April 2018

74

White maize meal prices and

trends from shortage to deficit

T

he maize meal value chain experi-

enced many challenges through-

out the 2016/2017 marketing year.

South Africa found itself in a situa-

tion where the drought caused a shortage in

the South African white maize market. This

phenomenon resulted in drastic increases

in maize and maize meal prices. The rand

depreciated and therefore contributed to

higher maize prices.

CEO’s of milling companies reported that

the season was one of the most challeng-

ing in a long time. It was underpinned by

very high maize prices, an unpredicted for-

eign exchange market and weak consumer

demand.

The 2017/2018 season turned out be South

Africa’s biggest crop ever with maize prices

decreasing to export parity levels.

This article provides information on the

trends of maize and maize meal.

Price trends

The prices of the four main nodes in the

food chain are the average producer price,

the mill door price, the list price and the con-

sumer price. In this case, the average pro-

ducer prices and retail prices will be used

to estimate the farm value, farm-to-retail-

price-spread, retail value and farm value

share.

The calculations of these items are based

on the assumptions that:

The producer price (also known as

the farm gate price) is derived from

the Safex spot price minus the aver-

age transport differential and handling

costs.

The transport costs from the farm gate

to the silo are calculated as the average

Safex transport differential to all the ma-

jor maize silos.

The handling costs are based on re-

sponses from silo owners about the es-

timated average handling costs and the

daily storage tariff (per ton).

Specific mill site costs are only avail-

able on an annual base. Therefore, the

monthly mill site costs are kept constant

throughout the year.

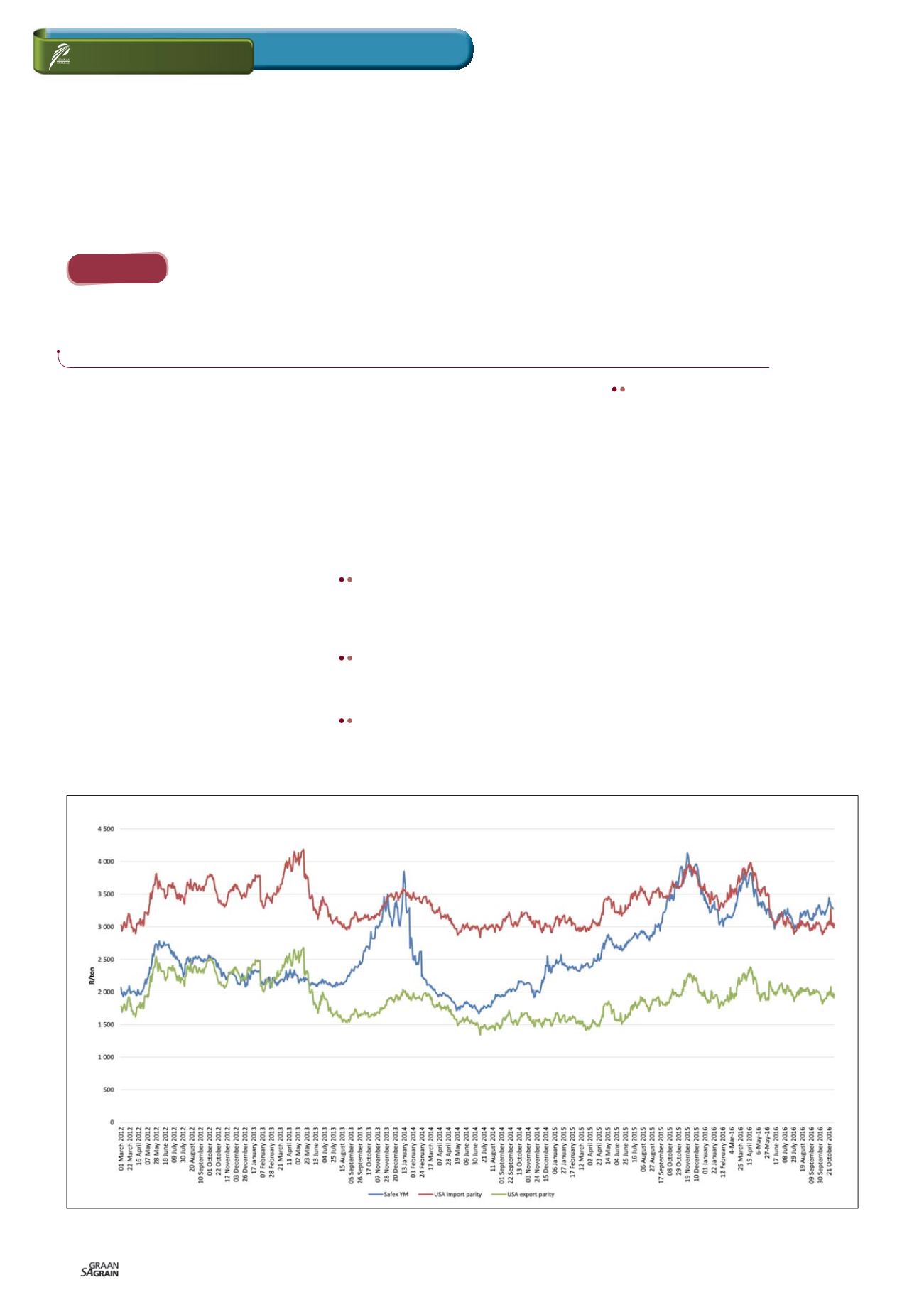

Graph 1

illustrates trends of white maize

prices in South Africa. The average spot

price for white maize started to increase in

December 2015.

The spot price peaked at the begin-

ning of January 2016 and rapidly in-

creased even further to above import

parity in March 2016. The average spot price

for white maize was at R3 988/ton in Decem-

ber 2016.

Graph 2

displays the retail value of maize

meal as calculated by the National Agri-

cultural Marketing Council (NAMC) and the

spot price of white maize. Graph 2 shows

the transmission time or lag between maize

and maize meal prices.

RELEVANT

DR CHRISTO JOUBERT,

manager: Agro-Food Chains, Market and Economic Research division, National Agricultural Marketing Council

and

RIKA VERWEY

, senior economist: Agro-Food Chains, National Agricultural Marketing Council

Graph 1: Import parity, export parity and South African Futures Exchange (Safex) for white maize.

Source: Grain SA (2017)

Part 2