37

June 2015

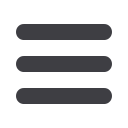

various provinces. From (2005 - 2010), the

ARC average yield was 2,1 t/ha and coun-

try average was 1,2 t/ha. Naturally, yield

trial data will always produce higher yields

on small plots compared to actual full scale

production. It does, however, illustrate the

yield gap that exists between the genetic

potential of the plant and the actual yields

that are obtained in the field. What is more

interesting to note is that these gaps seem

to be proportionally larger than what is the

case for maize and soybeans.

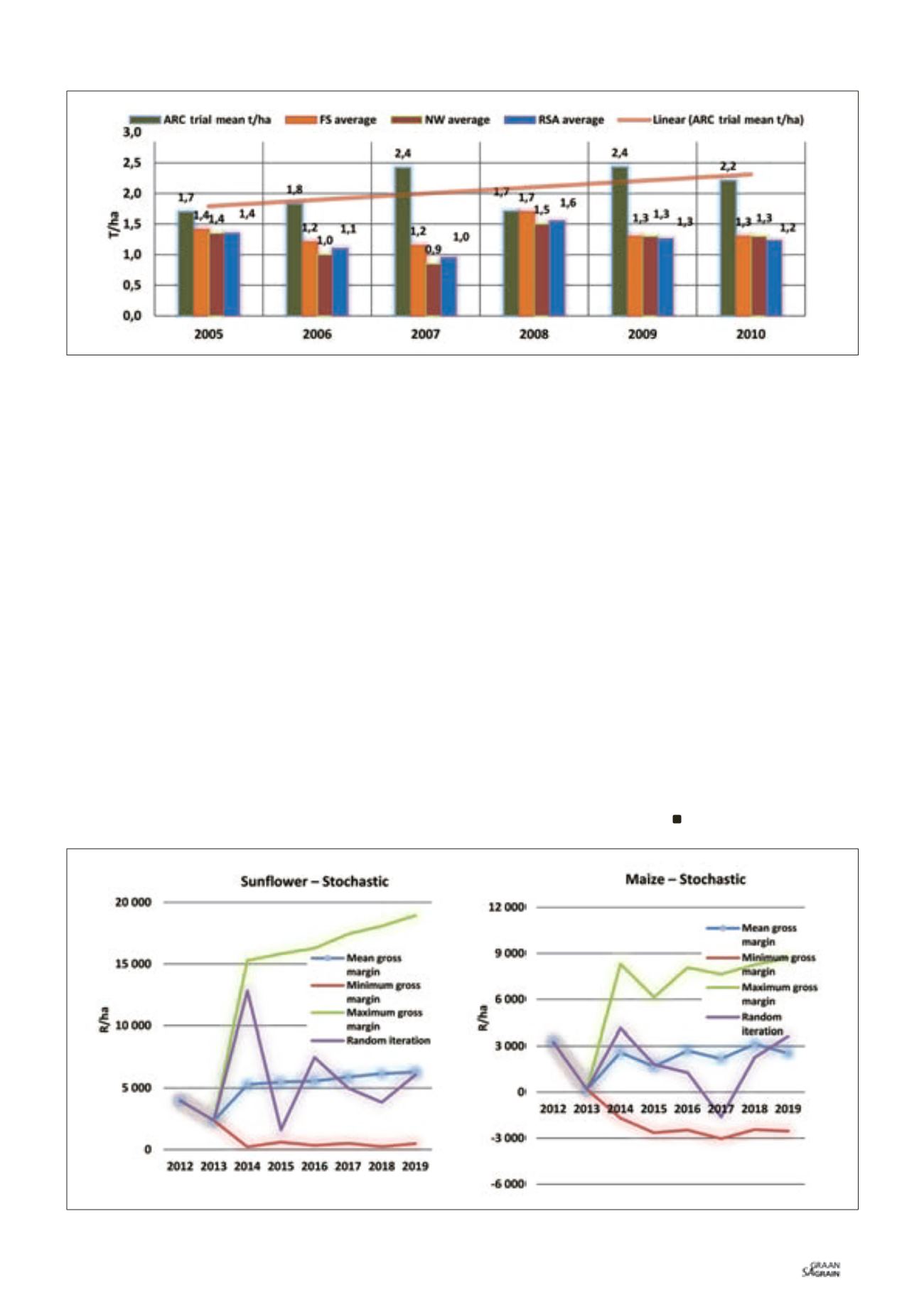

Drawing any final conclusions merely on

yields is an over-simplification of a com-

plex production system. Therefore, BFAP

applied a financial simulation model

(FINSIM) to generate a stochastic outlook for

the gross margins of a prototype maize and

sunflower farm in the North West Province

(

Graph 3

).

The stochastic outlook was generated by

imposing the actual historic variations in

yields, costs and prices of a specific farm

on to the outlook that was generated by the

BFAP sector level model. It has to be men-

tioned that this 1 200 ha crop farm in the

North West Province cannot be regarded as

a typical farm as actual yields that were re-

corded over the survey period (2010 - 2013)

exceeded the average yields of the region.

This, however, stresses the point that if

sunflowers are treated as a cash crop in its

own right, it becomes a profitable enter-

prise to consider. The results indicate that

the sunflowers proved to have a higher

average gross margin than maize over the

long run and more importantly, the poten-

tial minimum gross margin for sunflower

remained positive throughout the outlook

period, whereas the potential minimum

gross margin for maize turned out to be sig-

nificantly negative.

At the end of the day it all comes down to

the competitiveness of the industry. It is im-

portant to take a holistic approach since it is

not only the competitiveness of sunflowers

relative to other cash crops at farm level that

counts, but also the competitiveness of the

complete value chain relative to the major

exporting countries.

The sunflower seed price is derived from

the cake and oil prices and since these

commodities are imported, the domestic

industry is facing stiff competition from im-

ported seed, oil and cake that can be traced

right back to farm level. For example, being

a major exporter and therefore trading at

export parity levels, the average farm gate

price in Argentina (converted to rand) for

the period 2010 - 2012 equalled R2 153/ton

compared to the South African producers

who received an average farm gate price of

R3 747/ton that was derived from the im-

port parity levels of oil and cake. Finally, it

is important to note that a number of issues

related to the competiveness of sunflower

seed production were not discussed in this

article. For example, the potential premium

on sunflower seed with high oil content or

the development of niche markets like the

high-oleic market that has been expanding

in Europe.

Graph 2: Average yield comparison – ARC trial study and national averages (2005/2006 - 2010/2011).

Source: Nel, A.A. in ARC-GCI (2012) compiled by BFAP (2013)

Graph 3: Stochastic evaluation of gross margins on sunflower versus maize production in the North West Province.

Source: BFAP (2013)