Augustus 2014

88

SouthAfricanmaizemarket structure

andEast Africanexport opportunities

under the spotlight

S

outh Africa’s 2014/2015maize export pace have been slow

relative to last year’s pace; on 18 June 2014 total exports

were 60% behind last year (at 139 313 tons, compared to

345 019 tons in 2013/2014).

There are a number of factors resulting in this slow pace, but one

notably being the soft demand in traditional South African export

markets. Thus, this article aims to view the South African export

market structures, as well as the possible export opportunities in

East Africa.

Maizemarket structure

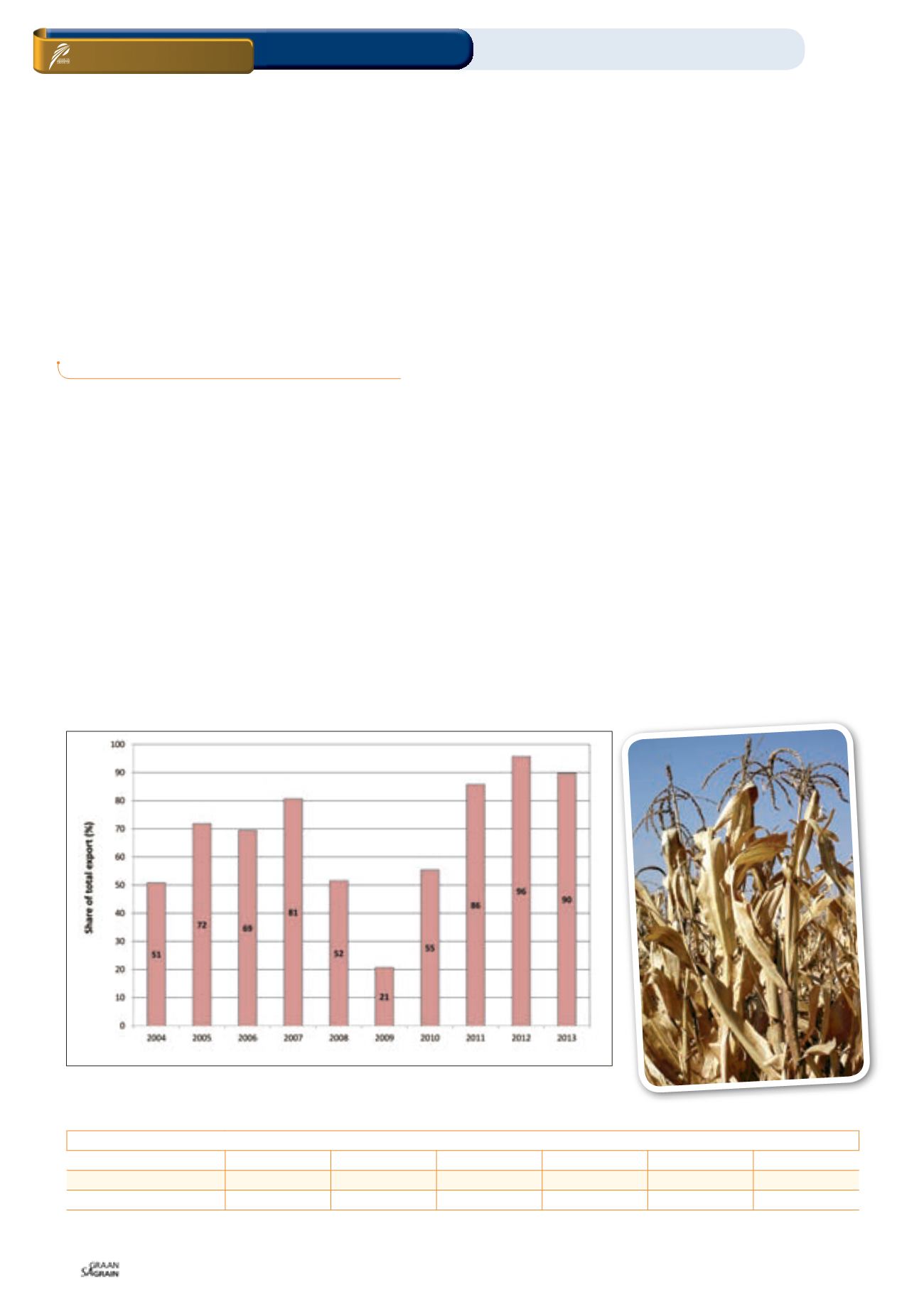

Graph 1

shows that in the past three years, South African maize

exports becomemore concentrated; meaning that a large quantity

of South African maize have been increasingly going to a few

countries. However, this was not the case ten years ago; evidently

in 2004 the top tenSouthAfrican importing countries accounted for

approximately 51%of the total exports (ITC, 2014).

This means that South African maize export markets were wide,

hence a positive view for market development and/or expansion.

Over the years this trend continued at a volatile pace; with 2007

data showing that the top ten South African importing countries

accounted for approximately81%of the total exportedquantity, and

sobecomingmore concentrated (ITC, 2014).

In 2009, South African maize exports were wide, only 21% of the

total maize went to the top ten importing countries. However, the

past three years’ data shows that maize export markets became

highly concentrated; with the 2011, 2012 and 2013 top ten importing

countries accounting for 86%, 96% and 90%, respectively (Graph 1).

This trendbasicallyshows that agreaterpercentageofSouthAfrican

exportswent to few countries (markets became concentration).

Highmarket concentration tends to increase the level of dependency

to few importers. Evidently, the current crop (2014/2015 maize) is

showing a slow export pace, owing to slow demand from the few

ON FARM LEVEL

Maizemarket / Export opportunities / East Africa

Markets

WANDILE SIHLOBO,

economist, Industry Services, Grain SA

KENYA

2013

2014

e

2015

f

2016

f

2017

f

2017

f

Production

3,6

2,9

3,0

3,2

3,4

3,5

Consumption

3,8

3,8

3,9

4,0

4,1

4,2

Estimated imports*

0,2

0,9

0,9

1,0

0,7

0,7

TABLE 1: KENYAMAIZEPRODUCTION, CONSUMPTIONAND ESTIMATED IMPORTS (MILLION TONS).

e= estimate; f= forecast; estimated imports*=own calculations

Source: BMI (2014)

Graph 1: Trends in the concentrationof SouthAfrica’smarkets structure (top ten importing countries).

SAGrain/

Sasol Nitrophoto competition