Luan van der Walt, Economist, Grain SA

In a year such as this, with good productions, and prices under pressure, producers should look at various alternatives that can be used for risk management and marketing purposes. However, there are some important aspects to keep in mind when marketing decisions are considered - of which risk and pricing possibilities are certainly the most important.

Some of the producers’ first questions that comes to mind, are what should I do? Questions like, "Do I sell now and get it over with, do I store to sell later should prices increase or do I sell now and make use of derivative instruments on SAFEX to benefit from a rising market" is all in the order of the day.

The various risks associated with using different strategies are one of the most important factors to consider when making these decisions. This risk mainly involves price and cash flow risk. There are also various costs associated with the use of the different strategies to be considered and these strategies as well as costs will be discussed below. The costs of the strategies will also be updated as the season progresses. The costs are calculated on a per/ton basis and also shown by a hypothetical example of 1 000 ton of maize that has to be marketed to put it in perspective. The direct production cost of the maize amounts to R1 800/ton.

Strategies

The different strategies that can be considered include:

1. Sell only in the spot market - serve as a guideline strategy

2. Store maize up to December and/or March

3. Sell in spot market and buy Call options on SAFEX

Prices

Table 1: Income and cost when using strategy 1

|

If the producer does not apply any alternative marketing strategies, he will only sell the maize as it is harvested and therefore his received price will be that price at which the market is trading on the day of sale, and no further marketing strategy costs will be incurred. It is important to note that these calculations reflect only the SAFEX price and do not include area differential and/or other marketing fees/brokerage fees.

Table 2: Income and cost when using strategy 2

|

*Interest on income if the maize was to be sold

**Interest on production costs not covered.

Table 2 clearly indicate that storage costs amount to approximately R150/ton until December and between R260/ton and R270/ton to March 2017. However, this mean that prices should increase by more than these levels up to the date of sale, to justify the maize's storage costs for this period for the producer. The minimum SAFEX price when the strategy ends reflects the minimum price at which the producers has to sell his maize to justify the use of the specific strategy. If the SAFEX price is higher than this minimum prices the producer will cover his cost and make a profit.

Table 3: Income and cost when using strategy 3

|

*Premium obtained from SAFEX

**Interest on income (6.5% p.a) if profit/loss is greather that the option costs, otherwise interest on overdraft account (10.5% p.a)

Table 3 clearly indicate that the costs associated with the use of options are approximately in line with storage costs. The December call option is around R150/ton and R160/ton while the March call option is slightly cheaper than storage costs until March. The price of these strategies amounts to between R215/ton and R225/ton. However, it also shows that the minimum SAFEX prices for these option strategies should be slightly higher during the option expiry month than with the storage strategies. The reason for this is due to the option being bought at a specific price, namely the strike price. This price is equal to the price at which the futures (December or March) trade on the day that the call option is purchased. For the producer to make a profit on the strategy, the SAFEX price in the option expiry month (December or March) must be higher than the strike price plus strategy costs.

Important to keep in mind

The purpose of post-harvest marketing is to create the opportunity for you to obtain a better price if the market is to trade positively in the producer's favour (prices increase), but also to minimize the risk should the market not trade favourably. Thus, the risks associated with the different strategies should be taken into account when producers decide which alternative they want to use.

By selling only in the spot market after harvest, the producer has no further price risk, but he also cannot benefit if the market should trade well. However, his risk as well as the possibility of a better price, are limited.

When a producer stores, the risk and price possibilities are unlimited. If the market does not increase sufficiently to cover the storage and interest costs, it will be detrimental to the producer. There is always the risk that the market price does not increase and then the producer still has the commodity – with a lower value - along with the costs associated with the strategy.

When the producer makes use of the call strategy, the producer's risk is limited and the profit potential, unlimited. If the market price does not increase until option expiration date, the producer can only lose the marketing costs (premium and interest) and not incur further losses as he has already sold the maize and received the income. However, if the market grows more than the strategy has cost him, the producer will make a profit with the strategy.

The past two months provided benefit to producers as fuel prices dropped, with the July fuel price changes providing the biggest relief since August 2016.

The trend could be interrupted as recent reports from the Central Energy Fund present a possibility of a fuel hike for August. With harvests still underway in some parts of the country, it is important for producers to brace themselves for the expected hike next month. Petrol (95) is expected to increase by 10 cents per litre (c/l) while diesel (0.05%) could rise by 22 c/l.

General expectation on fuel prices

As an important input variable, which is used to compile enterprise budgets, it remains of interest to highlight fuel price expectations for the upcoming production season.

