97

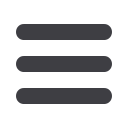

ITEM

WAARDEVER-

MINDERINGS-

METODE

GEMIDDELDE

WAARDEVER-

MINDERINGS-

KOERS

Grond en geboue

Reguitlyn

0% - 10%

Aanleg en masjinerie

Reguitlyn

20%

Meubels en toebehore

Reguitlyn

20%

Motorvoertuie

Reguitlyn

20%

Kantoortoerusting

Reguitlyn

20%

Rekenaartoerusting

Reguitlyn

20%

Spysenierings- en ander toerusting

Reguitlyn

20%

Rekenaarsagteware

Reguitlyn

33%

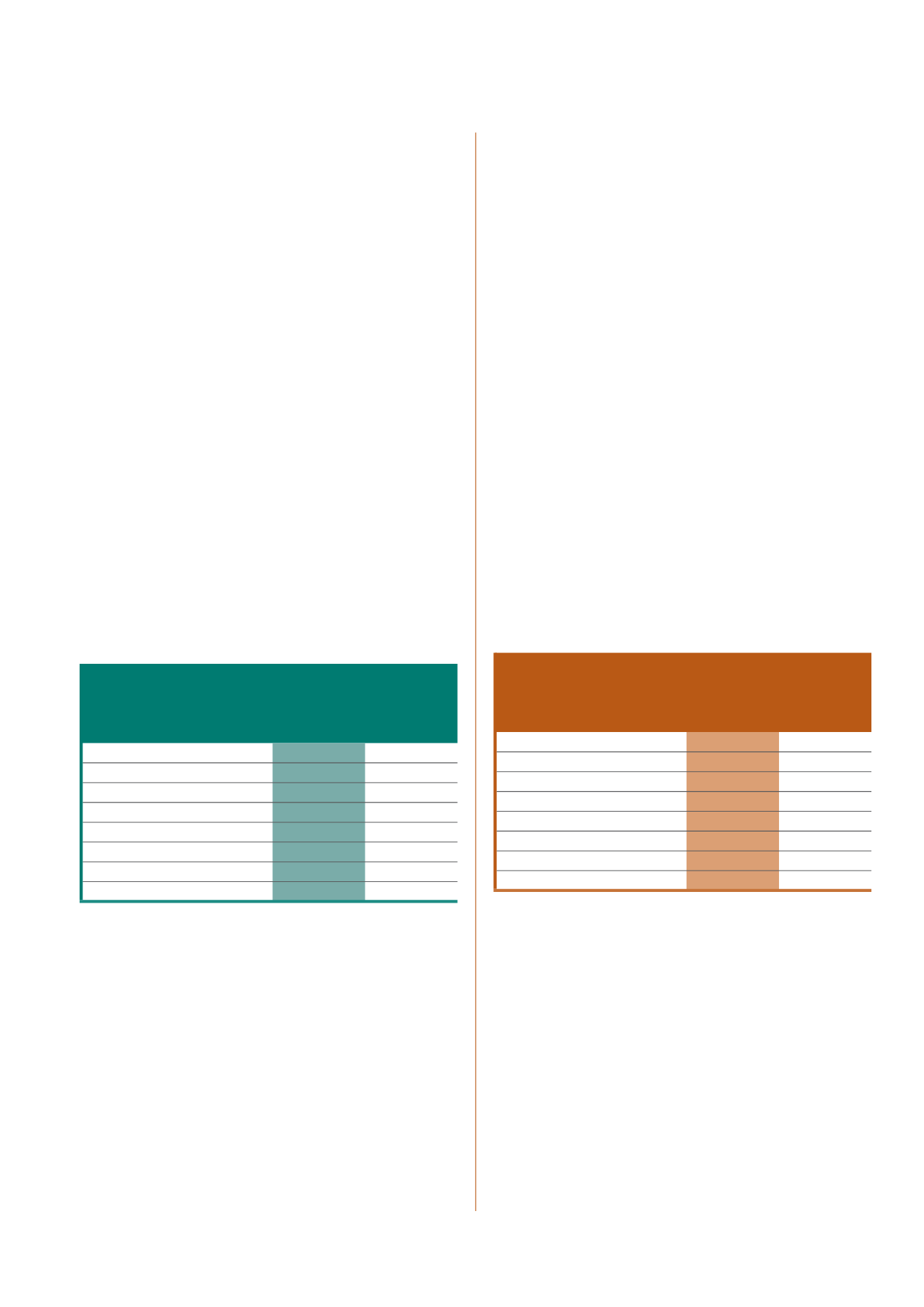

ITEM

DEPRECIATION

METHOD

AVERAGE

USEFUL LIFE

Land and buildings

Straight line

0% - 10%

Plant and machinery

Straight line

20%

Furniture and fixtures

Straight line

20%

Motor vehicles

Straight line

20%

Office equipment

Straight line

20%

Computer equipment

Straight line

20%

Catering and other equipment

Straight line

20%

Computer software

Straight line

33%

Eiendom, aanleg en toerusting word aanvanklik teen kosprys gemeet.

Die kosprys sluit koste in wat aanvanklik aangegaan is om ’n item van

eiendom, aanleg en toerusting te verkry of te bou en koste wat daarna

aangegaan is om daarby toe te voeg, ’n deel daarvan te vervang, of dit

te diens. Indien ’n vervangingskoste erken word in die drabedrag van

’n item van eiendom, aanleg en toerusting word die drabedrag van die

vervangde gedeelte omgeswaai.

