April 2018

The diesel rebate was designed to protect local industries against international competition (where primary farmers enjoy protection), as well as to provide relief to consumers who do not necessarily use roads.

Depending on the industry, the rebate provides full or partial relief from the fuel levy and the Road Accident Fund levy. Agriculture receives about 40% relief from the fuel levy and 100% from the Road Accident Fund levy. The diesel rebate is currently R2,83 per litre. A farmer qualifies for 80% of his lawful use (i.e. 80% of the qualifying litres).

How does one qualify for the diesel rebate?

To qualify for the diesel rebate, a farmer must be registered for VAT and for the diesel rebate in terms of the Customs and Excise Act.

To qualify for the rebate and to be able to claim it back, a farmer must be able to prove and calculate the amount of lawful consumption in terms of Schedule 6 to the Customs and Excise Act. This schedule lists the activities that qualify for the rebate, as well as how diesel usage must be recorded. The rebate is regarded as a ‘provisional concession’ until the farmer can prove reasonably that the diesel was used lawfully.

Logbooks

In addition to the fact that farmers must provide proof of diesel purchases, they must also be able to indicate how the diesel was consumed.

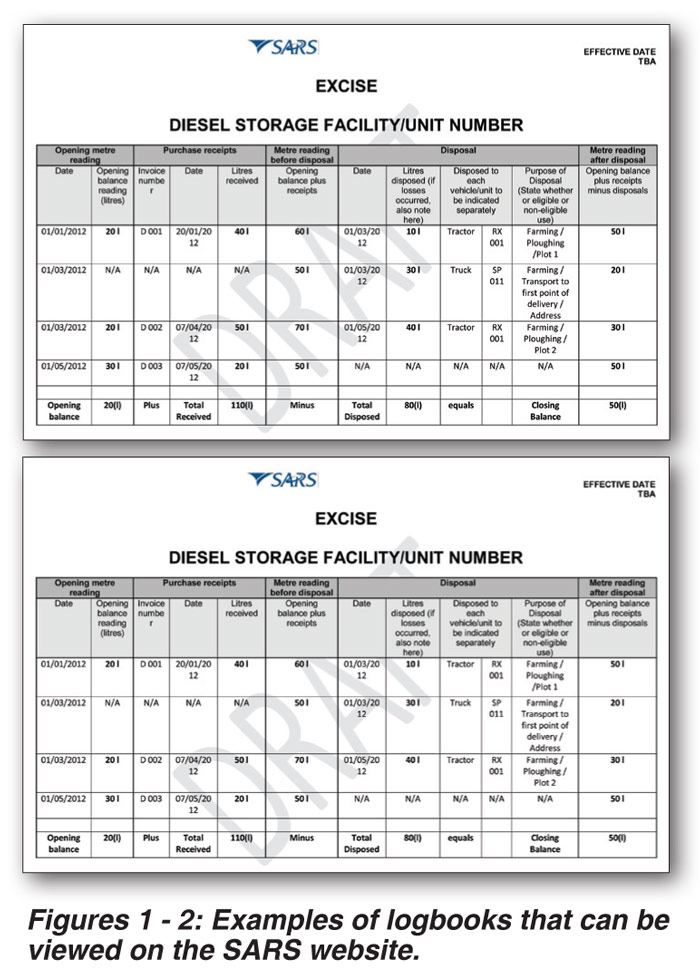

An official logbook from SARS is in the pipeline. SARS has made recommendations to Treasury with respect to an agriculture-specific logbook. SARS is waiting for feedback from Treasury in this regard. Unclear logbook records or records containing little detail can lead to delays in processing and the possible rejection of claims. For example, failure to indicate the purpose for which diesel is used will lead to delays. Farmers are encouraged to keep clear and detailed records, including supporting documents. Examples of logbooks that can be viewed on the SARS website:

The following guidelines are recommended for this purpose:

Keep a complete record of diesel used on the farm (from main distribution points):

Note: Experience with audits has shown that SARS can also ask a farmer to indicate where on the farm the activity takes place. Do not use ‘general’ as an activity – rather specify according to the qualifying activities in Schedule 6.

Please note that the final logbook and guide still have to come from SARS. The above information may therefore change.

For more information on managing the diesel rebate and the qualifying activities, refer to the Customs and Excise Act (Schedule 6, part 3): http://www.sars.gov.za/AllDocs/LegalDoclib/SCEA1964/LAPD-LPrim-Tariff-2012-19%20-%20Schedule%20No%206.pdf.

New diesel rebate system has been proposed

New diesel rebate system has been proposed

The National Treasury published a discussion document earlier this year in which they requested comments for the revision of the diesel rebate system. Grain SA and Agri SA responded to the request. The Treasury and SARS aim to implement the new system in 2018. Some of the most important amendments that are being proposed are:

Conclusion

The diesel rebate is one of the only benefits received from the government and the system must therefore always be above suspicion. Should members experience problems with their rebate or its implementation, they may contact Grain SA.

Article submitted by Corné Louw, Grain SA Senior Economist. For more information, send and email to corne@grainsa.co.za.

Publication: April 2018

Section: Pula/Imvula