Grain SA Focus introduces a series that focuses on Profitability at Export Parity. A look at Grain SA’s activities to ensure its members can produce grain sustainably. View the next clips in the series, as published on social media below.

Part 3 – Sustainable Grain Production - Market Information & Import and Export contracts | Dirk Strydom, Manager: Grain Economy & Marketing, Grain SA

Part 3 (cont) – Sustainable Grain Production - Market Information & Commitment of Trader's Report | Dirk Strydom, Manager: Grain Economy & Marketing, Grain SA

Part 3 (cont) – Sustainable Grain Production - Market Information & Processing Figures | Dirk Strydom, Manager: Grain Economy & Marketing, Grain SA

Keep an eye on the Grain SA social media channels for the next few video clips that will follow during the next couple of weeks.

In the recent Crop Estimates Committee 7th production estimates for the 2017/18 season, the soybean production is estimated to be 77% more than the previous season (2016/17) while sunflower production estimated to be 15% more, both estimated at 1.316 million tons and 870 000 tons, respectively.

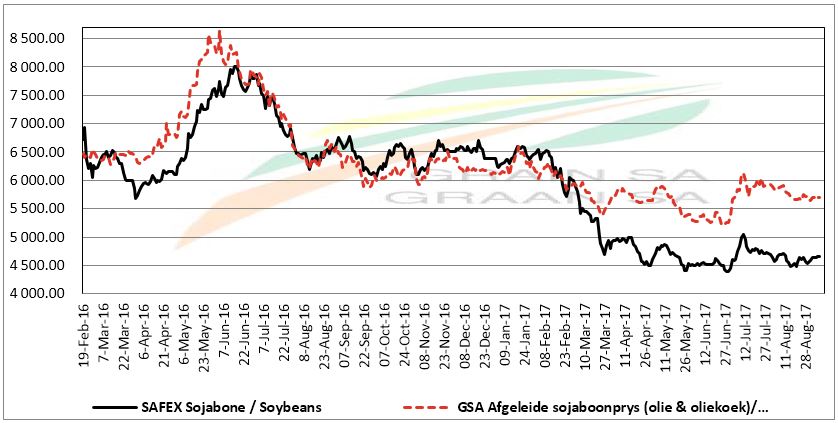

The record crop in soybean particularly has raised questions amongst producers on the prospect of crushing activity for the new season. During the drought year, 2016/17 marketing season, soybean crushing margins were mainly at a slower pace. This was mainly due to the fact that soybean SAFEX prices were trading higher than the derived prices (see graph 1). Towards June 2016, local soybean prices began trading closely to derived prices, meanwhile towards September and February 2017, local soybean prices were trading above the derived prices. In this instance, it was relatively cheaper to import oilcake than to crush locally produced soybean as higher prices did not provide a margin for local crushers to crush locally produced soybean.

Source: Grain SA

Towards March 2017, local soybean prices began to trend below the derived prices and have since carried on the trend. In the case where local prices are lower than derived prices, this provides a margin for local crushers to crush locally produced soybeans.

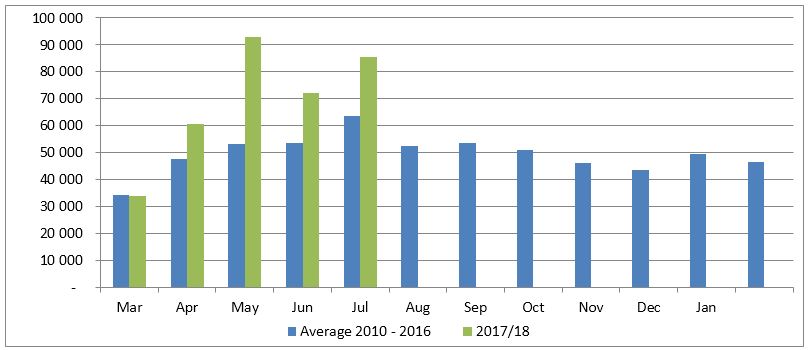

Graph 2 and 3 below indicates the crushing margins for soybean and sunflower for the 2017/18 marketing season. Graph 2 indicates the five-year average soybean crushing activity along with the current season’s crushing activity until July 2017. In general, this season’s crushing activity has picked up pace, and is relatively well ahead than the 5-year average. Between March and April, the activity was at a much slower pace and this can be mainly attributed to a technical delays which were caused by a crushing plant that had a breakdown that slowed down the monthly crushing pace. Towards May 2017, the activity began gaining momentum, crushing a total of 92 973 tons of soybeans, which was 53% higher than the month prior.