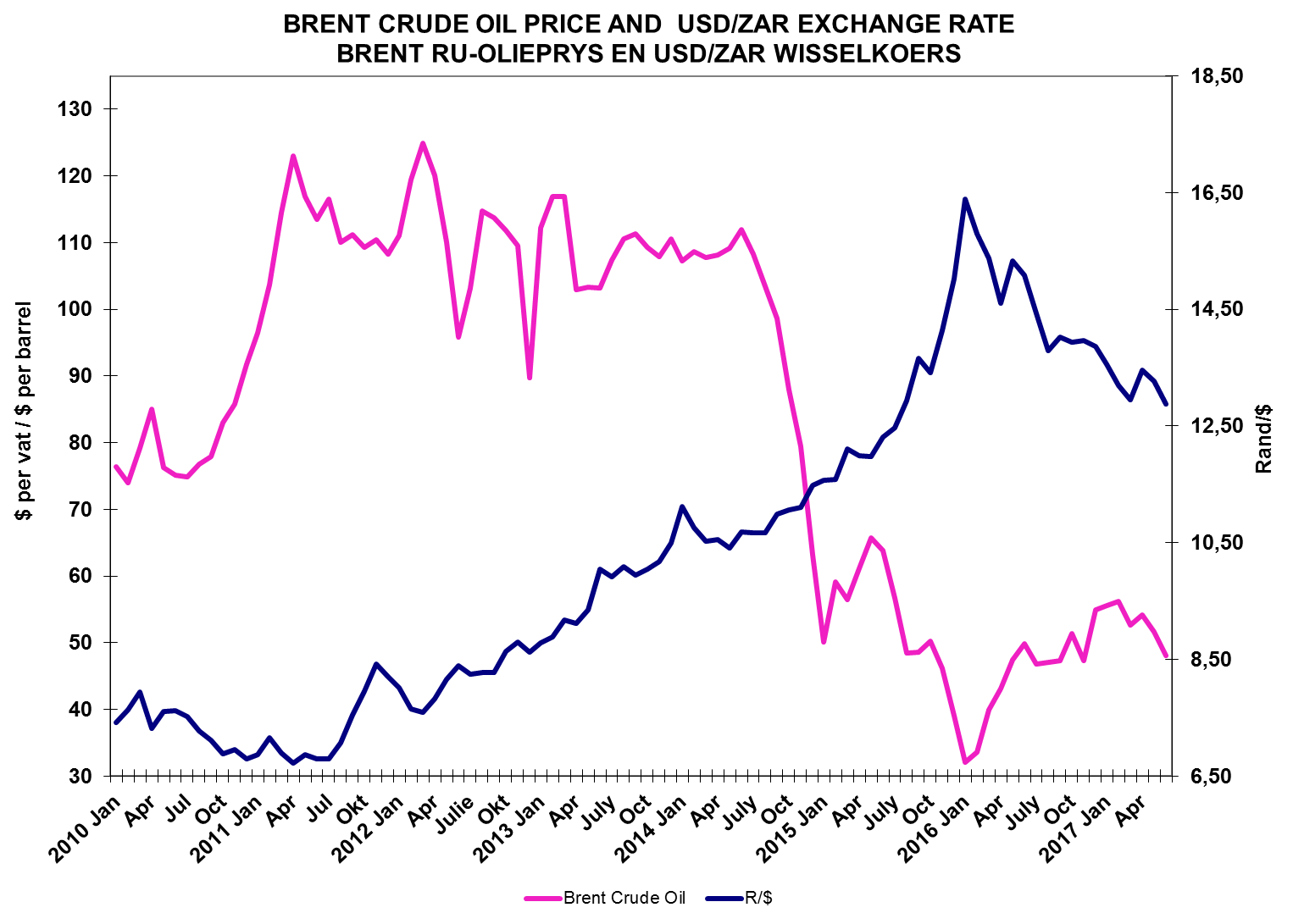

Fuel prices are mainly influenced by Brent crude oil prices and the exchange rate. Higher Brent crude oil prices and a weaker exchange rate tend to lead to a fuel hikes. Although both variables have remained volatile recently, the trend as seen on Graph 1 indicates weaker oil prices and relatively stronger exchange rate.

Graph 1: Brent crude oil price and local exchange rate (USD/ZAR)

It’s expected that Brent crude oil prices could remain low for longer periods due to non-compliance from non-OPEC members. Since the cost of new technology of producing shale is much lower, most companies continue pumping oil even when oil prices are below the psychological US per barrel level, placing pressure on global oil markets due to ample supplies which limit gains.

The local currency has shown resilience, along with other emerging markets on the back of a hawkish stance from major economies. This suggests that local currency could perform better than the previous year but that is still largely dependent on the impact of economic climate and political events that may occur.

Conclusion

On a general sense, based on these outlooks, it is expected that the diesel price contribution in the enterprise budgets could provide a relief on the total cost of inputs. A more resilient local currency along with lower oil prices could keep diesel prices stable, with fewer increases seen throughout the season. Therefore, final fuel price changes will however depend on the performance of the rand and the movements in international product prices.