May 2018

In last year’s May article, we looked at ‘What maize prices are telling us’ and discussed the effect that the bumper crop had on local maize prices.

Throughout the 2017/2018 marketing season so far, local maize prices were trading at export parity and this was mainly due to the fact that the country was in a surplus year; having more supply than the actual demand.

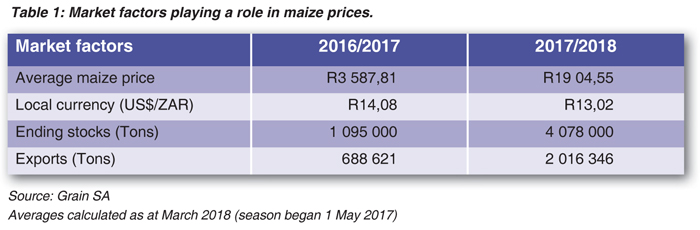

For instance, average domestic demand for maize is around 10,5 million tons, but the country found itself sitting with total maize production of 16,7 million tons in the 2017/2018 marketing year. In the same period, the average price for local maize was R1 904,55 versus R3 587,81 in the 2016/2017 marketing year, when total maize production amounted to 7,7 million tons. Between the two seasons, it is clear that maize prices declined by 88% due to the surplus production.

With the 2017/2018 marketing season drawing to a close, focus begins to shift to the 2018/2019 marketing season and the question that would come to a farmer’s mind is ‘how will prices react this time?’

In the most recent production forecast released by the Crop Estimates Committee, it is estimated that maize production for the new season could amount to 12,2 million tons, a 27% decline from the 2017/2018 marketing season which was caused by some farmers planting soybeans as an alternative crop to maize and the drought conditions during the 2017/2018 production season that caused a decline in area planted to maize.

Based on the estimated maize production volume of 12,2 million tons, it is clear that some supply and demand fundamentals for maize are likely to change and as a result, the same can be expected for maize prices. There are three main underlying factors that affect the day-to-day maize price movements and once these are understood, one can have an idea on how maize prices could perform for the season ahead. The three main factors are the exchange rate, supply and demand fundamentals and trade.

Using the 2017/2018 marketing season as the form of measure, we can see that price movements were mainly reacting to these three factors.

The local currency has an effect on the day-to-day price movements traded on the JSE Safex platform. A stronger rand tends to place pressure on local prices. Table 1 indicates the average exchange rate between 2016/2017 and 2017/2018. It is clear then, that the local currency plays a role on price movements among other factors.

The local currency has an effect on the day-to-day price movements traded on the JSE Safex platform. A stronger rand tends to place pressure on local prices. Table 1 indicates the average exchange rate between 2016/2017 and 2017/2018. It is clear then, that the local currency plays a role on price movements among other factors.

The supply and demand fundamentals are vast, in this particular article we look at the ending stocks, which forms part of these fundamentals. In a year with relatively large ending stocks, it is more likely that prices would be under pressure as ending stocks increase the supply of maize, such as what we saw in the 2017/2018 marketing season. Trade is important for ensuring price stability. Even in a season with a significantly high surplus, when the country has open export markets to sell this maize to, this is likely to support prices higher, however in the 2017/2018 season; the country was only able to export around 2 million tons, leaving a surplus of 4 million tons.

It is therefore important for farmers to keep up to date with local factors that have an impact on the exchange rate as this indicates the direction that daily traded maize prices could take; it’s also important to understand the supply and demand fundamentals as all grain and oilseed market factors change from season to season.

Article submitted by Michelle Mokone, Agricultural Economist: Grain SA. For more information, contact Luan van der Walt or send an email to luan@grainsa.co.za.

Publication: May 2018

Section: Pula/Imvula