Die aanvanklike raming van die koste van afbreek en verwydering van ’n

bate en die herstel van die terrein waarop dit geleë is, word ook by die

kosprys van eiendom, aanleg en toerusting, ingesluit wanneer sodanige

afbreek, verwydering en herstel verpligtend is.

Uitgawes wat daarna aangegaan is vir groot dienste, toevoegings

tot of vervangings van dele van eiendom, aanleg en toerusting word

gekapitaliseer indien dit waarskynlik is dat toekomstige ekonomiese

voordele wat verband hou met die uitgawe na die organisasie sal vloei

en die koste betroubaar gemeet kan word. Dag tot dag dienskoste word

in die tydperk waarin dit aangegaan is by wins of verlies ingesluit.

Eiendom, aanleg en toerusting word gevolglik openbaar gemaak teen

kosprys minus opgehoopte waardevermindering en enige opgehoopte

waardedalingsverliese, behalwe vir grond wat teen kosprys minus enige

opgehoopte waardedalingsverliese openbaar gemaak word.

Waardevermindering van ’n bate begin wanneer die bate beskikbaar is vir

gebruik soos deur bestuur beoog. Waardevermindering word gehef om

die drabedrag van die bate oor sy geskatte nuttige lewensduur af te skryf

na sy geskatte reswaarde, deur gebruik te maak van ’n metode wat die

patroon waarin die bate se ekonomiese voordele wat deur die organisasie

opgeneem word, die beste reflekteer.

Die nuttige lewensduur van items van eiendom, aanleg en toerusting is

soos volg geëvalueer:

Wanneer aanwysers teenwoordig is dat die nuttige lewensduur en

reswaardes van items van eiendom, aanleg en toerusting sedert die

mees onlangse jaarlikse verslagdoeningsdatum verander het, word dit

herevalueer. Enige veranderings word vooruitwerkend as ’n verandering

in rekeningkundige raming verantwoord.

Waardedalingstoetse word uitgevoer op eiendom, aanleg en toerusting

wanneer daar ’n aanduiding is dat waardedaling moontlik plaasgevind

het. Wanneer die drabedrag van ’n item van eiendom, aanleg en

toerusting se evaluasie hoër is as die beraamde verhaalbare bedrag,

word ’n waardedalingsverlies onmiddellik in wins of verlies erken om die

drabedrag in lyn te bring met die verhaalbare bedrag.

’n Item van eiendom, aanleg en toerusting word omgeswaai wanneer

dit verkoop word, of wanneer geen toekomstige ekonomiese voordele

vanuit sy voortgesette gebruik of verkoop verwag word nie. Enige wins

of verlies wat voortspruit uit die omswaai van ’n item van eiendom,

aanleg en toerusting, wat bepaal word as die verskil tussen die netto

opbrengs uit verkope, indien enige, en die drabedrag van die item, word

by wins of verlies ingesluit wanneer die item omgeswaai word.

An item of property, plant and equipment is recognised as an asset when

it is probable that future economic benefits associated with the item will

flow to the organisation, and the cost of the item can be measured reliably.

Property, plant and equipment is initially measured at cost.

Cost includes costs incurred initially to acquire or construct an item of

property, plant and equipment and costs incurred subsequently to add

to, replace part of, or service it. If a replacement cost is recognised in the

carrying amount of an item of property, plant and equipment, the carrying

amount of the replaced part is derecognised.

The initial estimate of the costs of dismantling and removing an asset

and restoring the site on which it is located is also included in the cost

of property, plant and equipment, when such dismantling, removal and

restoration is obligatory.

Expenditure incurred subsequently for major services, additions to or re-

placements of parts of property, plant and equipment are capitalised if it

is probable that future economic benefits associated with the expenditure

will flow to the organisation and the cost can be measured reliably. Day

to day servicing costs are included in profit or loss in the period in which

they are incurred.

Property, plant and equipment is subsequently stated at cost less accumu-

lated depreciation and any accumulated impairment losses, except for land

which is stated at cost less any accumulated impairment losses.

Depreciation of an asset commences when the asset is available for use

as intended by management. Depreciation is charged to write off the as-

set's carrying amount over its estimated useful life to its estimated residual

value, using a method that best reflects the pattern in which the asset's

economic benefits are consumed by the organisation.

The useful lives of items of property, plant and equipment have been as-

sessed as follows:

When indicators are present that the useful lives and residual values of

items of property, plant and equipment have changed since the most

recent annual reporting date, they are reassessed. Any changes are

accounted for prospectively as a change in accounting estimate.

Impairment tests are performed on property, plant and equipment when

there is an indicator that they may be impaired. When the carrying

amount of an item of property, plant and equipment is assessed to be

higher than the estimated recoverable amount, an impairment loss is

recognised immediately in profit or loss to bring the carrying amount in

line with the recoverable amount.

An item of property, plant and equipment is derecognised upon

disposal or when no future economic benefits are expected

from its continued use or disposal. Any gain or loss arising from

the derecognition of an item of property, plant and equipment,

determined as the difference between the net disposal proceeds, if

any, and the carrying amount of the item, is included in profit or loss

when the item is derecognised.