheffing per

ton op alle graan geproduseer, met ’n minimum bedrag van R1 000 plus

BTW betaalbaar vir volwaardige lidmaatskap. Studiegroeplede betaal

tans R50 per jaar.

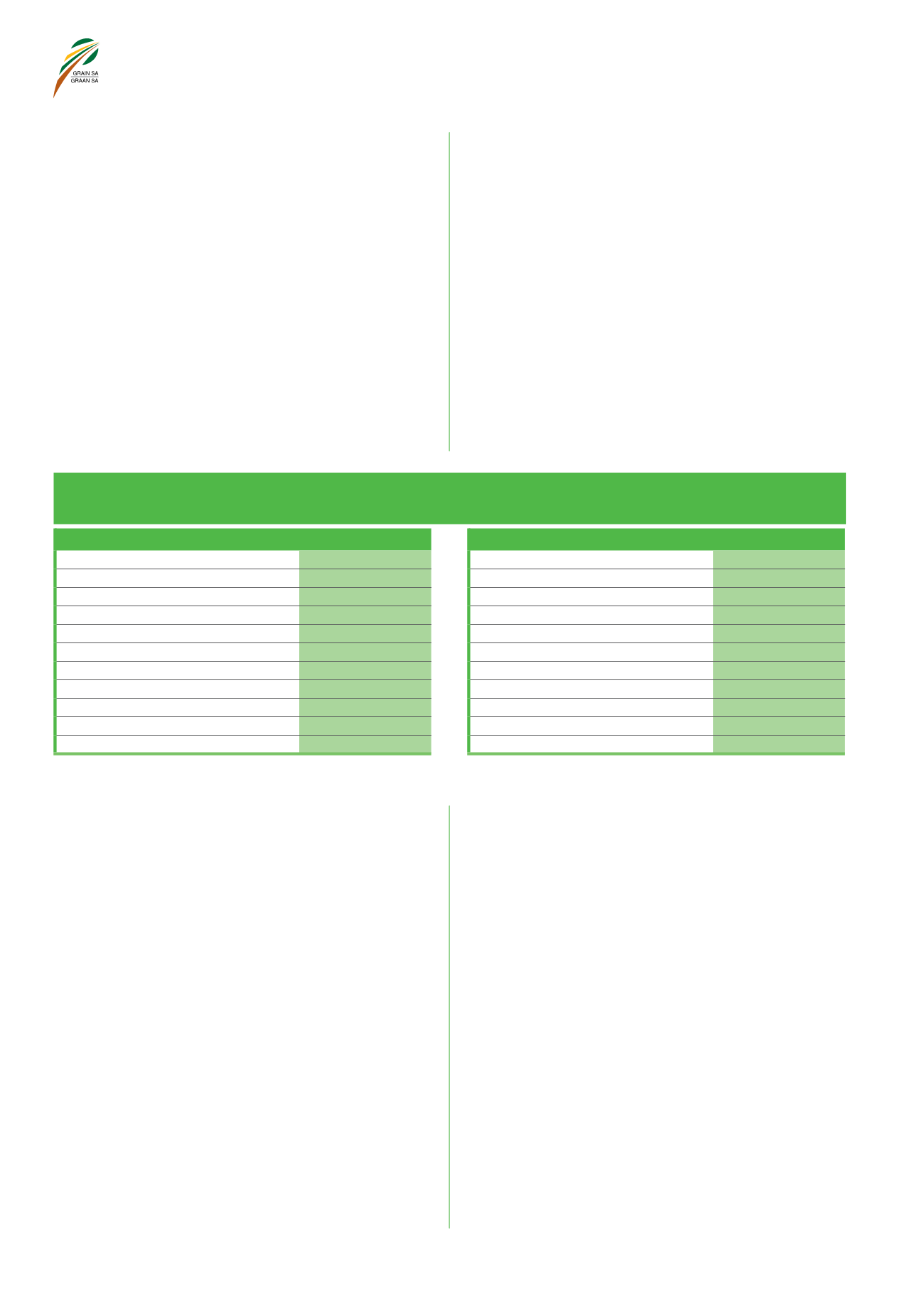

TABLE 2 – Grain SA levy per ton per type of crop for 2019/2020.

