The record 2017/18 marketing season is something of the past and the focus is once again on the season ahead. Initially, before the optimal plant window for summer crops commenced in most parts of the country, widespread rain occurred and it seemed as if it would again be a top season. However, the season took a different turn and the rain remained elusive for long periods which delayed the planting process. The plantings in particular the western parts of the country, were struggling to get under way because of the shortage of the necessary soil moisture for optimal planting. There are currently many uncertainties in the market regarding how many of the different crops are actually planted, with more certainty only expected once the National Crop Estimate Committee announces the preliminary plantings of summer grains on 30 January.

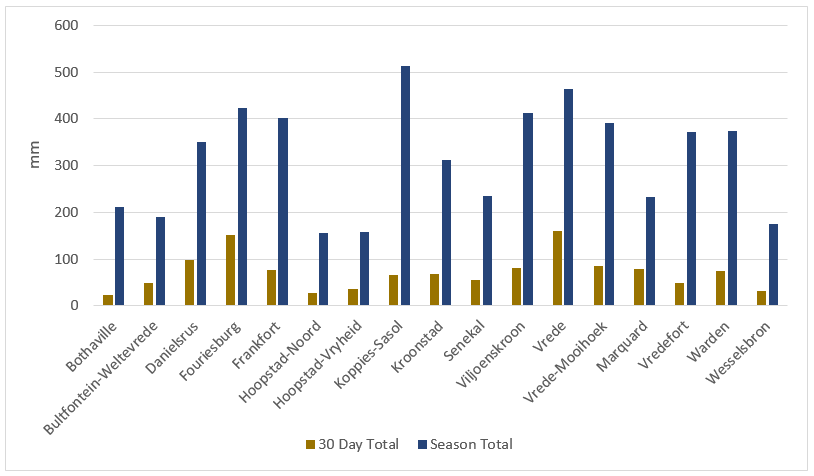

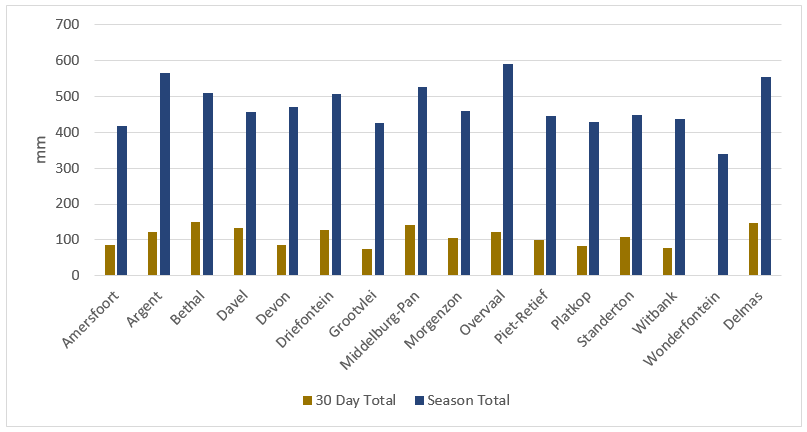

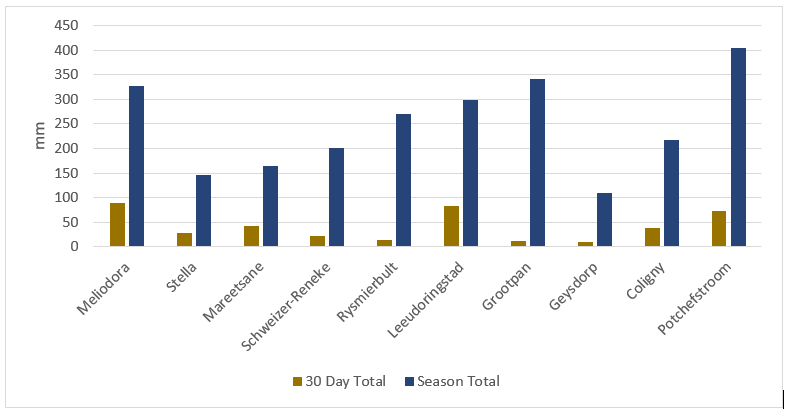

Further uncertainty about the number of hectares planted exist, because of areas that have received enough rain, but with others that have not managed to plant at all. Below graphs indicate the rainfall for some localities in the country since July 2017. It is of course important to take into account the timeliness of the rainfall.

Source: BVG

Source: BVG

Source: BVG

It is clear that the western parts of the country received the least rainfall in the last 30 days. There are also other areas that have received rain and it creates uncertainties about what the current status of the harvest.

One of the current biggest questions in the market is regarding the impact of less plantings as well as various yield possibilities, on the approaching season, since the possibility of large transfer stocks at the end of the 2017/18 marketing season. The attached sensitivity analysis indicates the possible exportable surpluses available for the 2018/19 season given different area planted and yield scenarios. The area planted is deviations from the CEC's intention to plant while the different yield scenarios are deviations from the 5-year yield average. The consumption in the coming season equals the average consumption over the past 3 years, while the pipeline stock equals 1.5 months (6 weeks) consumption.

The exportable surpluses shown in the sensitivity analysis are green when less than 1.5 million tons for the season and red when more than 1.5 million tons. Possible no exportable surpluses are indicated in bright red with white lettering. It is clear that given the season’s transfer stock, plantings should be significantly less than the intention and the average yield across the country should be significantly lower than the average.

