ISSN 1814-1676

EIENAAR/UITGEWER

GRAAN SA

POSBUS 74087, LYNNWOOD RIDGE, 0040

Tel: 086 004 7246

www.grainsa.co.zaSUBSKRIPSIE EN VERSPREIDING

(ADRESVERANDERINGE):

Marina Kleynhans

SA GRAAN/GRAIN,

POSBUS 88, BOTHAVILLE, 9660

Tel: 086 004 7246

E-pos:

marina@grainsa.co.zaREDAKSIE

Dr Dirk Strydom

BESTUURDER: GRAANEKONOMIE EN BEMARKING

Tel: 086 004 7246 • Sel: 082 852 4810

E-pos:

dirks@grainsa.co.zaBESTURENDE REDAKTEUR:

Johan Smit

Tel: 018 468 2716 • Sel: 082 553 7806

E-pos:

johan@infoworks.bizREDAKTEUR:

Estie de Villiers

Tel: 081 236 0534 • Sel: 083 490 9449

E-pos:

estie@infoworks.bizREDAKSIONELE ASSISTENT:

Elmien Bosch

Tel: 018 468 2716 • E-pos:

elmien@infoworks.bizGRAFIESE ONTWERP:

Nadine Stork

Infoworks Media Publishing

Tel: 018 468 2716 • E-pos

:

nadine@infoworks.bizDRUKWERK:

Typo Print

Tel: 011 402 3468/9

MASSAVERSPREIDING:

Prosource

Tel: 011 791 0410

SPOTPRENTTEKENAAR:

Frans Esterhuyse

ADVERTENSIEVERKOPE

KOLBE MEDIA – Kaapstad

Jurgen van Onselen – Advertensiekoördineerder

Tel/faks: 021 976 4482 • Sel: 082 417 3874

E-pos:

jurgen@kolbemedia.co.zaINFOWORKS MEDIA PUBLISHING – Johannesburg

Ruth Schultz – Advertensiekonsultant

Tel: 081 480 6413 • Sel: 072 855 2450

E-pos:

ruth@infoworks.bizGRAAN SA HOOFKANTOOR

Blok C, Alenti Office Park

Witheritestraat 457

Die Wilgers

Pretoria

0041

Tel: 086 004 7246

Faks: 012 807 3166

Besoek Graan SA by

www.grainsa.co.zaof skandeer dié

QR-kode:

• Die menings van die skrywers van artikels in hierdie blad

is hul eie en verteenwoordig nie noodwendig die mening

van Graan SA nie.

•

The opinions expressed by contributors are their own.

They do not necessarily express the opinion of Grain SA.

• “Promosie-artikels” is betaalde artikels; terwyl “produk-

inligting”-artikels feite kan bevat oor kommersiële produkte.

•

´Advertorials´ are paid articles; while ´product informa-

tion´ articles may contain facts on commercial products.

ALLE regte van reproduksie van alle berigte, foto’s, teke-

ninge, advertensies en alle ander materiaal wat in hierdie

tydskrif gepubliseer word, word hiermee uitdruklik voorbe-

hou ingevolge die bepalings van Artikel 12(7) van die Wet

op Outeursreg Nr. 98 van 1978 en enige wysigings daarvan.

62

Grondgedraagde swamsiektes – die wortel van

alle kwaad

AKTUEEL

/

RELEVANT

65

Sewe-stap miljoenêrsplan vir dames

66 Political analysis:

South African politics in a holding pattern

68

Global research network ensures better hybrids

69

No place for weakest links

71 Graan SA/Sasol fotokompetisie:

Reik (jou kamera) na die sterre

72

It’s all about changing lives

73

Topbul haal hoogste prys op veiling

75

Suksesse in grondhervorming op databank vasgelê – Agri SA

76

Opbrengskompetisie se gewildheid neem toe

RUBRIEKE

/

FEATURES

4

Graan SA Standpunt:

Wat staan ons te doen?

5

Grain SA Point of View:

What are we to do?

7

Uit die Woord

7

Op die kantlyn

79 Wiele vir die plaas:

Nuwe Renault Duster EDC is nou outomaties

80 E-posse:

Die bok

Die Graanprodusent van die Jaar-toekenning

(waarvan Syngenta die hoofborg is) is in

Oktober vanjaar oorhandig.

Foto: Helenus Kruger

3

Voorblad

/

Cover

017

South African politics

in a holding pattern

H

istory will probably look back at

2017 and refer to it as the year in

which South Africa was caught

in a perfect political and economic

storm. Apart from the two stepchildren of

government policy, i.e. agriculture andmin-

ing, very few sectors recorded economic

growth.

Due to record crops in maize, soybeans

and sunflower, aswell as amodestupswing

in the global commodity cycle, it is safe

to say that these two sectors prevented

the country from more than a technical

recession.

Politically the fragmentation of the ruling

ANC into at least two factions causedpoliti-

cal paralysis in decision-making and confu-

sion in policy development. South Africa

became a victim of the worst of political

infighting, suffering very detrimental politi-

cal decisions, such as the cabinet reshuffle

in which Minister Pravin Gordhan lost his

job as Minister of Finance, with his brave

battle against state capture and corruption

recorded ashisonly sin.

The perfect storm was a storm of low

economic growth coupled with policy un-

certainty linked to a volatile currency and

factionalism in thegoverningparty.

This new normal is often referred to as

a VUCA world. The VUCA concept fits

South Africa like a glove at the moment.