TABEL 2 – Graan SA-heffing per ton per gewas vir 2019/2020.

CROP

LEVY PER TON*

Summer grains

Maize

R3,00

Sorghum

R3,00

Soybeans

R6,00

Sunflower

R6,00

Groundnuts

R11,50

Winter grains

Wheat

R3,50

Canola

R4,70

Barley

R3,50

Other cereals

R3,50

GEWAS

HEFFING PER TON*

Somergrane

Mielies

R3,00

Sorghum

R3,00

Sojabone

R6,00

Sonneblom

R6,00

Grondbone

R11,50

Wintergrane

Koring

R3,50

Kanola

R4,70

Gars

R3,50

Ander grane

R3,50

* Bogenoemde bedrae sluit BTW uit

* The above amounts exclude VAT

LEVY DIVISION

Commodity levy

We would like to thank members of Grain SA who regularly paid their

levies over the past year. The levy income remains the most important

source of income to Grain SA. The 2017/2018 marketing year felt the

first pressures of the low commodity prices in the interior, as well as of

the drought in the Cape. Nevertheless, producers continued to pay their

levies faithfully. Grain SA would like to thank all members who loyally

make their contributions on all their tons. However, members can be

assured that expenses were actively reduced in order to compensate

for the smaller income from the commodity levies.

Membership of Grain SA

The constitution of Grain SA makes provision for commercial as well

as study group members. In terms of the constitution, membership

for commercial members is subject to the payment of a commodity

levy per ton on all grain produced, with a minimum amount of

R1 000 plus VAT payable for full membership. Study group members

currently pay R50 per year.

Nuwe era-boere wat graan produseer, kan ’n lid van Graan SA word

deur die neergelegde heffing te betaal – soos wat vir kommersiële

produsente geld.

Eksklusiewe voordele vir lede is ook geskep:

Momentum polispakket is hersien en aangepas volgens lede

se behoeftes.

Ford bied spesiale pryse op enige voertuig aan vir Graan SA-lede.

Belastingvrye spaarplan by Corporate Guarantee.

NAMPO kaartjies.

Invordering van heffing

Heffings word op die volgende wyses ingesamel:

DEUR INVORDERINGSAGENTE

Invorderingsagente is maatskappye waar graan gelewer word.

Graan SA sluit kontrakte met die organisasies waar hulle onderneem

om met toestemming van die produsente heffings te verhaal by die

eerste punt van lewering en dit binne ’n sekere tyd aan Graan SA oor

te betaal. Die logo’s van Graan SA se vennote verskyn in

Figuur 1

.

DIREKTE OORBETALINGS

Lede kan ook hul heffings direk aan Graan SA oorbetaal by wyse van tjek,

deposito of elektroniese oorbetaling. Die metode van betaling is veral

gepas waar produsente se graan bemark word aan partye wat nie deel

vorm van Graan SA se heffingstrukture nie.

New Era farmers who produce grain can also become members of

Grain SA by paying the same set levies as commercial members.

Exclusive benefits were also created for members:

The Momentum policy package was revised and adjusted to

members’ needs.

Ford offers Grain SA members special prices on any vehicle.

Tax-free savings plan with Corporate Guarantee.

NAMPO tickets.

Collection of levy

Levies are collected in the following ways:

BY COLLECTION AGENTS

Collection agents are companies to whom grain is delivered. Grain SA

concludes contracts with the organisations in which they undertake

to collect levies at the first point of delivery with the agreement of the

producers and to pay over these levies to Grain SA within a stipulated

period. The logos of the Grain SA partners appear in

Figure 1

.

DIRECT TRANSFERS

Members can also pay their levies directly to Grain SA by way of a

cheque, a bank deposit or an electronic transfer. This payment method

is particularly suitable where producers market their grain to parties who

do not form part of the Grain SA levy structures.