Download a copy of the sensitivity analysis here

Entering into 2018 will require some slight adjustments due to changes that took place along the way, both politically, economically and in the agricultural environment.

South Africans entered the New Year with a hope that the displeasing service of President Jacob Zuma as the head of state would soon come to an end after Cyril Ramaphosa was elected as the new president of the ANC in December 2017. There was generally positive sentiment following his victory and this was seen in the strengthening of the rand, which appreciated by 2.75% from R13.10 to R12.75 to the dollar. However, Cyril Ramaphosa’s victory has not entirely erased some uncertainties that long existed. From an agricultural point of view, Ramaphosa’s comments over the ANC’S decision to seek land expropriation without compensation has raised concern within the industry. Land reform is a complex issue which could explain the reason why it has been dealt with at snail’s pace, however it is critical for the ANC to implement policies that will drive economic growth, create food security and promote growth in food production. The agricultural sector is a driving force in the South African economy and was a major contributor to GDP in 3 quarters of 2017, contributing 0.9% in the 3rd quarter of 2017. It is therefore critical that the new resolutions under the new leadership of the ANC takes into consideration the going concern of the industry by structuring policies that will attract investment and grow the industry.

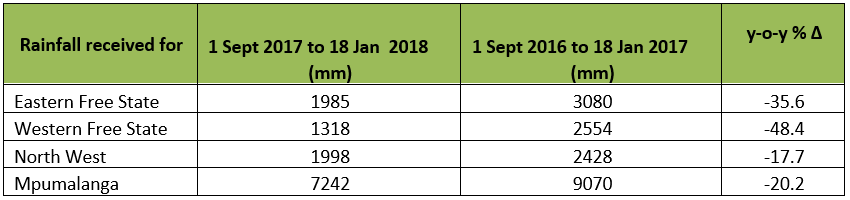

While the industry anticipated good rains during the 2017/18 production season, it was only met by dryness that continued into the New Year. As at 15 January 2018, in a questionnaire conducted by Grain SA, it was indicated that few additional grain hectares were planted due to high temperatures and drought conditions. As a result, farmers across the major maize production areas could not plant their intended hectares. According to the RMD daily rain report, it’s evident that 2017/18 production season received very low amounts of rainfall compared to the same period a year ago. The Western Free State has so far shown significantly low levels of rainfall; from the 1st of September 2017 to date, the region has only received 1 318 mm of rain, which is a 48% decline from the corresponding period, a year ago. The North West Province also recorded a decline in the amount of rain received, representing a 17% year-on-year decline, from 2 428 mm in the 2016/17 production season to 1 998 mm in the 2017/18 production season. It is however too early to tell the effect of the drought on the summer crops that were planted, once again leaving a door of uncertainty for the new season that lies ahead.

Source: RMD

On the economic landscape, the local currency has strengthened, reacting to political changes seen in December 2017. The strengthening of the rand was a welcome stimulus, which helped keep local fuel prices from increasing. In recent months, particularly January, the country recorded a decrease in fuel prices for the first time in 4 months; meanwhile another decrease in fuel prices is expected for February 2018. If the rand keeps on trading in support levels, the country could see more fuel price decreases. On Thursday, the South African Reserve Bank held its first Monetary Policy Committee for the year, in this meeting, the repo rate and interest rate were kept unchanged at 6.75% and 10.25%, respectively. The SARB revised its forecast for the GDP growth for 2017, from 0.7% to 0.9%. Forecast for the year ahead has been adjusted to 1.4%. Due to favourable forecasts, particularly the stronger rand and lower electricity price assumption, it is expected that inflation for the year could reach a low midpoint of the target range of 3-6%.

Over the past two months (December and January) there have clearly been some shifts in the political, economic and agricultural environment that will require some adjusting. It is however too early to tell how the year will turn out, we are all at the mercy of uncertainty.

The regional meetings kicked off this week and was well attended by our members. The remainder of the meeting dates are as follows:

This ever-popular annual highlight on the conservation agriculture calendar, which takes place from 13-14 March 2018 at the Ottosdal Showground, will this year focus on Diversity's key role in the regeneration, resilience and profitability of conservation agriculture.

For further details download the entry form and program here

Landbouweekblad, VKB and Dekalb SA - together with the Riemland Study Group and Grain SA - brings together world-renowned speakers, experts and the best farmers who’ve paid the school fees, for the first South African conference focused on revival agriculture.

The conference will be held on the VKB-showgrounds in Reitz on 19 and 20 March 2018. Contact Dalene Ricketts (dricketts@landbou.com) for bookings or click here to download the programme.

The 2018 global sorghum conference themed, “Sorghum in the 21st Century: Food, Feed and Fuel in a Rapidly Changing World,” will be hosted in Cape Town from 9-12 April 2018.

The conference, the first of its kind in over 30 years, will bring together hundreds of participants from around the world, including researchers, grain industry representatives, business entrepreneurs, governmental organizations, development practitioners and more. Sorghum’s versatility as a staple nutritious food crop, specialty gluten-free ingredient, livestock feedstuff and biofuel source makes it a key commodity that is poised to help address looming global concerns, including food security, climate change, clean energy and environmental sustainability.

The International Sorghum Conference is hosted by the Feed the Future Innovation Lab for Collaborative Research on Sorghum and Millet of Kansas State University, USA and co-hosted by the University of Pretoria, South Africa

For further information, visit the International Sorghum Conference website https://21centurysorghum.com