The first letter of this abbreviation stands

for

volatility

and our currency, the rand, is

a very good examplewith its almost unpre-

dictable swings. The second letter stands

for

uncertainty

and the ANC’s leadership

contestation and subsequent policy paraly-

sis fitnicely into this slot.

In VUCA the third letter represents

com-

plexity

and managing a country with an

unemployment rate of 27,7% and youth

unemployment reaching 50%

illustrates

the complexity of policy formation and the

subsequent financing thereof. Land reform

also fits thisbill.

The last letter in the VUCA word is

ambi-

guity

. Ambiguity is the degree to which

information, situations and events can be

interpreted in multiple ways. Ambiguity

increases doubt, slows decision-making,

and results in missed opportunities (and

threats).

In analysing

the political economy of

South Africa towards the end of 2017, it is

useful to lookatdevelopmentsasavirtuous

cycle and a vicious cycle, because not eve-

rything is allbadoronlygood.

The virtuous cycle represents all those ac-

tions and decisions that bring South Afri-

canscloser toeachother in formingaSouth

African political culture. In this ‘good cycle’

that searches for themiddle; there are also

negative issues atwork, but they are domi-

natedby thepositives.

In the vicious cycle, however, the negatives

likecrime,corruptionandmaladministration

dominate thegood intentionsof the change

efforts. These two cycles engage very dy-

namically and findexpression in the reports

of theAuditorGeneral,ThePublicProtector,

several court cases andpolicydecisions.

November 2017

RELEVANT

THEOVENTER,

political and policy specialist,

NWUSchool ofBusiness andGovernance,North-WestUniversity

POLITICAL

analysis

September 2017 on the competitive nature

of 137 countries in 2017/2018, needs a

closer look. As part of the perfect storm

mentioned earlier, SouthAfrica dropped 14

places among137 countries from47thmost

competitiveeconomy to the61stmost com-

petitivenation.

These 14 places that we have lost is the

most significant drop since the start of

this annual survey in 2004. What caused

thisdrop so suddenly in 2017?

Looking at the different pillarmeasures, it

becomes clear that we have lost our com-

petitiveness because of financial institu-

tions and the integrity of our corporate

governance. Itused tobe among thebest in

the world, but dropped from 11/138 to

44/137 in 2017/2018.

Another reason for the drop in competi-

tiveness was that of institutions of state.

Previously we scored 40/138 and now it

dropped to 67/137. Both numbers show a

global decline in confidence in financial ar-

rangement and governance (KPMG and the

i

)

llas

due to issues such as institutionalised cor-

ruption and state capture allegations.

In addition, the WEF Global Competitive

Report publishes a list of issuesmaking it

difficult to do business in a country. For

years the normal culprits in South Africa

were things such as restrictive labour rela-

tions, inefficient government bureaucracy,

inadequate infrastructure, policy instability

and inadequately educatedworkforce, top-

ping the list.

The 2017/2018

list brings new

issues

to the fore and the top five now are:

Corruption, crime and theft, government

instability/coups, tax rates and insufficient

governmentbureaucracy.

It is in the context illustrated above that

the ANC is preparing for a leadership elec-

tion inDecember 2017. The intensity of the

leadership contest, aswell as theuncertain-

ty about President Jacob Zuma’s exit strat-

egy, causeshugepoliticaluncertainty.

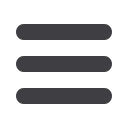

Figure 1

is an outline of the two roles

oftheANCinpolitics.Firstly, it is a politi-

governandsecondly itconstitutesagovern-

ment (Blue).

From this figure it is clear that theANC has

not succeeded in closing the gap between

electing its leadership for the political party

(December 2017) and forming a govern-

ment after an election (May 2019).

This lack of synchronisation between party

leadership and governing leadership (presi-

dent and cabinet) has created the notion of

‘two centresofpower’within theANC. It re-

fers toone leadership team inLuthuliHouse

and a different team sitting in the Union

Buildings. This scenario caused the ‘recall’

ofPresidentThaboMbeki in 2008, a scenar-

io thatmayplay itselfout again in 2018with

regards toPresidentZuma.

At its 54th National Conference, arranged

for 16 to 21 December 2017, the ANC will

have to do three important things. Firstly, it

will have to amend its constitution, then it

will have to amend and approve its policy

framework and lastly elect the leadership

for thenext five years.

President Zuma indicated that he is not re-

electable as president of the ANC and his

second term as State President will also

come toanend inMay2019.

Figure2

shows

the different possible candidates for the

ANC election inDecember 2017.

Uncertainty about who will succeed Presi-

dent Zuma has added to the perfect poli-

tical and economic storm in South Africa

– especially due to the corruption charges

and state capture allegations linked to the

Zumapresidency.

At this stage two candidates are looking

like frontrunners, i.e. the Deputy President,

Mr Cyril Ramaphosa, and the ex-wife of

President Zuma, Dr Nkosazana Dlamini-

Zuma.

ANC traditionwould favour the sitting dep-

uty president to take over from President

Zuma in December 2017, but the deep run-

ning factions in theANCmakes this predic-

tion extremely difficult. This uncertainty

adds to the view that SouthAfrican politics

is currently in a holding pattern due to un-

certainty and this situationwill continue at

leastuntil lateDecember2017andmayonly

2018

Figure 2:Differentpossible candidates for theANC election inDecember 2017.

0

POLITICAL ANALYSIS

66