Source: SAGIS

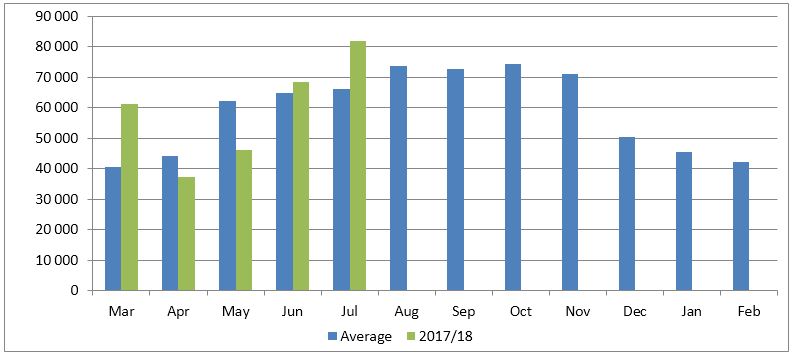

Graph 3 below indicates the soybean crushing activity along with the five-year average. In the beginning of the season, the sunflower crushing activity was above average but inconsistancies between April and May, caused the activity to remain below average. This was also mainly linked to a technical error which caused one plant to shut down and this can be seen by a decline in activity. Towards June 2017, crushing activity picked up again and remained above average for two consecutive months following the lag. Sunflower crushing activity has also improved from a year prior, with current crushes to date totalling 295 000 tons, a 29% increase from the same a year ago.

Source: SAGIS

Graph 4 below indicates the soybean oilcake locally produced and imported for the 2017/18 season, as at July 2017. On average, South Africa crushed 55 000 tons of oilcake per month and imported 40 000 tons. The average monthly oilcake demand in South Africa is 100 000 tons of oilcake. There has been a slight drop in oilcake imports, however, the future growth of the soybean industry begs the question: what is the possibility of local crushers relying on local soybean production and lowering oilcake imports?

The annual demand of oilcake in South Africa is around 1.3 million tons. Since oilcake accounts for 80% of raw soybean, this means the country would need to produce 1.7 million tons in order to meet total demand. Until such a time that the country can produce at those levels, the country would possibly begin seeing a decline in oilcake imports and more consistent crushing activity.

Conclusion

The 2017/18 marketing year was met by good production growth across all grains and oilseed locally. An increase in soybean and sunflower production was consequently met by an increase in consumption. Animal feed demand and crushing was evidently one of the biggest contributors to a rise in consumption, particularly in the soybean market. There is therefore scope to increase soybean production as this growth would be met by a demand in the crushing industry. With current production estimated at 1.3 million tons and lower maize prices, it is likely that soybean production would be a favourable alternative for farmers in the new planting season.

Recently, Kweleas has been observed in the Western Cape. Small-scale producers especially, who experience problems with Kweleas should take note of the following:

The Act on Agricultural Pests (Act No. 36 of 1983) declares Kweleas and locusts as a plague. The Department of Agriculture, Forestry and Fisheries is responsible for its control.

Procedures the complainant must follow in order to report Kweleas

Before a departmental official will conduct a physical inspection, the following procedures / steps must be followed by a complainant:

The complainant will contact one of the resource conservation inspectors (see the contact numbers below) with the above information to report the Kweleas, following which an appointment will be arranged with the complainant to conduct an inspection at the appropriate sleeping or breeding grounds

Contact details for Kweleas:

John Tladi

Deputy Director: Migrating Pests

Tel: 012 309 5743 | Cell: 082 457 3741

Khuliso Gangashe, Assistant Director

Tel: 012 309 5823 | Cell: 072 231 2192

Colin Burke

Tel: 012 309 5826 | Cell: 082 451 4861

Luka Geertsema

Tel: 012 309 5824 | Cell: 082 457 3742

Prudence Majozi

Tel: 012 309 5866 | Cell: 076 655 1466

Vincent Makhari

Tel: 012 309 5877 | Cell: 073 175 3843

The Sclerontinia Information Days presented by BAYER Crop Science and Grain SA, kicks off next week and will cover a Sclerotinia overview by Dr Bill Underwood, from the USA, a solution offered by Bayer and views of local scientists on the potential impact of soil borne diseases on soil health. These information days will conclude with a panel discussion. Dates and further information can be obtained on the link below.

|

Date |

Place |

Invitation |

|---|---|---|

|

18-September 2017 |

Nigel |

|

|

19-September 2017 |

Paarl |

|

|

22-September 2017 |

NAMPO Park |

Grain SA participated in the Swartland Skou, held in Moorreesburg during last week, and welcomed international tour groups and a couple of other famous visitors to the Grain SA Member's Hall. In addition, Grain SA together with Nedbank and Kaap Agri, presented a breakfast seminar on Friday morning, with a packed hall. Speakers included Dr Henning Gericke, addressing the phsyce of a champion, Jannie de Villiers discussing the turnaround strategy for wheat, and Annelize Crosby discussing land reform and its pertaining legislation.

