ON GROUND LEVEL

10

Desember 2015

Supply and demand scenarios for

South Africa’s maize market:

WANDILE SIHLOBO,

economist: Grain SA and

TINASHE KAPUYA

,

head: Trade and Investment, Agbiz

GRAIN MARKET

-overview

– 13 November 2015

Looking into the 2015/2016 a d 2016/2017 marketing years

I

n 2014, South Africa exported 2,1 million tons of maize

which translated to R6,5 billion in export revenue (ITC, 2015).

However, South frica will not achieve comparable export

revenues in the 2014/2015 production year due to unfavour-

able weather conditions.

South Africa will for the first time in seven years be a net importer

of maize. Grain SA estimates this season’s imports at 770 000 tons,

compared to 83 073 tons the previous season. The high level

if imports in the current marketing year will cost an estimated

± R2,2 billion.

At the time of writing, 62% of the 770 000 ton requirement had

already been imported. In this article, we briefly explore Grain SA’s

scenarios for the 2016/2017 marketing year.

Historic exports in perspective

South Africa is a net maize exporting market. In 2014, about 26% of

South African maize exports went to Taiwan,

followed by Zimbabwe, which accounted for

14% of South Africa’s export share. Japan,

Botswana and South Korea each accounted

for 7% of South Africa’s 2014 total maize ex-

ports.

Namibia, Mozambique, Lesotho, Swaziland

and Italy were also amongst the top ten

export markets with shares ranging be-

tween 3% and 6% of South Africa’s total

export revenue.

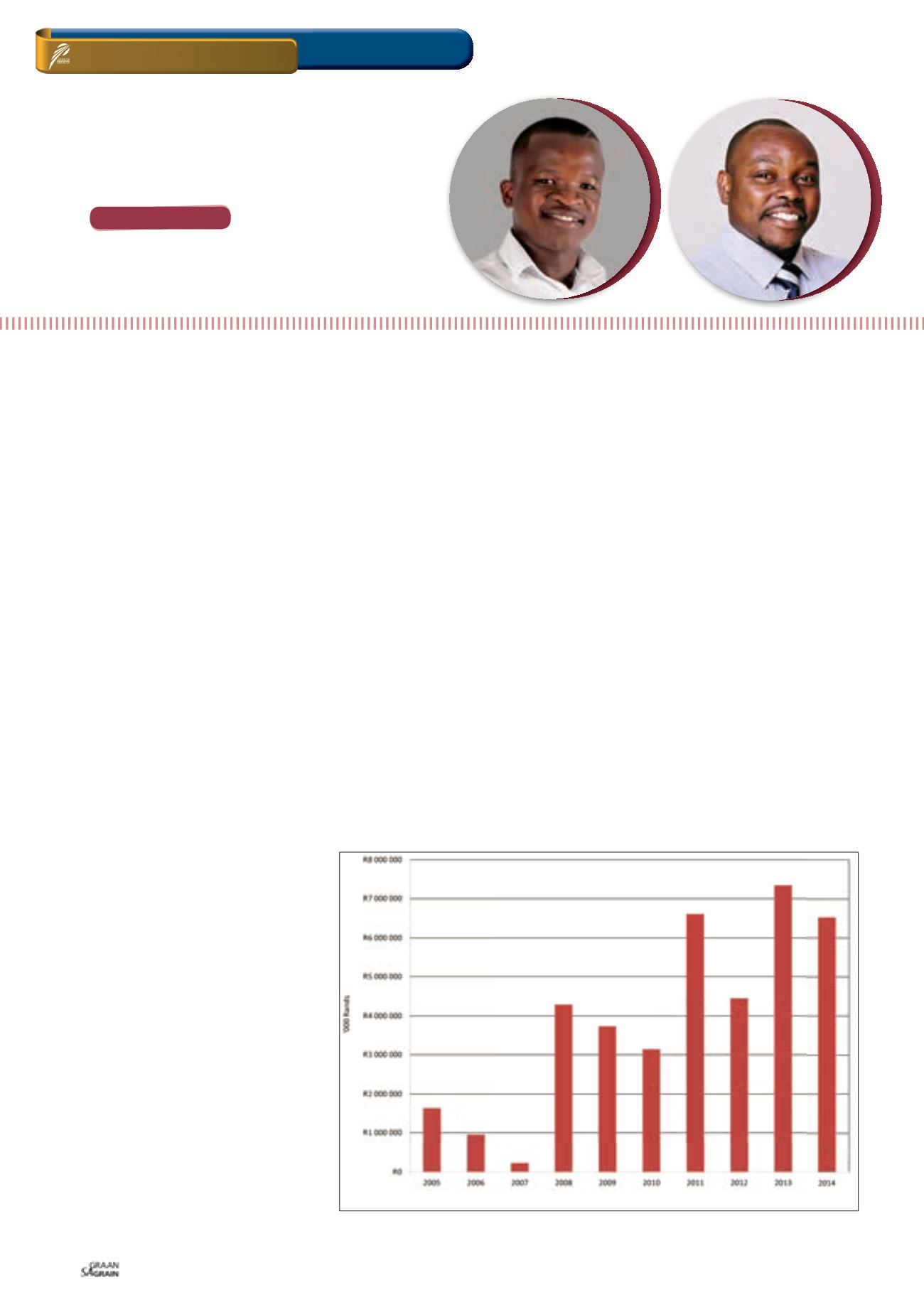

Graph 1

illustrates South Africa’s maize ex-

port earnings over the past ten years. The

highest export earnings were recorded in

2013, at R7,3 billion, on the back of exports

which were at 2,6 million tons (ITC, 2015).

Looking into the 2015/2016

and 2016/2017 marketing

years

The 2015/2016 drought is said to be the

worst since 1992 and shifted the domes-

tic maize market into a net import situ-

ation. Grain SA estimates that white maize imports might reach

70 000 tons, while yellow maize imports might reach 700 000 tons.

At the same time, South Africa’s exports to regional markets within

the Southern African Customs Union (SACU) are expected to reach

630 000 tons this season.

The continuing heatwave and drought have become a major cause

for concern throughout the country. The worrying weather condi-

tions have led to reluctance by producers to plant maize and the total

area for planting maize is expected to decrease by 4% year-on-year

to 2,55 million hectares.

Against this background, Grain SA has quantified three possible sce-

narios for the 2016/2017 marketing year and these are presented on

Table 1, Table 2

and

Table 3

. It is important to emphasise that all

scenarios are based on the intended planting area of 2,55 million

hectares, which might change as the season unfolds and new data

and insights come into the market.

Graph 1: South Africa’s maize in rand value.

Source: International Trade Centre (2015)