125

2022 2021

R

R

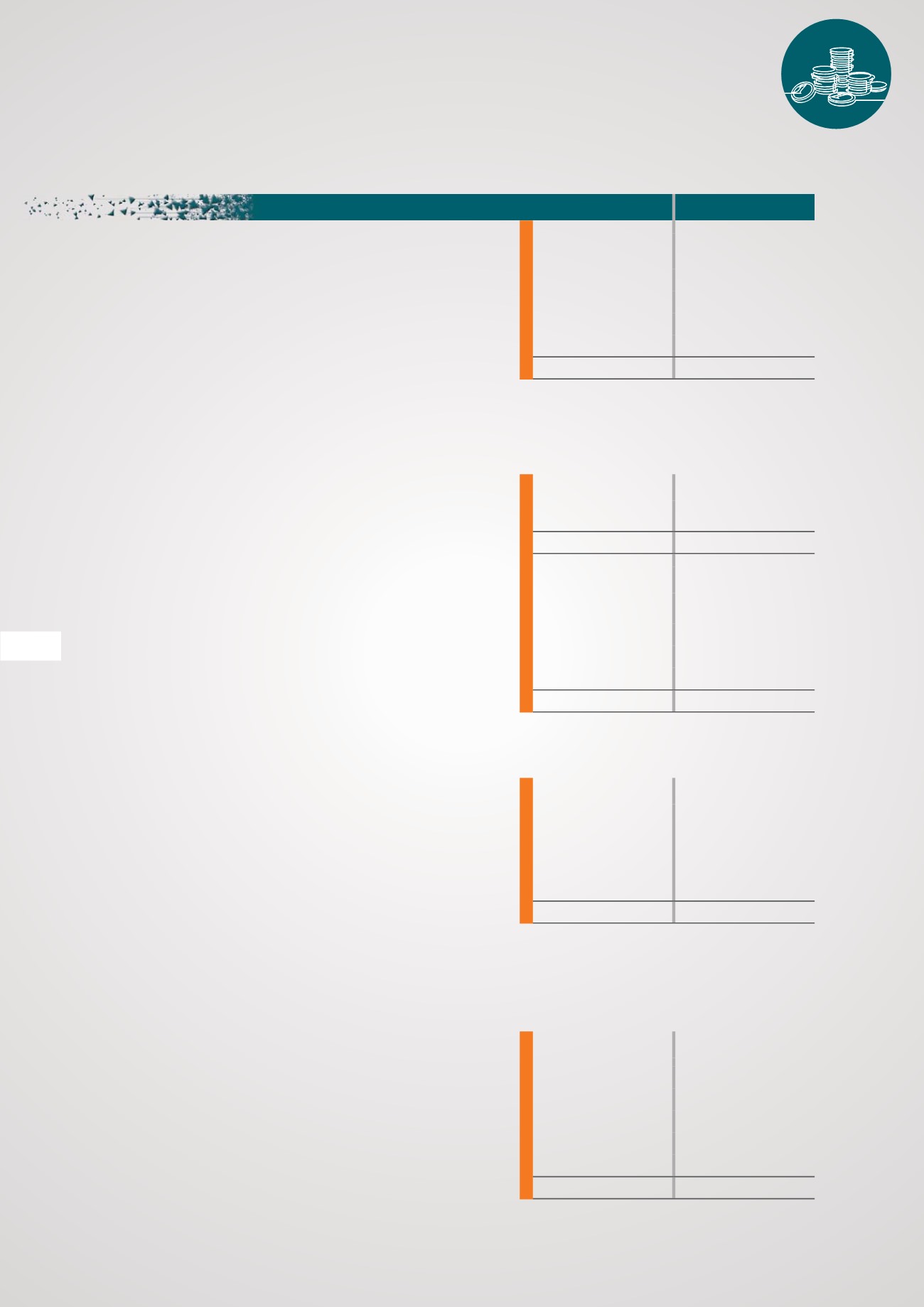

7. Other financial assets

At fair value

Sanlam Investment portfolio – Grain South Africa

20 286 112

14 591 147

Sanlam Investment portfolio – Farmer Development

-

7 456 177

Agri-bel Limited 32 062 shares @ R6,50 (2021: 32 062 @ R6)

240 465

208 403

20 526 577

22 255 727

12. Trade and other payables

Trade payables

15 268 362

2 473 439

Value Added Taxation

-

31 396

Income received in advance

12 732 336

30 828 666

Accrued employee cost

2 979 339

3 199 999

Accrued expenses

518 610

180 000

31 498 647

36 713 500

10. Cash and cash equivalents

Cash on hand

9 862

5 870

Bank balances

3 209 297

4 342 111

Bank balance: Money market

13 739 933

12 025 882

Bank balance: Research projects

6 740 510

5 654 487

23 699 602

22 028 350

8. Inventories

Beverages

316 690

136 218

316 690

136 218

9. Trade and other receivables

Trade receivables net of provision for bad debts

8 793 234

5 369 422

Prepaid expenses

757 756

452 916

Deposits

180 735

204 755

Value Added Taxation

60 317

-

9 792 042

6 027 093

The fair value of the investments is based on the quoted market price.

The Farmer Development Sanlam Investment portfolio was transferred to Phahama Grain Phakama NPC.

The provision for bad debts amounts to R- (2021: R-).

11. Commitments under operating leases

The organisation rents several sales offices under operating leases. The leases are renewed annually.

FINANC

IAL

STATEMEN

TS