Take a look at some highlights below

%2C%20Danieel%20Rossouw%20(Nedbank)%2C%20Hugo%20Lochner%20(Veeplaas)%2C%20Pierre%20Vlok%20(BKB.jpg) l.t.r - Breyton Milford (Agri Expo), Danieel Rossouw (Nedbank), Hugo Lochner (Veeplaas), Toit Wessels (Graan SA) and Pierre Vlok (BKB)

l.t.r - Breyton Milford (Agri Expo), Danieel Rossouw (Nedbank), Hugo Lochner (Veeplaas), Toit Wessels (Graan SA) and Pierre Vlok (BKB)

International touring group

International touring group

Another touring group visiting the member's hall

Another touring group visiting the member's hall

Breakfast seminar in a packed hall

Breakfast seminar in a packed hall

Swartland show breakfast seminar with Nedbank and Kaap Agri

Swartland show breakfast seminar with Nedbank and Kaap Agri

Agri SA and Grain SA recently met with SARS regarding farmers concerns over diesel refunds. SARS acknowledged their appreciation for the key role agriculture plays in our economy. The agricultural sector increased its production by 33,6% in the second quarter of 2017 and helped to lift the economy out of recession.

The key areas discussed included:

1) Delays in diesel refunds

We communicated our members’ concerns over delays in payment of diesel refunds. SARS highlighted the need for farmers to submit all the relevant information. Should farmer’s experience delays, it essential to log a call with the SARS contact centre and to keep record of the reference number for the call. Regulations require the contact centre to only communicate directly with the taxpayer or a person which has been assigned power of attorney to act on the taxpayer’s behalf. For this reason, farmers should contact SARS directly or through a third party with the legal right to do so.

2) The log book

SARS has made recommendations to Treasury on an agriculture specific log book. SARS is awaiting feedback from Treasury. Log book records which are unclear, with limited explanatory detail, may lead to delays in processing. For example, not disclosing the purpose for which diesel is used will lead to delays. Farmers are encouraged to keep clear and detailed records, including supporting documents. We can provide the following tips for diesel refunds:

Please note that the final logbook is still awaited from SARS, accordingly, the above-mentioned information may be subject to change. For more information on managing the diesel refund, refer to (Schedule 6 part 3):

http://www.sars.gov.za/AllDocs/LegalDoclib/SCEA1964/LAPD-LPrim-Tariff-2012-19%20-%20Schedule%20No%206.pdf

Furthermore, it is important for producers to note the activities which qualify for the refund (Schedule 6 part 3)

3) Communication

We highlighted the concern that there is no single channel for clear communication on diesel rebates. SARS noted our concern. Delays in issuing notification of audit letters are attributed to the manual issuing process. SARS is working hard to convert to a web based automated system, but it is not yet in place.

4) Other concerns

In addition to the above, we highlighted the following concerns:

SARS responded that they do not purposefully delay any refunds, rather submissions with insufficient or incomplete information can lead to delays as well as system errors. The payment of refunds is linked to other departments within SARS, for example VAT and debtors. Tax payers need to know their net position in terms of diesel refunds and VAT, which will influence the processing of refunds. Furthermore, SARS highlighted that diesel rebates are “conditional / preliminary” in the sense that until a claim has been audited, SARS may revert on a refund that was made. SARS denied rumours that commission earning consultants are used to delay refunds. Auditors are not permitted to earn such commission.

SARS suggested that farmers be aware of suppliers who sell diesel mixed with other fuels, for example paraffin. Possession of such mixed fuels is a criminal offence. Only reputable suppliers should be used and diesel deliveries should be inspected to avoid receipt of mixed fuels.

SARS noted the concerns we raised and we trust that going forward, the process will improve. SARS assured us that should a case not be resolved, after following the correct procedures, the matter can be taken further and we welcome members to contact Agri SA or Grain SA with such concerns.

It’s expected that fuel prices for October could be increasing for the third consecutive month. According to the information from the Central Energy Fund, petrol and diesel prices are likely to increase on 04 October 2017. Petrol (95) is expected to increase by 35 cent per litre (c/l) and diesel (0.05%) by 33 c/l. Final fuel price changes will however depend on the performance of the rand and the movements in international product prices. As seen on the table below, the movements in international product prices are contributing towards a price increase.

|

ANALYSIS MOVEMENT OF AVERAGE OVER/(UNDER) RECOVERY |

|||

|---|---|---|---|

|

|

Petrol 95 |

Diesel 0.05% |

Diesel 0.005% |

|

Movement in International Product Prices |

(47.423) |

(44.526) |

(44.760) |

|

Movement in Exchange Rate |

12.365 |

11.866 |

11.979 |

|

Average Unit Over/(Under) Recovery |

(35.058) |

(32.660) |

(32.781) |

Economic factors affecting fuel prices

In the second week of September, Brent crude oil prices were trading at a 3-month high following damage caused by Hurricane Harvey that led to refineries in Texas shutting down. The shutdown created backlogs of oil supply and increased demand in oil was the main support for prices. This week, Brent crude oil prices traded above the US mark for the first time since April 2017. At the time of writing, Brent crude oil prices were trading at around US.21 per barrel.

The local currency appreciated within the first two weeks of September mainly gaining support from positive local economic data such as a positive 2.5% GDP growth for the second quarter of 2017. The rand was trading below the R13 level but later retracted, weakening at the back of global jitters as US inflation topped expectations which could result in a possible rate increase by the end of the year. At the time of writing, the rand was trading at around R13.19 to the dollar.