I

N THIS ARTICLE WE WILL GIVE AN OVERVIEW OF THE

2020/2021 MARKETING SEASON, IN TERMS OF SUPPLY

AND DEMAND AS WELL AS PRICES.

INTERNATIONAL MARKET TRENDS

Global maize prospects for the new season are looking

good, with production expected to exceed the previous

season by 2,8%. However, there are less than favourable

weather conditions in certain parts of the major produc-

ing countries delaying harvesting as well as sowing, this

coupled with strong demand, especially from China. The

impact is reflected by increasing prices for major produc-

ers like USA, Ukraine, Brazil and Argentina; as a result,

we have seen price increases also in South Africa, due

to the influence that production conditions and the ex-

change rate of those countries have on our local market.

LOCAL MARKET TRENDS

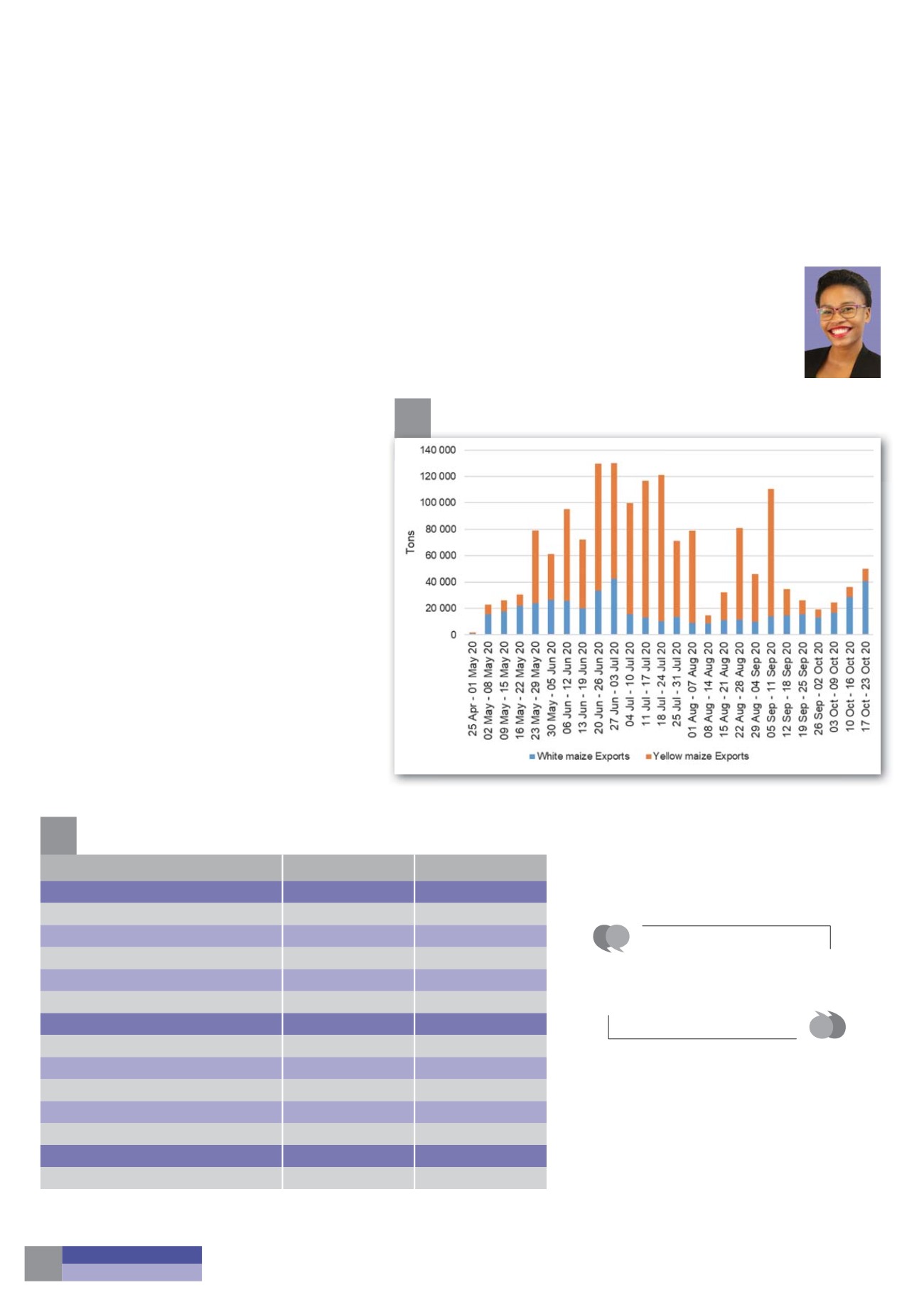

According to recent SAGIS figures, producer deliver-

ies for maize at the end of October totalled 13,8 million

tons, 7,9 million tons of white maize and 5,9 million

tons of yellow maize, which amounts to about 93,6%

of the estimated production by the Crop Estimates

Committee (CEC) (

Table 1

).

It is no surprise that we have no imports of maize,

given the large crop for the season. Projected closing

stocks for the end of the season (30 April 2021) are

estimated at 1,887 million tons. If we process about

939 083 tons per month on average, this means we

will have enough stock levels to last us two months

or 61 days at the end of the season, before new

deliveries arrive or we import.

Domestic demand for maize remains good. About

5,6 million tons of maize, was processed for human

consumption, animal feed and gristing, this is a 4,5%

increase compared to the same period last year.

Looking at

Table 2

, white maize processing increased

by 25%, with animal feed taking up most of the white

maize. There has been an overall decline of 14% for

Maize market prospects

for next season

Ikageng Maluleke, Agricultural

Economist, Grain SA. Send an

email to Ikageng@grainsa.co.za

1

2019/2020

2020/2021

Supply

Tons

Tons

Opening stocks

2 663 086

1 000 601

Producer deliveries

10 887 053

14 750 220

Imports

509 684

0

Early deliveries

15 057

-1 241

Surpluses

22 336

28 000

Total supply

14 082 159

15 777 580

Demand

Local demand

11 106 412

11 269 000

Exports

1 745 000

2 560 000

• Products

360 812

300 000

• Whole maize

1 448 761

2 150 000

Total demand

13 081 558

13 890 500

Ending stocks (30 April)

1 00 601

1 887 080

Local supply and demand.

1

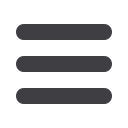

Weekly local exports of white and yellow maize.

Source: SAGIS

The forecast for the new season

in terms of production planning

is looking favourable, therefore,

it is expected that the local

production may be good in the

2020/2021 season.

MADE POSSIBLE BY

THE MAIZE TRUST

10