May 2024

|

JOHAN TEESSEN, AGRICULTURAL ECONOMIST INTERN, AND LERATO RAMAFOKO, APPLIED ECONOMICS INTERN, |

|

In the fourth and final article, the futures market and its distinctions from the forward market will be explored. Additionally, a practical example will be provided to illustrate the functioning of a futures contract.

EXPLAINING THE FUTURES MARKET

A commodity futures market is simply a public space (JSE-Safex) where commodities are contracted for buying or selling at an agreed-on price and on a specified date, regulated by a standardised contract. The contract is standardised for the quality, quantity, delivery date and place of delivery, with the only variable being the price decided on through an auction process between the buyer (farmer) and sellers (silo or miller) on a futures market.

The main reason futures markets were created, is so that farmers (who are hedgers) can use futures contracts to offset their positions in the cash market. This helps farmers to manage the risk of price changes, as they can transfer this risk from the cash market to the futures market.

Futures markets involve various participants, including:

Factors that differentiate between the forward and futures contracts:

Overall, while both futures markets and forward contracts serve similar purposes, they differ in terms of standardisation, liquidity, counterparty risk, flexibility, regulation and marking to the market, making each suitable for different types of market participants and trading strategies.

PRACTICAL EXAMPLE

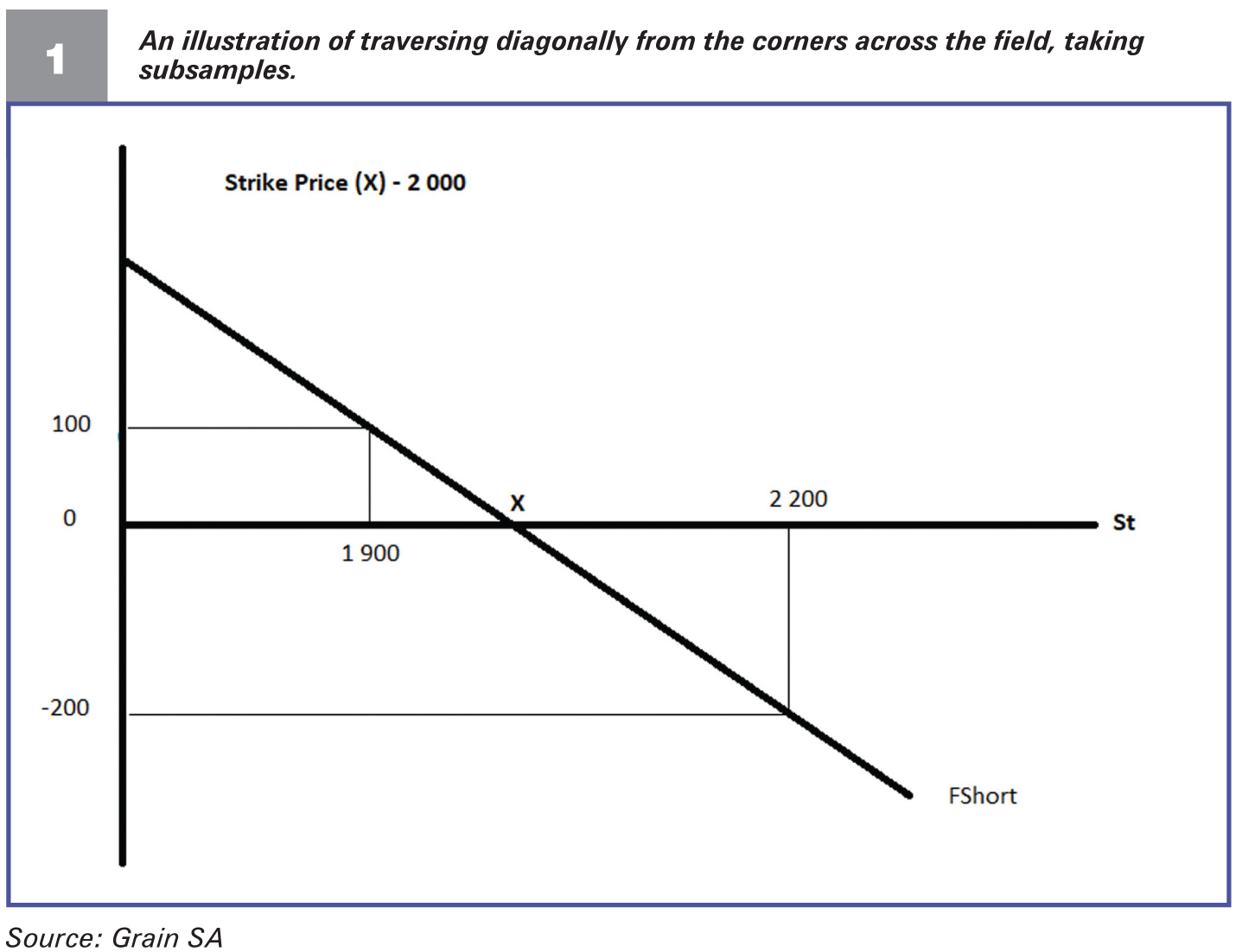

Figure 1 illustrates the payoff diagram of the transaction about to be explained.

Making a profit

Should the market price between the day he entered the July 2024 contract and the expiry date in July decrease and close at R1 900/t, farmer John would make a profit of R100/ton. This profit was realised because he sold his maize at R2 000/t, which is R100/t more than the prevailing market price of R1 900/t.

Making a loss

Should the market price between the day he entered the July 2024 contract and the expiry date in July increase and close at R2 200/t, farmer John would make a loss of R200/t. The loss was realised because he sold his maize for R2 000/t, which is R200/t less than the prevailing market price of R2 200/t.

CONCLUSION FOR THE SERIES

This series of articles was crafted with the intention of providing readers with comprehensive knowledge on various methods of selling maize. This information is crucial, as it equips farmers to make informed decisions regarding the sale of their maize. To summarise:

In article 1, Grain hedging can save costs, which was published in the January/February issue, the fundamentals of hedging were examined, elucidating its significance. A concise overview of the different grain-selling methods was provided.

Article 2, Navigating options: Choosing a put or call, which can be found in the March issue, the disparities between call and put options were navigated, along with guidance on when to employ each.

In article 3, Ensure optimum grain marketing, published in the April issue, the concept of the spot price was expounded, elucidating its significance and appearance.

Lastly, article 4 (this article) ventured into futures market exploration, offering insights into forthcoming trends.

By adhering to these guidelines, a farmer can tailor a marketing strategy designed not only to generate profits but also to ensure longevity on the farm.

Publication: May 2024

Section: Pula/Imvula