processed yellow maize compared to the same time last year, with

the most decline attributed to gristing.

According to the supply and demand estimates, the projected ex-

port quantity for maize is 2,150 million tons for the 2020/2021 season

and 1,613 million tons has been exported already. About 475 915 tons

of white maize was exported to neighbouring countries and recently to

Italy. Yellow maize exports were mainly destined for Vietnam, Taiwan,

Japan, Korea and our neighbouring countries (

Figure 1

). There is also

300 000 tons of processed maize products estimated for exports for

the 2020/2021 marketing season and about 148 927 tons have been

exported already.

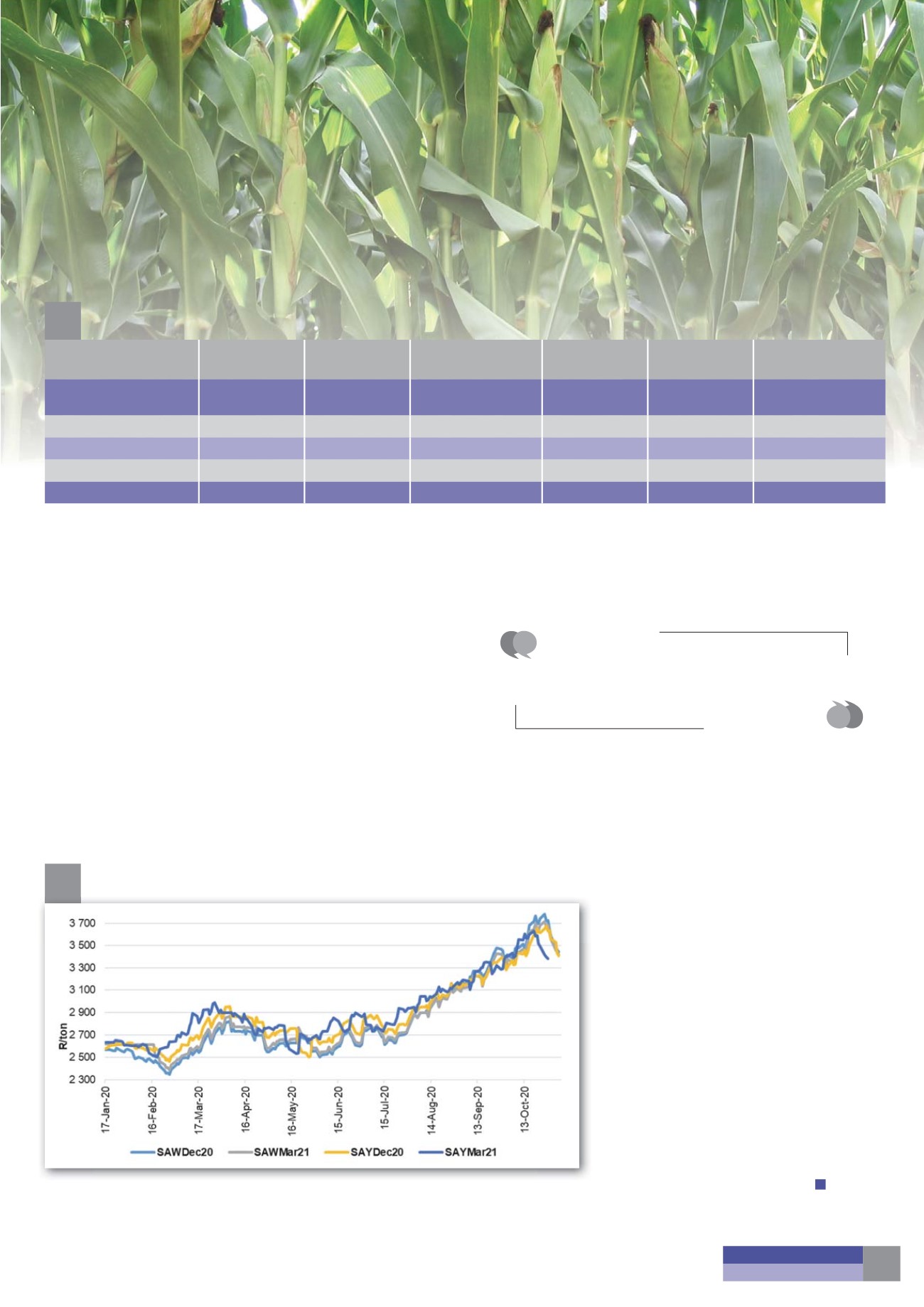

PRICE MOVEMENTS

Local prices have been on the rise for the past few months; the main driver

has been higher international prices and the weak exchange rate. Since

June 2020, December white maize futures prices increased by 37,8% and

December yellow maize futures prices increased by 29,5% (

Figure 2

).

The forecast for the new season in terms of production planning is look-

ing favourable, therefore, it is expected that the local production may

be good in the 2020/2021 season. According to the latest report by the

CEC, intentions to plant for 2021 is 2,746 million ha of maize which is

135 200 ha more than last season. At the time of

writing this article, most of the actual plantings still

need to take place so there is still a lot of produc-

tion risk, therefore weather conditions will play a

critical role in the next few months.

Looking at possible price movements, if a good

crop is realised, prices are likely to move closer to

export parity levels, but the other determining fac-

tors will be the exchange rate and international

prices. If the international prices remain high and the

exchange rate remains weak as current levels, we

could see prices of between R2 800 and R3 400 for

the 2020/2021 season.

If the international prices drop and the ex-

change rate becomes stronger, the local prices

can come down to below R2 500. In summary,

prices can range between below R2 500/ton up to

R4 500/ton. The most likely scenario given current

market fundamentals is that the prices should be

between R2 800/ton and R3 200/ton.

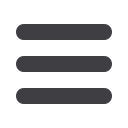

2

2019*

2020*

y/y

% change

2019*

2020*

y/y

% change

Processed for

local market

White maize White maize

Yellow maize Yellow maize

Human

2 322 589

2 655 545

14,34

312 310

311 126

-0,38

Animal

206 218

519 948

152,14

2 562 390

2 159 822

-15,71

Gristing

5 325

5 664

6,37

5 539

3 224

-41,79

Total

2 534 132

3 181 157

25,53

2 880 239

2 474 172

-14,10

Maize processed for local consumption.

Source: SAGIS

*April - September

2

White and yellow maize futures price movements.

Source: Grain SA

Domestic demand for maize remains good.

About 5,6 million tons of maize, was processed

for human consumption, animal feed and

gristing, this is a 4,5% increase compared

to the same period last year.

MADE POSSIBLE BY

THE MAIZE TRUST

11