57

July2014

the physical market throughout most of the year. The supposition

that can be made is that they do not need a formal Safex hedging

strategy. Their pricingmethods strive toobtain an average seasonal

price. The other half are more inclined to focus on certain time

periods, hoping to cherry-pick somebetter prices.

Producers hedgingdirectly onSafex

This sectiondealtwith the coreof the survey. Theproducerwas first

askedwhether he currently has or whether he has ever had a Safex

account.

37% of the producer respondents indicated that they had (or still

have) a Safex account. Their viewwas not quite supported by the

traders and agri-businesses if factored in over all of the Western

Cape. If the viewof the producers and those of the traders and agri-

businesses are combined, an estimated 10% - 20% of producers

across the grain producing areas of the Western Cape had Safex

accounts.

The survey then endeavoured to determine the trading activity of

the37%of respondents (that indicated that theyhadopenedaSafex

account). This was done by establishing if there was an increase,

decrease or no change in the active participation.

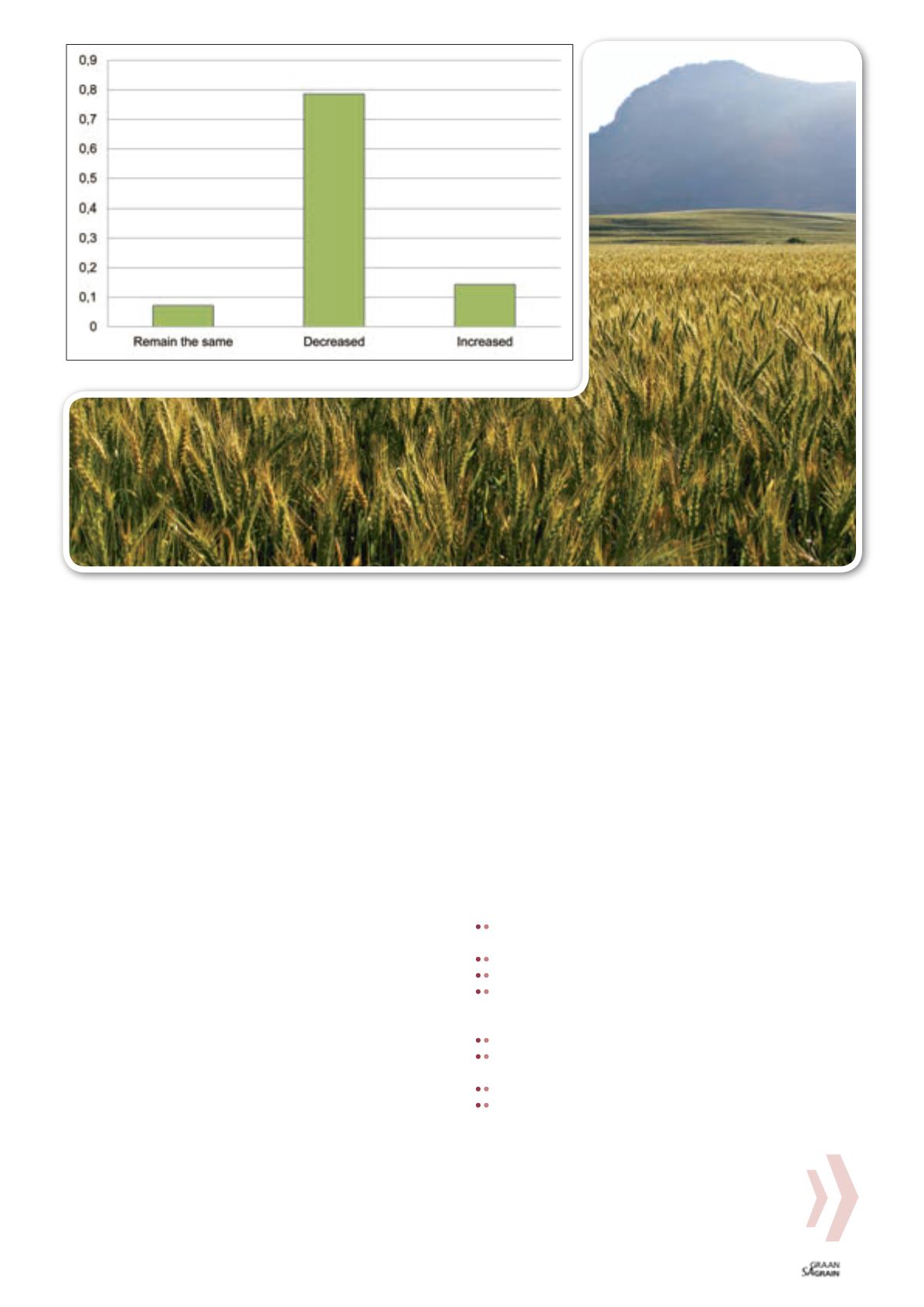

Graph 1

depicts

the response. 79% of once active Safex account holders said that

their activities decreased. Of these account holders, 91% stopped

trading altogether.

This was entirely supported by the traders and agri-businesses.

A trader active in the Southern Cape stated that “there are only

five producers on their books that hedge” and according to an

agri-business, the number was “less than 5% in total”. Another

institutional respondent estimated current producer participation in

theWesternCapeat 5%ofwhichalmost all arespeculative innature.

A trader and an agri-business active in the Swartland, estimate

participation (limited to a specific area) at “one producer” and “5%

of whichonlyoneproducer hedges”.

Cognisance should be taken of the fact that all traders and agri-

businesses stated that they themselves have activeSafex accounts.

Reasons for the decline indirect Safex

participationby producers

Having determined that producer participation has declined steeply

over time, the survey then strived to identify the reasons for this

trend. Respondents were asked to identify the reasons why their

participationdeclined.

They indicated cash flow requirements as the single biggest reason

why producers have reduced (and completely stopped) their

participationonSafex. The initial andvariationmarginswere the first

and thirdmost important reasons given, respectively.

The secondmost important reason that producers picked, was that

a producer could achieve the samebenefits andmore than couldbe

obtainedby tradingdirectlyonSafex, bymakinguseof the services

offered by the grain traders and agri-businesses. Although not

included in the survey questionnaire completed by producers, the

interviewswith tradersandagri-businesses identified theseservices

as follows:

Hedging on the trader’s account makes it unnecessary for the

producer toopenhis own account.

The traderwouldpay the initialmargin.

The traderwouldpay the variationmargin, if applicable.

The trader offered various types of contracts, including fixed

price, minimum price, minimum/maximum price and sell now/

price later.

Financingof grain.

Option strategies similar to those that could be achieved on

Safex.

Access tomarket reports that analyse events andprice trends.

The opportunity for one-on-one discussions/consultations with

the trader/agri-business todetermine a strategy.

Other aspects that were highlighted by producers as reasons to

rather work through traders or brokers, were the exposure to high

price volatility on Safex, which goes hand in hand with short term

cash requirements. Skills required to trade on Safex was rated

second last,whilebroker commissionsdonot seem tobean issueat

all, since it was rated last.

Graph 1: Change in trading activity.

SAGrain/

Sasol Nitrophoto competition